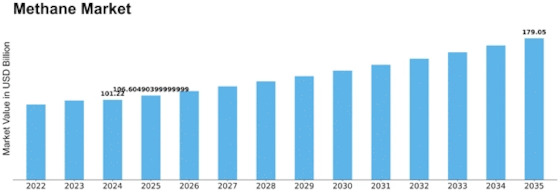

Methane Size

Methane Market Growth Projections and Opportunities

The Methane Market is influenced by a variety of factors that collectively shape its trends and growth dynamics. One of the primary drivers is the increasing demand for natural gas, of which methane is a major component, as a cleaner and more environmentally friendly energy source. Methane is a significant greenhouse gas, but when utilized as a fuel, it produces fewer emissions compared to traditional fossil fuels. The global shift towards cleaner energy sources and the transition to natural gas for power generation contribute to the growing demand for methane.

Methane Market Size was valued at USD 89.9 Billion in 2022. The Methane market industry is projected to grow from USD 95.4 Billion in 2023 to USD 153.2 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.10%

Global economic conditions play a pivotal role in the Methane Market. Economic growth and industrialization contribute to increased energy consumption, fostering the need for natural gas as a versatile and reliable energy source. Developing economies, undergoing rapid industrial expansion and urbanization, significantly drive the market's growth as they increase their energy consumption to meet growing demands.

Technological advancements in methane extraction and production impact the market dynamics. Ongoing research and development efforts lead to innovations that improve extraction techniques, enhance storage capabilities, and optimize transportation methods. Companies that invest in these technological advancements gain a competitive edge by offering efficient and sustainable methane solutions, meeting the evolving needs of various industries while addressing environmental concerns.

Environmental considerations are crucial factors in the Methane Market. Methane is a potent greenhouse gas, and efforts to mitigate climate change involve managing and reducing methane emissions. Sustainable practices in methane production, storage, and utilization, along with the implementation of advanced technologies for methane capture, contribute to the market's growth. Companies that prioritize environmental responsibility align with global sustainability goals and gain favor in the market.

Geopolitical factors and trade dynamics play a role in shaping the Methane Market. Fluctuations in trade relations, changes in energy policies, and geopolitical tensions can impact the supply chain and pricing of methane. Companies need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Moreover, the energy sector significantly contributes to the demand for methane. As countries seek to diversify their energy mix and reduce reliance on traditional fossil fuels, natural gas, including methane, becomes a critical component of the energy transition. Methane is used for power generation, heating, and as a feedstock in various industries, driving its demand in the energy sector.

The environmental regulations and policies of individual countries and international agreements also shape the Methane Market. Efforts to reduce methane emissions, improve energy efficiency, and transition to cleaner energy sources influence the production and utilization of methane. Companies in the market must comply with evolving regulations and align their practices with global sustainability initiatives to maintain a positive market position.

Raw material prices, particularly those related to natural gas extraction and processing, play a role in shaping the Methane Market. Fluctuations in the costs of natural gas impact the production costs and pricing of methane. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Leave a Comment