Geopolitical Tensions

Geopolitical tensions and regional conflicts are exerting considerable influence on the Military Fixed-Wing Aircraft Market. Nations are compelled to enhance their military capabilities in response to perceived threats, leading to increased procurement of advanced aircraft. The ongoing conflicts in various regions have underscored the necessity for robust air power, prompting countries to invest in modern fixed-wing platforms. This heightened focus on military readiness is expected to sustain demand for new aircraft, as nations seek to bolster their deterrence capabilities. Consequently, the Military Fixed-Wing Aircraft Market is likely to benefit from these dynamics, with a sustained emphasis on modernization and capability enhancement.

Increased Defense Budgets

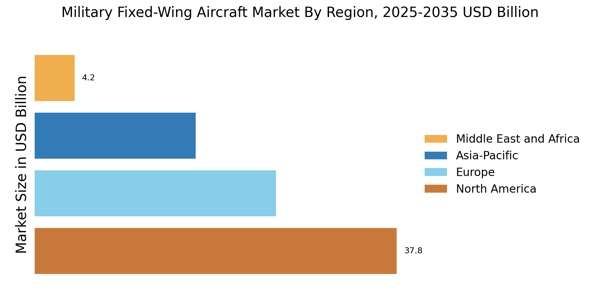

Rising defense budgets across various nations are a pivotal driver for the Military Fixed-Wing Aircraft Market. Governments are prioritizing military modernization to address evolving threats, leading to substantial investments in new aircraft and upgrades to existing fleets. For instance, defense spending in regions such as Asia-Pacific and Europe has seen notable increases, with some countries allocating over 2% of their GDP to defense. This financial commitment is likely to bolster procurement programs for advanced fixed-wing aircraft, thereby stimulating market growth. The emphasis on enhancing air power capabilities is expected to create a robust demand for military fixed-wing platforms, further solidifying the industry's trajectory.

Technological Advancements

The Military Fixed-Wing Aircraft Market is experiencing a surge in technological advancements, particularly in avionics, materials, and propulsion systems. Innovations such as stealth technology and advanced radar systems enhance operational capabilities and survivability. The integration of artificial intelligence and unmanned systems is also transforming traditional roles, allowing for more efficient mission planning and execution. As nations invest in next-generation aircraft, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 4% in the coming years. This trend indicates a shift towards more sophisticated platforms that can operate in contested environments, thereby driving demand in the Military Fixed-Wing Aircraft Market.

Focus on Multi-Role Capabilities

The Military Fixed-Wing Aircraft Market is increasingly oriented towards multi-role capabilities, allowing aircraft to perform various missions such as reconnaissance, transport, and combat. This versatility is essential for modern military operations, where adaptability can significantly enhance operational effectiveness. As a result, manufacturers are developing platforms that can seamlessly transition between roles, thereby maximizing resource utilization. The demand for multi-role aircraft is reflected in procurement strategies, with many nations seeking to acquire versatile platforms that can meet diverse operational requirements. This trend is likely to drive innovation and competition within the Military Fixed-Wing Aircraft Market, as companies strive to deliver adaptable solutions.

Environmental Regulations and Sustainability

The Military Fixed-Wing Aircraft Market is increasingly influenced by environmental regulations and the push for sustainability. As governments and military organizations become more aware of their environmental impact, there is a growing emphasis on developing aircraft that meet stringent emissions standards. This shift is prompting manufacturers to innovate in areas such as fuel efficiency and alternative propulsion systems. The integration of sustainable practices in aircraft design and operation is not only a regulatory requirement but also a strategic advantage in enhancing operational efficiency. As a result, the Military Fixed-Wing Aircraft Market is likely to see a rise in demand for eco-friendly aircraft solutions, aligning military objectives with environmental stewardship.