Market Growth Projections

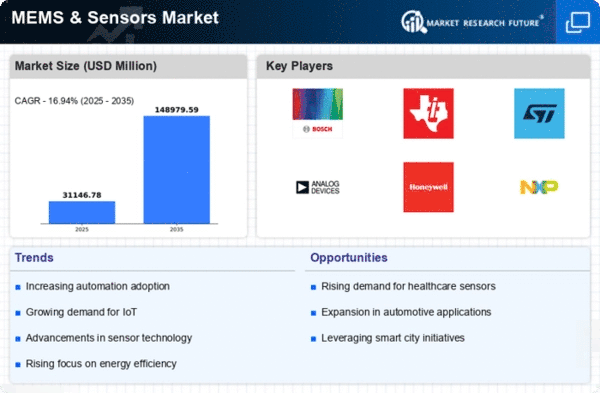

The Global MEMS Sensors Market Industry is poised for substantial growth, with projections indicating a market value of 26.6 USD Billion in 2024 and an impressive increase to 148.9 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 16.94% from 2025 to 2035. Such figures reflect the increasing integration of MEMS sensors across various sectors, including consumer electronics, automotive, industrial automation, IoT, and healthcare. The anticipated expansion underscores the critical role of MEMS technology in driving innovation and enhancing functionality in modern applications.

Growth in Industrial Automation

The Global MEMS Sensors Market Industry is bolstered by the rising trend of industrial automation, where MEMS sensors play a crucial role in monitoring and controlling processes. These sensors facilitate real-time data collection, enabling manufacturers to optimize operations and enhance productivity. For example, MEMS pressure sensors are utilized in various industrial applications, including process control and environmental monitoring. As industries increasingly adopt smart manufacturing practices, the MEMS sensor market is poised for substantial growth, with a projected CAGR of 16.94% from 2025 to 2035, underscoring the technology's importance in the industrial landscape.

Rising Demand for Consumer Electronics

The Global MEMS Sensors Market Industry is experiencing a surge in demand driven by the proliferation of consumer electronics. As devices such as smartphones, wearables, and smart home appliances become increasingly sophisticated, the integration of MEMS sensors enhances functionality and user experience. For instance, MEMS accelerometers and gyroscopes are pivotal in enabling features like motion detection and orientation sensing. This trend is reflected in the market's projected growth, with an estimated value of 26.6 USD Billion in 2024, indicating a robust consumer appetite for advanced sensor technologies.

Advancements in Automotive Applications

The automotive sector significantly contributes to the Global MEMS Sensors Market Industry, as manufacturers increasingly adopt MEMS technology to enhance vehicle safety and performance. MEMS sensors are integral to systems such as airbag deployment, tire pressure monitoring, and stability control. With the automotive industry shifting towards electric and autonomous vehicles, the demand for MEMS sensors is expected to escalate. This is evidenced by the anticipated market growth, with projections indicating a value of 148.9 USD Billion by 2035, highlighting the critical role of MEMS in modern automotive innovations.

Emergence of IoT and Smart Technologies

The integration of MEMS sensors within the Internet of Things (IoT) ecosystem is a key driver for the Global MEMS Sensors Market Industry. As smart devices proliferate, the demand for sensors that can collect and transmit data seamlessly is escalating. MEMS sensors enable functionalities such as environmental monitoring, health tracking, and smart city applications. This trend is indicative of a broader shift towards interconnected systems, which is expected to propel the market forward. The anticipated growth trajectory suggests that the MEMS sensor market will continue to expand, reflecting the increasing reliance on smart technologies across various sectors.

Healthcare Innovations and Wearable Devices

The healthcare sector is a significant contributor to the Global MEMS Sensors Market Industry, particularly through the rise of wearable devices that monitor health metrics. MEMS sensors are essential in devices that track vital signs, such as heart rate and blood pressure, providing real-time data to users and healthcare providers. This trend is likely to grow as the demand for remote patient monitoring and personalized healthcare solutions increases. The market's expansion is supported by advancements in sensor technology, which enhance accuracy and reliability, thereby fostering greater adoption of MEMS sensors in healthcare applications.