- Global Market Outlook

- In-depth analysis of global and regional trends

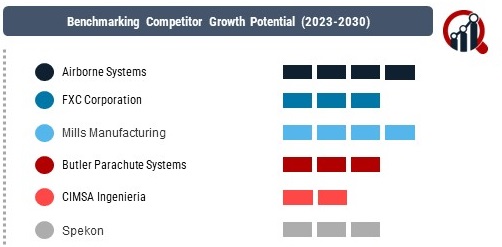

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Key Players

Airborne Systems (U.S.)

FXC Corporation (U. S.)

Mills Manufacturing (U. S.)

Butler Parachute Systems (U. S.)

CIMSA Ingenieria (Spain)

Spekon (Germany)

Strategies Adopted

Surviving and thriving in the military parachute market requires strategic foresight and innovation. Key players have adopted multifaceted approaches to maintain their competitive edge. Technological innovation stands out as a primary strategy, with companies investing in the development of advanced parachute systems that offer enhanced precision, control, and safety. Airborne Systems, for instance, is known for its innovation in guided precision aerial delivery systems, elevating the accuracy of parachute landings.

Strategic partnerships and collaborations are also prevalent strategies in this market. Establishing strong ties with defense organizations and government agencies allows companies to secure long-term contracts and gain a competitive advantage. Moreover, diversification of product offerings, including specialized parachutes for various military applications, enables companies to cater to a broad spectrum of defense requirements.

Factors for Market Share Analysis

The military parachute market is influenced by several factors that contribute to the analysis of market share. The reliability and performance of parachute systems in real-world military operations play a crucial role. Companies with a proven track record of successful deployments and a history of meeting stringent military standards are more likely to secure a larger market share. Additionally, the ability to offer a comprehensive range of parachute solutions, including personnel parachutes, cargo parachutes, and guided precision systems, contributes to market dominance.

Research and development capabilities are key differentiators in this competitive landscape. Companies that invest in advancing parachute technologies, improving aerodynamics, and enhancing materials to withstand diverse operational environments gain a competitive advantage. The agility to adapt to evolving military requirements and regulations also plays a significant role in determining market share, as defense agencies seek partners capable of providing cutting-edge solutions.

New and Emerging Companies

While established players dominate the military parachute market, new and emerging companies are making strides by introducing innovative technologies and approaches. Companies such as Drone Delivery Canada, although relatively new to the scene, are exploring the integration of unmanned aerial vehicles (UAVs) with parachute systems, presenting novel solutions for cargo delivery in military operations.

Moreover, startups focused on parachute materials and manufacturing processes are entering the market with sustainable and advanced materials. These companies aim to address environmental concerns, reduce the ecological footprint of parachute systems, and contribute to the overall modernization of military equipment. While they may not yet have the market presence of industry giants, their innovative contributions are shaping the future of military parachuting.

Industry News

The military parachute market is not immune to the impact of global events and geopolitical developments. Recent industry news highlights advancements in parachute technology, with a focus on improving safety features and incorporating smart technologies for real-time monitoring. The integration of artificial intelligence (AI) and Internet of Things (IoT) capabilities into parachute systems is a notable trend, providing military forces with enhanced situational awareness during aerial operations.

Additionally, news surrounding successful military exercises and deployments involving parachute systems showcases the reliability and effectiveness of various manufacturers. Collaborations between defense agencies and parachute suppliers for joint research and development projects contribute to industry advancements and foster innovation.

Current Company Investment Trends

Investment trends in the military parachute market reflect the industry's response to evolving defense requirements and technological advancements. Companies are allocating resources to research and development to enhance the precision and safety features of parachute systems. The integration of smart technologies, including sensors and communication modules, is a key focus area, allowing for real-time data transmission and improved control during parachute operations.

Furthermore, sustainability is emerging as a significant investment trend, with companies exploring environmentally friendly materials and manufacturing processes. The development of reusable parachute systems and the reduction of single-use materials align with broader trends in sustainable practices within the defense industry. Investors are increasingly recognizing the importance of companies that prioritize both technological innovation and environmental responsibility.

Overall Competitive Scenario

The competitive landscape of the military parachute market is characterized by the dominance of established players with a rich history of innovation and collaboration. Key strategies include technological advancement, strategic partnerships, and diversification of product offerings. Market share is determined by factors such as reliability, R&D capabilities, and the ability to meet evolving military requirements.

New entrants, while not yet reaching the scale of industry leaders, contribute to the market's vibrancy by introducing innovative technologies and sustainable practices. Industry news reflects ongoing advancements in parachute technology and the impact of global events on military parachute deployments. Current investment trends emphasize the integration of smart technologies, sustainability, and research and development.

As the military parachute market continues to evolve, companies that can balance technological innovation with environmental responsibility and strategic collaborations will likely shape the future of airborne operations and maintain a strong competitive position in this critical sector of the defense industry.

Recent New

Airborne Systems (UTC)

Awarded a multi-million dollar contract by the U.S. Army to supply their T-11R single-pin reserve parachutes, boasting faster opening times and enhanced stability.

Partnered with leading research institutions to explore parachute designs inspired by birds and insects, aiming for improved maneuverability and wind resistance.

Mills Manufacturing (Mills)

Secured a contract with the British Army to provide their T-10R reserve parachutes, known for their ruggedness and reliability in harsh environments.

Invested in advanced manufacturing techniques and material research, aiming to create lighter and stronger parachute systems for soldiers.

Military Parachute Market Highlights:

Military Parachute Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.