Microcellular Plastics Size

Microcellular Plastics Market Growth Projections and Opportunities

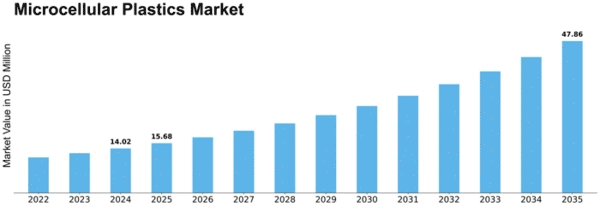

The Microcellular Plastics Market is governed by a range of factors which altogether shape its dynamics and growth path. One of the main drivers is increasing demand for light weight materials in numerous industries including automotive and aerospace. Microcellular plastics are low density with highly enhanced mechanical properties which have become crucial in dealing with the issue of weight reduction without undermining structural integrity. Therefore, as companies increasingly focus on fuel efficiency and safe environment, this market will expand gradually.The microcellular plastic market is estimated to be worth USD 20,072.3 Million by 2030 with a CAGR of 7.9% from 2022 to 2028.

Moreover, automotives make up a significant fraction of the microcellular plastic industry’s input variables. With EVs becoming more popular and hybrid cars emerging as an alternative, manufacturers are looking out for lighter materials to help increase overall vehicle efficiency. Due to their ability to reduce weight thus improving fuel economy, microporous plastics have gained prominent acceptance within auto manufacturing today. As such, demand for microporous plastics for manufacturing EV components as well as battery enclosures will increase further due to rapid transition towards electric mobility.

Market factors equally evolve due to changes in customer preferences and environmental concerns.Changing consumer behavior focusing more on eco-friendly products means producers need sustainable solutions.Thus, these preferences fit well into micro-cellular plastics attributes characterized by recyclability and carbon footprints reductions.Therefore, as business people adapt their production processes they seek supplies of eco-friendly goods.

The market for microcellular plastics is also significantly driven by technological developments. Continuous efforts in research and development have resulted into various innovations on microcellular plastics hence broadening their scope of applications. The use of new formulations as well as processing techniques enhances material properties thus making microcellular plastics more versatile and appealing to several industries. This creative process is predicted to bring in further opportunities so that the market can grow even larger.

However, there are obstacles like high production costs and limited awareness about the advantages of microcellular plastics. Removing these barriers will be crucial so that companies can fully exploit the potential of microporous materials across different sectors. In conclusion, multiple factors impact growth in the Microcellular Plastics Market including industry trends, regulatory framework, consumer behavior, technology advancements and challenges that shape this dynamic market."

Leave a Comment