Market Share

Introduction: Navigating the Competitive Landscape of the Mercury Market

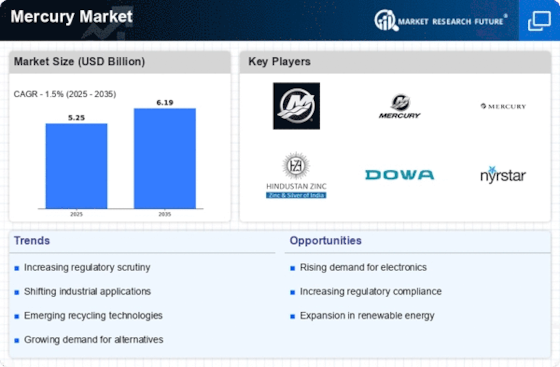

Competition is shaped by the speed of technological change, regulatory changes, and consumers’ demands for efficiency and sustainability. Competition is raging between the players in the field, from manufacturers and IT system integrators to smart grids and IoT solutions. These technology-driven differentiators not only optimize the company’s operations, but also the customer relationship through personalization and improved service. Furthermore, the development of biometrics and green energy is establishing new standards for compliance and the environment. These trends are especially evident in the emerging economies, where the strategic focus is on integrating smart technology and sustainable practices to meet the demands of the more demanding consumers in 2024–25.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions across multiple segments of the Mercury Market, integrating various technologies and services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Barrick Gold | Global leader in gold production | Mining and resource extraction | North America, South America, Africa |

| Teck Resources | Diverse portfolio in metals and minerals | Mining and resource management | North America, South America |

| Southern Copper Corporation | Leading copper producer with extensive operations | Copper mining and production | North America, South America |

Specialized Technology Vendors

These vendors focus on niche technologies and solutions that enhance operational efficiency and sustainability in the Mercury Market.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| American Elements | Innovative materials and chemicals supplier | Advanced materials and chemicals | Global |

| Gulf Coast Environmental Systems | Expertise in environmental solutions | Environmental management and remediation | North America |

Infrastructure & Equipment Providers

These vendors supply essential infrastructure and equipment necessary for mining and resource extraction operations.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Mercury Marine | Leading manufacturer of marine engines | Marine equipment and technology | North America, Europe |

| Xstrata | Integrated mining and metals company | Mining and processing equipment | Global |

| Hindalco Industries | Global leader in aluminum and copper | Aluminum and copper production | Asia, North America |

| China Minmetals Corporation | State-owned enterprise with vast resources | Metals and mining operations | Asia, Global |

| Eurasian Resources Group | Diverse resource base and operations | Mining and metallurgy | Europe, Asia, Africa |

| Orvana Minerals | Focused on gold and copper mining | Mining operations | South America |

| Almaden Minerals | Exploration-focused mining company | Mineral exploration and development | North America |

| Nuclear Decommissioning Authority | Expertise in nuclear site management | Nuclear decommissioning services | United Kingdom |

Emerging Players & Regional Champions

- MERCURY INNOVATIONS, based in the USA, is a developer of advanced mercury detection and remediation technology. It recently won a contract with a major government agency to monitor mercury in water. It is competing with established suppliers by offering a low-cost, high-precision alternative.

- The German company Ecomercury Solutions is active in the field of mercury management and in the development of new methods for the recovery of mercury. In collaboration with a major automobile manufacturer it recently carried out a large-scale project for the collection and re-use of mercury from old cars. Ecomercury supports the established players by enabling them to increase their efforts in the field of sustainable development.

- This is a company in India that offers a mercury-free solution for industrial applications. It has recently launched a pilot project in a local manufacturing hub and is promoting safer practices to compete with traditional mercury-based solutions.

Regional Trends: In 2024, there is a notable increase in the use of mercury-reduction technology, driven by stricter regulations and the growing importance of sustainable development. A growing number of companies are specializing in eco-friendly solutions and innovating detection methods, thereby strengthening the competitiveness of the new players against the established suppliers.

Collaborations & M&A Movements

- Mercury Corp and SpaceTech Innovations entered a partnership to develop advanced propulsion systems aimed at enhancing satellite deployment efficiency, thereby strengthening their competitive positioning in the aerospace sector.

- Planetary Resources acquired Asteroid Mining Solutions in early 2024 to consolidate their capabilities in resource extraction from celestial bodies, significantly increasing their market share in the emerging space mining industry.

- AstroDynamics and Orbital Technologies formed a collaboration to create a joint research initiative focused on sustainable mercury extraction methods, responding to increasing regulatory pressures for environmentally friendly practices.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | Clear, Inc., SITA | Clear has been a pioneer in the field of biometric boarding, and has successfully installed such systems at several U.S. airports. The system has increased the speed of boarding and reduced the time spent waiting in line. SITA’s Smart Path solution has been adopted by several airports around the world, demonstrating its scalability and its ability to work with existing systems. |

| AI-Powered Ops Mgmt | Amadeus, IBM | Amadeus leverages AI for real-time operational insights, improving resource allocation and efficiency. IBM's Watson has been utilized in predictive maintenance for airport equipment, demonstrating significant reductions in downtime. |

| Border Control | Gemalto, Thales | Gemalto’s border control solutions are widely used throughout Europe, enabling a single, continuous identity verification. Thales offers the most advanced biometric systems, combining security with high throughput, as shown by the success of its systems at major airports. |

| Sustainability | Honeywell, Schneider Electric | Honeywell's Eco-smart solutions focus on energy efficiency in airport operations, with case studies demonstrating reduced carbon footprints. Schneider Electric's green initiatives have been recognized in a number of airports. They focus on reducing waste and using green energy. |

| Passenger Experience | Travelport, Airbnb | Travelport enhances the travel experience with a personal touch. Travelport has integrated Airbnb into its airport services to improve the accommodation of travellers. |

Conclusion: Navigating the Mercury Market Landscape

The mercury market in 2024 is characterized by intense competition and a high degree of fragmentation, with both established and new players competing for market share. Regional trends indicate a shift towards more localized solutions, and this is influencing the strategies of the suppliers. The established players rely on the trust and brand loyalty of their customers, while the new players focus on innovation, such as AI, automation and sustainability. The ability to offer flexible solutions will be the key to market leadership in the future. The suppliers must prioritise these competences to meet the current demand and to anticipate future changes in both customer preferences and regulatory frameworks.

Leave a Comment