Growing Aerospace Sector

The aerospace sector's expansion significantly influences the Metal Foundry Products Market. As air travel continues to rise, the demand for lightweight and high-strength metal components becomes increasingly critical. Aerospace manufacturers require advanced materials that can withstand extreme conditions while maintaining structural integrity. This demand drives foundries to innovate and produce specialized alloys and components tailored for aircraft applications. The aerospace industry's growth trajectory suggests a sustained increase in metal foundry product consumption, further solidifying its role as a key market driver. The interplay between aerospace advancements and metal foundry capabilities is likely to shape future market trends.

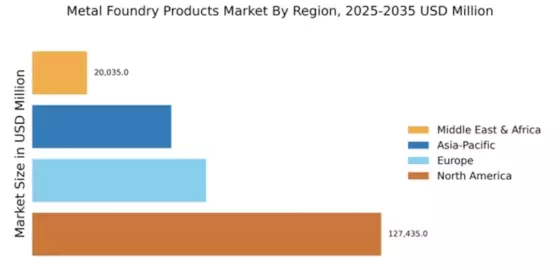

Market Growth Projections

The Metal Foundry Products Industry is projected to experience substantial growth in the coming years. With a market valuation of 254.9 USD Billion in 2024, it is anticipated to reach approximately 426.6 USD Billion by 2035. This growth trajectory indicates a robust compound annual growth rate (CAGR) of 4.79% from 2025 to 2035. Such projections reflect the increasing demand for metal foundry products across various sectors, including automotive, aerospace, and construction. The anticipated growth underscores the industry's resilience and adaptability in meeting evolving market needs, positioning it favorably for future opportunities.

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions serve as a crucial driver for the Metal Foundry Products Industry. Governments are increasingly investing in infrastructure projects, including bridges, roads, and railways, to stimulate economic growth. This investment leads to heightened demand for metal castings used in construction machinery and structural components. For instance, the anticipated growth in infrastructure spending is expected to elevate the market's value significantly, with projections indicating a rise to 426.6 USD Billion by 2035. Such initiatives not only bolster the demand for metal foundry products but also create a ripple effect across related industries, enhancing overall market dynamics.

Rising Demand for Automotive Components

The Metal Foundry Products Market experiences a notable surge in demand for automotive components, driven by the increasing production of vehicles worldwide. As manufacturers strive to enhance fuel efficiency and reduce emissions, the need for lightweight and durable metal components becomes paramount. In 2024, the market is valued at approximately 254.9 USD Billion, reflecting the automotive sector's significant contribution to this growth. The trend towards electric vehicles further amplifies this demand, as these vehicles require specialized metal parts for batteries and structural integrity. Consequently, the automotive industry's evolution is a key driver of the Global Metal Foundry Products Market.

Sustainability and Recycling Initiatives

Sustainability and recycling initiatives are emerging as pivotal drivers within the Metal Foundry Products Market . As environmental concerns gain prominence, foundries are increasingly adopting sustainable practices, including the recycling of scrap metal and the use of eco-friendly materials. This shift not only reduces waste but also aligns with global efforts to minimize carbon footprints. The emphasis on sustainability is likely to attract investments and foster innovation in the metal foundry sector. Consequently, the integration of sustainable practices may enhance the market's appeal to environmentally conscious consumers and industries, thereby influencing overall growth trajectories.

Technological Advancements in Casting Processes

Technological advancements in casting processes are revolutionizing the Metal Foundry Products Market . Innovations such as 3D printing education and automated casting techniques enhance production efficiency and reduce waste. These advancements allow foundries to produce complex geometries and customized components that meet specific client requirements. As a result, manufacturers can respond more swiftly to market demands, thereby increasing competitiveness. The integration of smart technologies in foundry operations is likely to further streamline processes, contributing to a projected CAGR of 4.79% from 2025 to 2035. This technological evolution is pivotal in shaping the future landscape of the Global Metal Foundry Products Market.