Global Microcatheters Market Overview

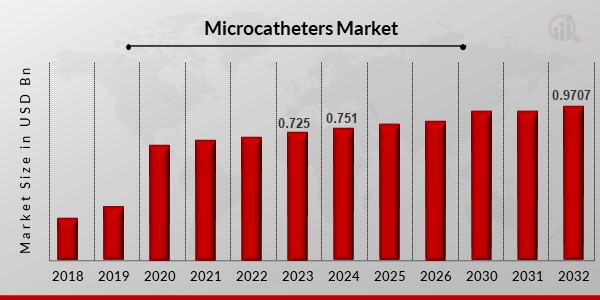

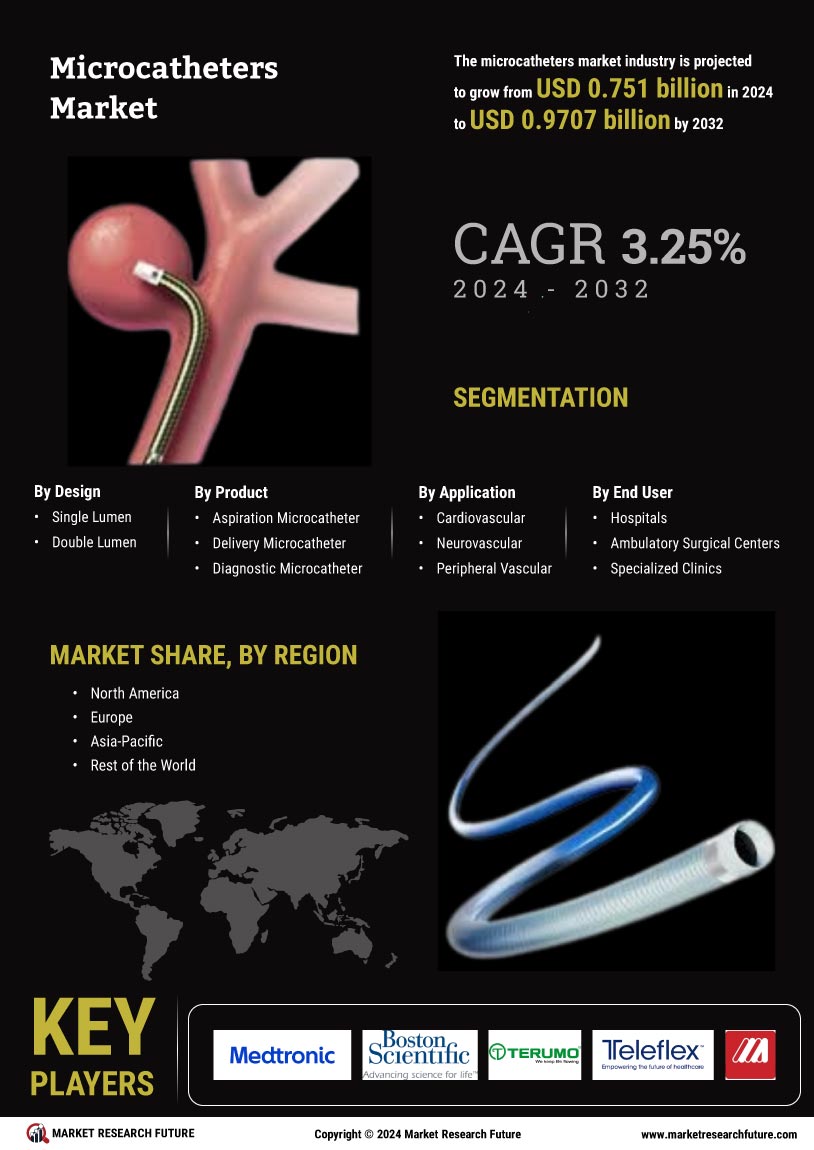

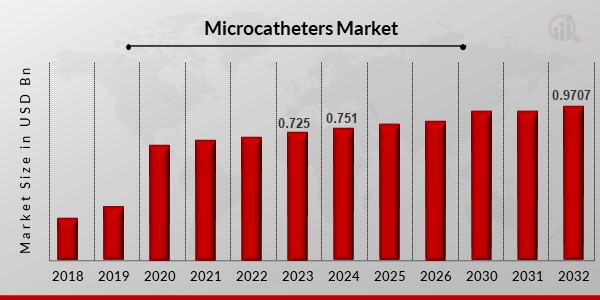

Microcatheters Market Size was valued at USD 0.725 billion in 2023. The microcatheters market industry is projected to grow from USD 0.751 billion in 2024 to USD 0.9707 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.25% during the forecast period (2024 - 2032). The primary market drivers anticipated to propel the market are the rise in chronic diseases including cancer, cardiovascular disorders, neurovascular disorders, and other diseases, as well as the increased use of minimally invasive procedures.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Microcatheters Market Trends

Growing incidence of chronic diseases is driving the market growth

The number of people with chronic illnesses like cancer, cardiovascular diseases, and neurovascular disorders has significantly increased over the past two decades. One of the primary reason for death worldwide is cardiovascular disease (CVD). According to the Burden of Disease (GBD) Study 2019, there were 271 million CVD cases worldwide in the 1990s and 523 million in 2019. Because of this, there is a rapidly growing need for microcatheters for steer ability, diagnostics, and delivery of the embolic agent to specific areas with minimally invasive operations.

Aneurysms, intracranial shunts, and stenotic lesions are just a few examples of vascular anomalies that can be diagnosed and treated with microcatheters. Microcatheters are essential for traveling the body's extensive network of veins and eliminating blocked vessels.

Furthermore, the benefits of minimally invasive surgery over traditional open surgery, which include smaller and fewer scars, less discomfort, quicker hospital stays and recovery times, lower costs, and overall better outcomes, are driving up demand for the procedure. A catheter is among the instruments used most frequently in minimally invasive surgery. The microcatheters market CAGR is increasing as a result of this.

Additionally, the governments of industrialized and emerging regions fund public health care to provide their citizens with high-quality healthcare. The health systems' effectiveness, equity, and quality in different locations will determine how well they function in containing newly emerging and reemerging diseases. The current COVID-19 outbreak makes governments throughout the world more conscious of the need to improve the healthcare system. As a result, governments are making more investments in the public healthcare system.

However, the practice of medicine is becoming simpler for doctors, more beneficial for patients, and less expensive for the overall healthcare system because of technological advances in medicine. These developments provide patients precise therapies that are less expensive, less invasive, and less difficult to complete because of more sophisticated instruments. Catheters are now more effective over the long term, have lower infection rates, and have less catheter malfunction because to technological improvements in the past ten years. As a result of increased catheter R&D, these catheters have experienced several changes. Thus, driving the microcatheters market revenue.

Microcatheters Market Segment Insights

Microcatheters Design Insights

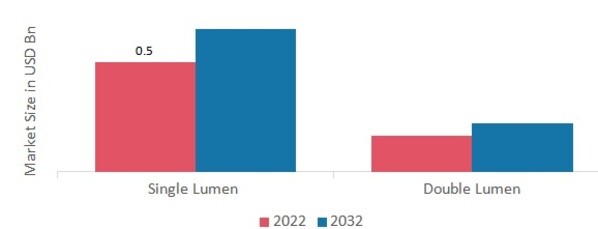

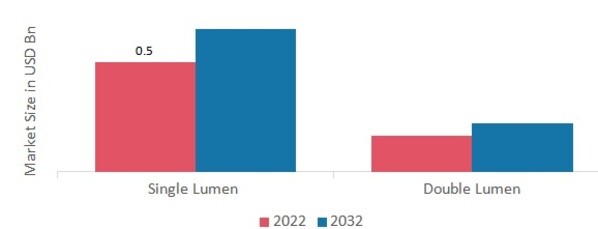

The microcatheters market segmentation, based on design includes Single Lumen and Double Lumen. The single lumen segment dominated the market. A microcatheter has a single lumen and a balloon tip, with the shaft reinforced at the distal end and extending into the balloon to minimize abrupt stiffness changes. The balloon could be made out of hydrogenated polyisoprene, a thermoplastic polyisoprene rubber with better manufacturing and performance traits.

Figure 1: Microcatheters Market, by Design, 2022 & 2032 (USD billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Microcatheters Product Insights

The microcatheters market segmentation, based on product, includes Aspiration, Delivery, Diagnostic and Steerable. The steerable category generated the most income. Steerable microcatheters' procedural advantages, the growing usage of robotically controlled surgical platforms, the prevalence of image-guided and minimally invasive medical procedures worldwide, and the rising incidence of vascular diseases are all factors in this market's expansion.

Microcatheters Application Insights

The microcatheters market segmentation, based on application, includes Cardiovascular, Neurovascular, Peripheral Vascular, Oncology, and Urology. The cardiovascular category generated the most income because cardiovascular diseases are becoming more prevalent globally. More than 3.6 million people are anticipated to pass away from cardiovascular disease, which is brought on by unhealthy lifestyle choices like not getting enough exercise, being overweight, smoking, drinking, and having high blood pressure.

Microcatheters End User Insights

The microcatheters market segmentation, based on end user, includes Hospitals, Ambulatory Surgical Centers, and Specialized Clinics. The hospitals category generated the most income. The rise in the number of hospitals with cutting-edge amenities, the increased emphasis on providing patients with a superior patient experience, and the rising inclination of patients to choose hospitals for neurological diseases treatment are all factors contributing to the market expansion for this category.

Microcatheters Regional Insights

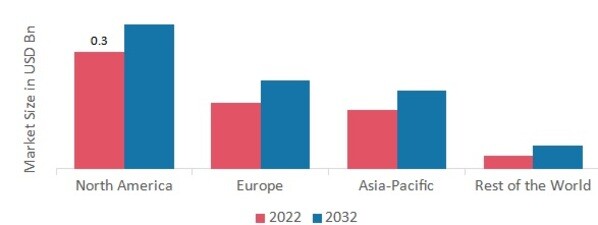

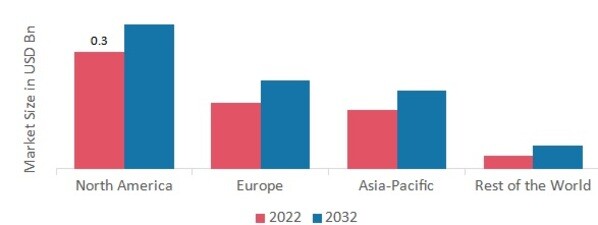

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American microcatheters market area will dominate this market. The market in this region is anticipated to expand as a result of factors such the rising prevalence of cardiovascular diseases, rising healthcare spending, and the availability of better and more advanced healthcare facilities. The market is anticipated to expand as a result of increasing angiography and surgical procedures as well as the swift expansion of the healthcare industry.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: MICROCATHETERS MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe microcatheters market accounts for the second-largest market share due to an aging population that is growing, an increase in the number of people who experience stress in nations like Japan, an increase in the frequency of chronic illnesses, a sizable population base, better diagnosis quality, and rising patient affordability. Together, these causes have led to a sizable number of interventional operations. Further, the German microcatheters market held the largest market share, and the UK microcatheters market was the fastest growing market in the European region

The Asia-Pacific Microcatheters Market is expected to grow at the fastest CAGR from 2023 to 2032 as a result of factors including an aging population, an increase in heart disease incidence, and better healthcare facilities. A large population and introducing innovative microcatheter products in developing nations like China and India are anticipated to fuel market expansion in this area. Moreover, China’s microcatheters market held the largest market share, and the Indian microcatheters market was the fastest growing market in the Asia-Pacific region.

Microcatheters Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the microcatheters market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including contractual agreements, new product launches, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, microcatheters industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the microcatheters industry to benefit clients and increase the market sector. In recent years, the microcatheters industry has offered some of the most significant advantages to medicine.

Major players in the microcatheters market attempting to increase market demand by investing in research and development operations include Medtronic (Ireland), Boston Scientific (US), Terumo Medical Corporation (US), Teleflex Inc. (US) Merit Medical Systems, Inc. (US), Guerbet (France), Cook Medical (US), Acandis GmbH (Germany), Acrostak (Switzerland) Stryker Corporation (US), Asahi Intecc (Japan), Lepu Medical Technology Company (China), and Cerus Endovascular Ltd (US).

The Terumo Medical Corporation is a top producer of medical equipment and supplies worldwide. Our goal is to give healthcare practitioners and the patients they serve the greatest solutions available, and the first step in achieving this goal is to create an excellent workplace for our employees. We sell goods in one of four business areas as the American branch of the Tokyo-based Terumo Corporation: -Terumo Interventional Systems: a pioneer in minimally invasive entry site management, lesion access, and interventional technologies like stents, balloons, sheaths, and more.

In June 2021, the AZURTM Vascular Plug, a plug that may occlude arteries up to 8 mm in diameter, was introduced by Terumo Medical Corporation. Accuracy, stability, and dependable occlusion are all balanced across the product. The technique has distinct advantages that place it at the forefront of embolotherapy, which aims to improve clinical and financial outcomes.

Products for critical care and surgery are designed, developed, produced, and distributed by Teleflex Inc (Teleflex). Major items produced by the company include circuits, masks and bags, endotracheal tubes, pain pumps, supraglottic airways, catheters, adaptors, and connectors. Its products are used in surgery, anaesthesia, cardiac care, urology, emergency medicine, and respiratory care. In December 2020, Z-Medica, LLC, a business that produced hemostatic products, was bought by Teleflex Incorporated. With the upgraded product compatible with the EZ-IO and EZPLAZ 1 product lines, Teleflex strengthens its position in the military call points, hospitals, and EMS.

Key Companies in the microcatheters market include

Microcatheters Industry Developments

November 2022: Abiomed, a provider of medical device technologies, and Johnson & Johnson have inked a purchase agreement. With this acquisition, Johnson & Johnson's product line is expanded while benefiting patients.

August 2022: The development of the Gel Embolic Material (GEMTM) technology, which is used to symbolize blood vessels in the peripheral vasculature, was carried out by Obsidio, Inc., which Boston Scientific Corporation acquired. With this acquisition, Boston Scientific Corporation expands its interventional oncology and embolization suite to provide doctors and their patients with a modern treatment for illnesses including cancer, hemorrhages, and other crippling ailments.

Microcatheters Market Segmentation

Microcatheters Design Outlook

Microcatheters Product Outlook

Microcatheters Application Outlook

Microcatheters End User Outlook

Microcatheters Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 0.725 billion |

| Market Size 2024 |

USD 0.751 billion |

| Market Size 2032 |

USD 0.9707 billion |

| Compound Annual Growth Rate (CAGR) |

3.25% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Distribution Channel, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Medtronic (Ireland), Boston Scientific (US), Terumo Medical Corporation (US), Teleflex Inc. (US) Merit Medical Systems, Inc. (US), Guerbet (France), Cook Medical (US), Acandis GmbH (Germany), Acrostak (Switzerland) Stryker Corporation (US), Asahi Intecc (Japan), Lepu Medical Technology Company (China), and Cerus Endovascular Ltd (US) |

| Key Market Opportunities |

Increasing government funding for strengthening healthcare infrastructure |

| Key Market Dynamics |

Rise in the incidence of chronic diseases such as neurovascular and cardiovascular disorders Increasing adoption of minimally invasive surgery |

Microcatheters Market Highlights:

Frequently Asked Questions (FAQ):

The microcatheters market size was valued at USD 0.725 Billion in 2023.

The market is projected to grow at a CAGR of 3.25% during the forecast period, 2024-2032.

North America had the largest share in the market

The key players in the market are Medtronic (Ireland), Boston Scientific (US), Terumo Medical Corporation (US), Teleflex Inc. (US) Merit Medical Systems, Inc. (US), Guerbet (France), Cook Medical (US), Acandis GmbH (Germany), Acrostak (Switzerland) Stryker Corporation (US), Asahi Intecc (Japan), Lepu Medical Technology Company (China), and Cerus Endovascular Ltd (US).

The single lumen category dominated the market in 2023.

The cardiovascular category had the largest share in the market.