- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Global Military Parachute Market Overview

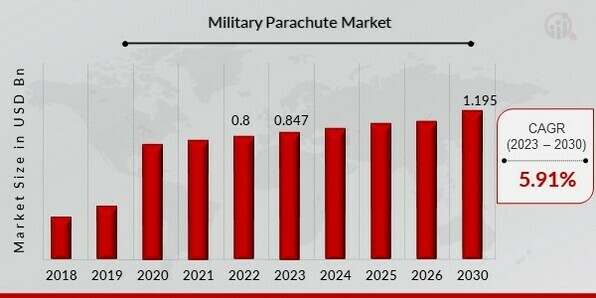

Military Parachute Market Size was valued at USD 0.8 billion in 2022. The Military Parachute market is projected to grow from USD 0.84728 Billion in 2023 to USD 1.195773056 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.91% during the forecast period (2024 - 2032). Increasing Level Of Parachute Technological Advancements and Growing Territorial Disputes are the key market driver enhancing market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Military Parachute Market Trends

Increase in the Deployment of Parachutes in Defense and the Evolution of Parachutes in Sports are driving the market growth

The use of parachutes in military operations has significantly increased demand, with the defense industry being the main user. The rise in wars worldwide, the expansion of ISR activities involving UAVs, and the expansion of parachuting as a recreational activity will increase demand for parachutes. Technological developments, including utilizing lightweight materials, integrating GPS systems, drogue chutes, and recovery parachutes, will further support the rise. Round parachutes are mostly used in military ejection seats, cargo, and drogue chutes. These parachutes are also utilized in recreational activities like parasailing and aircraft recovery systems. Due to rising spending by nations like China and India to increase their air superiority, the market for round parachutes in the Asia-Pacific region would experience rapid expansion.

Developed economies like North America and Europe significantly invest in creating and acquiring technical textiles for troop parachutes and recovery. Due to a lack of resources and understanding, emerging markets have had a slower adoption rate of parachutes and their potential advantages. Since these markets have several untapped and undiscovered prospects, their development is anticipated to increase during the projection period.

Yet, some significant restrictions may impact the military parachute market's growth in the ensuing years. These considerations include severe government regulations since it is difficult for manufacturers of parachute systems and parachute equipment to follow the regulations of procurement and inspection. Most worldwide military parachute market participants are from the North American and European continents, which is diverse and competitive. Based on their core strengths, businesses dominate the market. The United States Airborne Systems, Mills Manufacturing, Butler Parachute Systems, Spekon (Germany), FXC Corporation, and CIMSA Ingenieria are the major market participants (Spain).

Military Parachute Market Segment Insights

Military Parachute Application Type Insights

Based on application, the Military Parachute Market segmentation includes military, cargo, sports, rescue, recovery, and break chutes. The military segment held the majority share in 2022 concerning the Military Parachute Market revenue. As of 2014, the military sector dominated the market for military parachute equipment. The sector for sports applications is anticipated to expand at the highest CAGR from 2015 to 2020.

The nations of North America and Europe have engaged in several initiatives to bolster their armed forces, mostly to be combat-ready. Having enough paratroopers is necessary for this level of military readiness. Delivering equipment and supplies to soldiers in combat zones is now possible thanks to parachutes. Parachutes can be used on land and in the water to carry out combat drops and search and rescue missions.

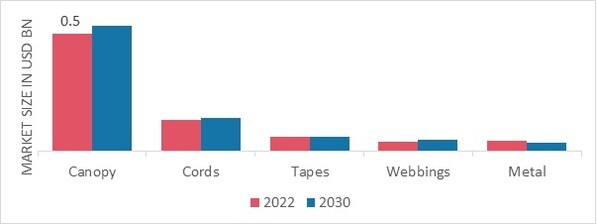

Military Parachute Components Insights

Based on components, the Military Parachute Market segmentation includes canopy, cords, tapes, webbings, and metal. The canopy segment held the majority share in 2022 concerning the Military Parachute Market revenue. Canopies are essential to military parachutes, providing the necessary lift and control to safely and efficiently deploy personnel and equipment. Here are some uses of canopies in the military parachute Industry. Canopies are used in military personnel parachutes to provide lift and control during the descent. They are designed to withstand extreme conditions and ensure a safe landing for soldiers. Canopies are also used in military cargo parachutes to deliver supplies and equipment to troops on the ground. The size and shape of the canopy are specifically designed to accommodate different types of cargo and ensure safe and accurate delivery. Thus, growth in the total market is anticipated in the upcoming years and positively impacts the market growth.

Figure 1: Military Parachute Market, by Components, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Military Parachute Type Insights

By type, the Military Parachute Market data includes Round Parachutes, Ram-air Parachutes, Square or Parafoil parachutes, and Ring or Ribbon parachutes. The round parachute sector dominates the market for parachute types among the parachute types included in the report. Round parachutes are mostly used in military ejection seats, cargo, and drogue chutes. These parachutes are also utilized in recreational activities like parasailing and aircraft recovery systems. Due to rising spending by nations like China and India to increase their air superiority, the market for round parachutes in the Asia-Pacific region would experience rapid expansion. The ram-air parachute segment is anticipated to develop at the greatest CAGR throughout the forecast period. The North American market for ram-air parachutes is projected to be dominated by Airborne Systems, a major producer of these devices.

Military Parachute Regional Insights

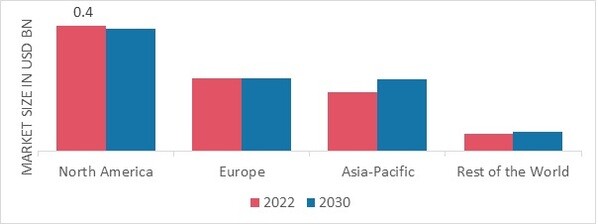

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America Military Parachute market accounted for USD 0.3664 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. In 2021, North America accounted for the largest Military Parachute Market share. North America is home to several significant parachute producers, such as Airborne Systems, BAE System Plc, and Mills Manufacturing. Also, several significant Military Parachute manufacturers, including Spekon, Ballenger International, Safran SA, Butler Parachute Systems Group, Aerodyne Research, LLC, and others, have their regional operational headquarters. Due to significant competitors in the market, the availability of technologically upgraded military parachutes is anticipated to drive sales growth in the area.

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: MILITARY PARACHUTE MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe’s Military Parachute market accounts for the second-largest market share. Europe is anticipated to rise at a notable growth rate throughout the forecast period. Significant players and R&D projects are anticipated to provide increased earnings over the projection period. Due to increased investment in parachute manufacturing businesses in this region, the European market is anticipated to grow at a moderate rate shortly. Further, the German Military Parachute market held the largest market share, and the UK Military Parachute Industry was the fastest-growing market in the North American region.

Asia Pacific’s Military Parachute market is expected to grow at the fastest CAGR from 2023 to 2030. Conversely, the Asia-Pacific area is anticipated to record the greatest CAGR due to the people's growing disposable income and the region's growing popularity of aerial sports like skydiving and parachute jumping. Further, India’s Military Parachute market held the largest market share, and the China Military Parachute was the fastest-growing market in the Asia Pacific region.

Military Parachute Key Market Players & Competitive Insights

Major market players are spending much on R&D to increase their product lines, which will help the Military Parachute market grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Military Parachute industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

The military and commercial parachute market's competitive landscape gives information per competitor. The company's financials, revenue generated, market potential, investment in R&D, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance are among the details that are included.

Numerous businesses are forging strategic alliances, partnerships, and acquisitions to establish a firm footing in the industry. The Military Parachute market’s major players include Airborne Systems (U.S.), FXC Corporation (U. S.), Mills Manufacturing (U. S.), Butler Parachute Systems (U. S.), CIMSA Ingenieria (Spain), Spekon (Germany) and others, are working on expanding the market demand by investing in research and development activities.

FXC Corporation, A privately held California corporation named FXC Corporation, was founded in 1973 and is officially recognized by the government as a Small Business entity. The FXC Corporate organization is a recognized supplier of Critical Safety Items products to the U.S. DoD and foreign military customers through its branch, Guardian Parachute. Design, testing, manufacture, and distribution of mechanical and electro-mechanical devices and parachute systems for military applications make up the core competencies and commercial base of FXC. Moreover, FXC continues to have creative capabilities for developing exclusive new products in aerial delivery systems and protection gear for aircrews for military uses.

Also, The Spekon Corporation has been a leader in producing textile goods since its founding in 1842. Modern parachute systems, for which we are currently among the top firms in the world, are only one example of the products we offer. We also offer many textile products and fiber compound materials for various application areas. Our company's ideology includes having an internal research and development division. This allows us to quickly implement fresh perspectives and ground-breaking ideas from conception to implementation.

Key Companies in the Military Parachute market include

- Airborne Systems (U.S.)

- FXC Corporation (U. S.)

- Mills Manufacturing (U. S.)

- Butler Parachute Systems (U. S.)

- CIMSA Ingenieria (Spain)

- Spekon (Germany)

Military Parachute Industry Developments

For instance, November 2020 The procedures for delivering supplies and equipment to soldiers in combat zones have been made possible thanks to worldwide parachutes.

For instance, November 2022 The capacity to perform combat drops and search and rescue missions on both land and water with parachutes is proving to help meet the target audience's expanding needs.

Military Parachute Market Segmentation

Military Parachute by Application Outlook

- Military

- Cargo

- Sports

- Recovery

- Break Chutes

Military Parachute by Components Outlook

- Canopy

- Cords

- Tapes

- Webbings

- Metal

Military Parachute by Type Outlook

- Round Parachute

- Ram-air Parachute

- Square or Parafoil Parachute

- Ring or Ribbon Parachute

Military Parachute Regional Outlook

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

-

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.