Focus on Joint Operations

The Military Amphibious Vehicle Market is increasingly shaped by a focus on joint operations among allied forces. As military strategies evolve, there is a growing recognition of the need for interoperability between different branches of the armed forces. Amphibious vehicles play a crucial role in facilitating joint operations, enabling seamless transitions between land and sea. This trend is particularly relevant in multinational exercises, where diverse forces collaborate to achieve common objectives. The emphasis on joint operations is likely to drive demand for versatile amphibious platforms that can accommodate various operational requirements. Consequently, the Military Amphibious Vehicle Market is expected to expand as nations invest in vehicles that enhance collaborative capabilities.

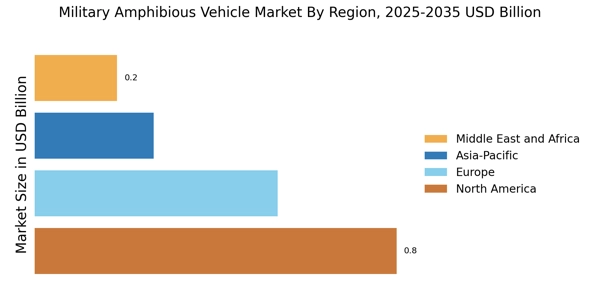

Increased Defense Budgets

The Military Amphibious Vehicle Market is benefiting from increased defense budgets across various nations. Governments are prioritizing military modernization efforts, which include the procurement of advanced amphibious vehicles. This trend is particularly evident in regions where maritime security is a growing concern. For example, recent reports indicate that defense spending in certain countries has risen by over 10% in the past year, with a significant portion allocated to amphibious warfare capabilities. This financial commitment suggests a long-term investment in enhancing operational readiness and versatility. As nations seek to bolster their amphibious forces, the Military Amphibious Vehicle Market is poised for substantial growth, driven by these increased defense expenditures.

Technological Innovations

The Military Amphibious Vehicle Market is experiencing a surge in technological innovations that enhance operational capabilities. Advanced materials, such as lightweight composites, are being integrated into vehicle designs, improving mobility and durability. Additionally, the incorporation of cutting-edge navigation and communication systems allows for better coordination during amphibious operations. As military forces seek to modernize their fleets, investments in research and development are expected to rise. Reports indicate that the market for amphibious vehicles is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years, driven by these technological advancements. This trend suggests that nations are prioritizing the enhancement of their amphibious capabilities to ensure readiness for diverse operational scenarios.

Environmental Considerations

The Military Amphibious Vehicle Market is increasingly influenced by environmental considerations and sustainability initiatives. As military organizations become more aware of their ecological footprint, there is a push towards developing amphibious vehicles that are not only effective but also environmentally friendly. Innovations in propulsion systems, such as hybrid technologies, are being explored to reduce emissions and enhance fuel efficiency. This shift towards sustainable practices is likely to resonate with defense procurement policies, as governments seek to align military operations with environmental standards. The integration of eco-friendly technologies into amphibious vehicles may also open new avenues for research and development, further propelling the growth of the Military Amphibious Vehicle Market.

Changing Geopolitical Landscape

The Military Amphibious Vehicle Market is significantly influenced by the changing geopolitical landscape. As nations reassess their defense strategies in response to emerging threats, there is a growing emphasis on amphibious capabilities. Countries are increasingly recognizing the importance of rapid deployment forces that can operate in both land and maritime environments. This shift is likely to drive demand for amphibious vehicles, as they provide strategic advantages in various conflict scenarios. For instance, recent military exercises have highlighted the necessity for versatile platforms that can adapt to different terrains. Consequently, defense budgets are being allocated to enhance amphibious capabilities, indicating a robust growth trajectory for the Military Amphibious Vehicle Market.