Growing Beverage Sector

The beverage sector is a primary driver of the Global Metal Cans Market Industry, with metal cans being the preferred packaging choice for a variety of drinks, including soft drinks, beer, and energy drinks. The convenience, durability, and lightweight nature of metal cans make them ideal for both manufacturers and consumers. As the beverage industry continues to expand, the demand for metal cans is expected to rise significantly, contributing to an estimated market value of 130.6 USD Billion by 2035. This growth is further supported by the increasing popularity of ready-to-drink beverages, which often utilize metal cans for their packaging.

Sustainability Initiatives

The Global Metal Cans Market Industry is increasingly driven by sustainability initiatives as consumers and manufacturers alike prioritize eco-friendly packaging solutions. Metal cans are recyclable and can be reused multiple times without loss of quality, which aligns with global efforts to reduce waste and promote circular economies. For instance, many beverage companies are now adopting metal cans over plastic alternatives, contributing to a projected market value of 60.2 USD Billion in 2024. This shift not only meets consumer demand for sustainable products but also helps companies comply with stringent environmental regulations, thereby enhancing their market position.

Technological Advancements

Technological advancements in manufacturing processes are enhancing the efficiency and quality of metal can production, thereby driving the Global Metal Cans Market Industry. Innovations such as improved coating technologies and automated production lines are reducing costs and increasing output. These advancements not only improve the durability and aesthetic appeal of metal cans but also enable manufacturers to meet rising consumer expectations for product quality. As a result, the market is poised for growth, with a projected CAGR of 7.29% from 2025 to 2035, reflecting the industry's adaptability to technological changes and consumer preferences.

Health and Safety Regulations

Health and safety regulations play a crucial role in shaping the Global Metal Cans Market Industry. Governments worldwide are implementing stricter regulations regarding food and beverage packaging to ensure consumer safety. Metal cans are favored for their ability to preserve product integrity and prevent contamination, making them a compliant choice for manufacturers. This regulatory environment encourages companies to invest in metal can production, as they seek to align with safety standards while also appealing to health-conscious consumers. The increasing focus on safety is likely to bolster the market's growth trajectory in the coming years.

Emerging Markets and Urbanization

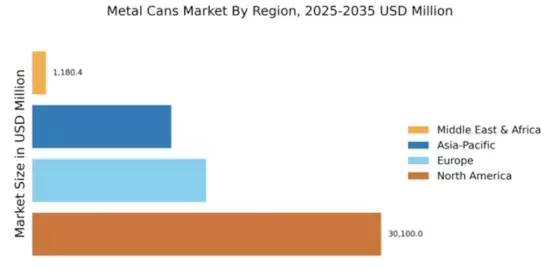

Emerging markets and urbanization are significant factors influencing the Global Metal Cans Market Industry. As urban populations grow, there is a rising demand for packaged food and beverages, which often utilize metal cans for their convenience and shelf stability. Countries in Asia-Pacific and Latin America are witnessing rapid urbanization, leading to increased consumption of canned products. This trend is expected to drive market growth, with projections indicating a market value of 60.2 USD Billion in 2024. The expansion of retail channels in these regions further supports the accessibility of metal cans, catering to the evolving consumer preferences.