Integration with Other Military Systems

The Military GPS Receiver Market is evolving with the integration of GPS technology into various military systems. This integration enhances the functionality of platforms such as drones, ground vehicles, and naval vessels, allowing for improved situational awareness and operational efficiency. The trend towards network-centric warfare necessitates that military GPS receivers work seamlessly with other systems, including communication and surveillance technologies. Market data indicates that the interoperability of GPS systems with other military assets is becoming a critical factor in procurement decisions. As a result, the demand for integrated military GPS solutions is expected to grow, reflecting the need for cohesive operational capabilities.

Increased Demand for Precision Navigation

The Military GPS Receiver Market is witnessing an increased demand for precision navigation solutions. As military operations require high levels of accuracy for mission success, the need for advanced GPS receivers that can provide precise location data is paramount. This demand is further fueled by the growing reliance on unmanned systems and autonomous vehicles, which necessitate accurate navigation capabilities. The market data suggests that the segment for precision navigation systems is expected to account for a significant share of the military GPS receiver market, potentially reaching a valuation of several billion dollars by 2027. This trend indicates a shift towards more sophisticated navigation technologies that can support complex military operations.

Emerging Markets and Defense Modernization

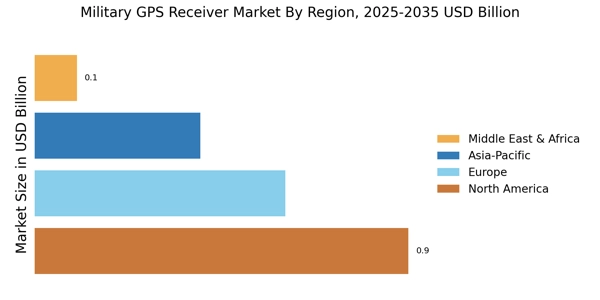

The Military GPS Receiver Market is also being driven by emerging markets that are modernizing their defense capabilities. Countries in regions such as Asia and the Middle East are increasingly investing in advanced military technologies, including GPS systems. This modernization effort is often motivated by the need to enhance national security and respond to regional threats. Market analysis suggests that these emerging markets could represent a substantial growth opportunity for military GPS receiver manufacturers. As these nations seek to upgrade their military infrastructure, the demand for reliable and advanced GPS technology is likely to increase, contributing to the overall expansion of the military GPS receiver market.

Geopolitical Tensions and Defense Spending

The Military GPS Receiver Market is significantly influenced by geopolitical tensions and the corresponding increase in defense spending. Nations are investing heavily in modernizing their military capabilities, which includes upgrading GPS systems to ensure operational effectiveness. The current geopolitical landscape suggests that countries are prioritizing the development of advanced navigation technologies to enhance their military readiness. As defense budgets expand, the military GPS receiver market is likely to benefit from increased procurement of advanced GPS systems. Analysts project that defense spending in various regions will continue to rise, thereby bolstering the demand for military GPS receivers and related technologies.

Technological Advancements in Military GPS Receivers

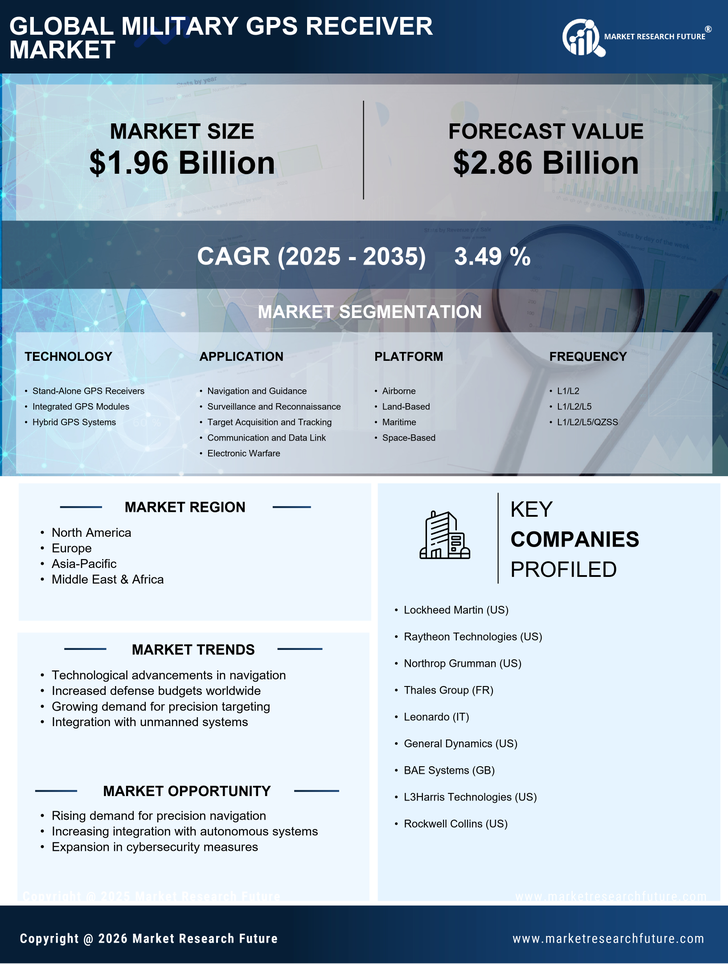

The Military GPS Receiver Market is experiencing a surge in technological advancements, which are enhancing the capabilities of GPS systems. Innovations such as multi-frequency receivers and advanced signal processing techniques are improving accuracy and reliability. The integration of artificial intelligence and machine learning algorithms is also being explored to optimize navigation and positioning. As military operations become increasingly complex, the demand for sophisticated GPS technology is likely to rise. Reports indicate that the military GPS receiver market is projected to grow at a compound annual growth rate of approximately 5.2% over the next several years, driven by these advancements. This growth reflects the military's commitment to maintaining operational superiority through enhanced navigation systems.