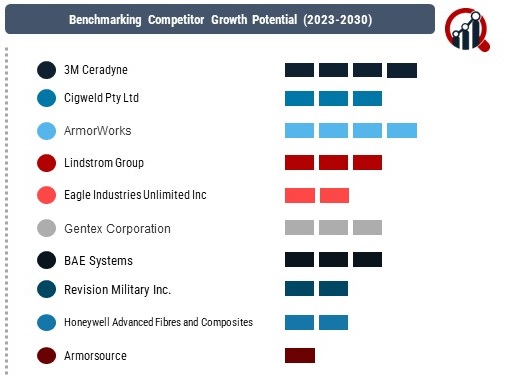

Top Industry Leaders in the Military Personal Protective Equipment Market

Key Players

3M Ceradyne (US)

Cigweld Pty Ltd (US)

ArmorWorks (US)

Lindstrom Group (Finland)

Eagle Industries Unlimited Inc. (US)

Gentex Corporation (US)

BAE Systems (UK)

Revision Military Inc. (US)

Honeywell Advanced Fibres and Composites (US)

Armorsource (US)

DuPont (US)

Strategies Adopted

In the competitive realm of military PPE, companies deploy strategic initiatives to secure market leadership. Technological innovation is a central strategy, with companies investing heavily in research and development to create PPE that not only meets but exceeds the stringent requirements of military environments. Honeywell, for instance, is at the forefront of developing advanced materials and smart textiles that enhance protection while ensuring comfort and mobility.

Strategic partnerships with defense agencies and military branches are another common tactic. Collaborating with government entities allows companies to understand specific operational requirements and tailor their PPE offerings accordingly. BAE Systems, a key player in this arena, often engages in collaborative ventures with defense organizations to develop state-of-the-art protective solutions.

Additionally, diversification of product portfolios is crucial. Companies aim to provide comprehensive PPE solutions that cover a spectrum of threats, from ballistic protection to chemical and biological defense. This approach not only addresses the multifaceted nature of modern warfare but also positions companies as one-stop solutions for military PPE needs.

Factors for Market Share Analysis

Several factors influence the market share dynamics of the military PPE sector. The ability to meet and exceed stringent quality and safety standards is paramount. Companies with a proven track record of delivering PPE that complies with military specifications, such as the National Institute of Justice (NIJ) standards for body armor, often secure a larger market share. Certification and compliance with international standards further enhance a company's credibility in the market.

Customization capabilities are also critical. Military operations vary widely, and PPE must be tailored to specific environments and threats. Companies that can offer bespoke solutions, adapting their products to the unique needs of different military branches or specific mission requirements, gain a competitive edge.

Geographic presence and the ability to serve a global customer base contribute to market share as well. As military forces worldwide seek reliable and technologically advanced PPE solutions, companies with a broad international reach can tap into diverse markets and establish a strong foothold.

New and Emerging Companies

While established players dominate the military PPE market, new and emerging companies bring fresh perspectives and innovations. Start-ups such as Avon Protection Systems and Revision Military are gaining prominence with their focus on introducing cutting-edge technologies, including augmented reality (AR) integrated helmets and lightweight, high-performance materials.

These emerging companies often specialize in niche areas, addressing specific gaps in the market. For instance, some focus on developing PPE for unconventional warfare scenarios, such as urban combat or irregular warfare. As the nature of military threats evolves, these companies play a crucial role in pushing the boundaries of innovation and diversifying the available options for military PPE.

Industry News

The military PPE market is dynamic, with industry news reflecting advancements, collaborations, and contract wins. Ongoing developments include the integration of smart technologies into PPE, such as sensors for real-time monitoring of physiological indicators. Innovations like these not only enhance the protective capabilities of gear but also contribute to the overall situational awareness of military personnel.

Contract awards and collaborations with defense agencies are significant news indicators in this sector. Companies securing contracts for the supply of military PPE often experience a boost in market visibility and credibility. Industry news also highlights advancements in materials science, with breakthroughs in lightweight yet robust materials that contribute to the development of next-generation protective gear.

Current Company Investment Trends

Investment trends in the military PPE market underscore the industry's commitment to innovation and preparedness. Companies allocate substantial resources to research and development, focusing on materials science, nanotechnology, and the integration of smart technologies. Investments in advanced manufacturing processes, such as 3D printing and additive manufacturing, contribute to the production of complex, customized PPE components.

Sustainability is emerging as a noteworthy investment trend, with companies exploring eco-friendly materials and manufacturing practices. This aligns with broader global trends toward responsible and sustainable defense solutions. Additionally, investments in cybersecurity technologies, as part of integrated PPE systems, reflect the growing recognition of the importance of protecting military personnel from cyber threats.

Overall Competitive Scenario

the competitive landscape of the military PPE market reflects a dynamic interplay of innovation, strategic partnerships, and a commitment to meeting the evolving needs of modern warfare. Established players leverage their expertise, international reach, and comprehensive product portfolios to maintain dominance. New and emerging companies contribute to the market's vibrancy by introducing disruptive technologies and niche solutions.

Factors influencing market share analysis include adherence to quality standards, customization capabilities, and global presence. Industry news highlights the ongoing evolution of military PPE, with a focus on smart technologies and sustainable practices. Current investment trends underscore the industry's dedication to staying at the forefront of defense technology, ensuring that military personnel are equipped with the best possible protection in an ever-changing threat landscape.

Recent News

3M Ceradyne

Secured a multi-million dollar contract to supply the U.S. Army with next-generation ballistic vests made with advanced composite materials for enhanced protection against small arms fire and fragmentation.

Developed a revolutionary helmet-mounted display integrating augmented reality and thermal imaging capabilities for improved situational awareness and decision-making on the battlefield.

BAE Systems plc (BAE)

Won a contract to provide the British Army with its latest combat clothing system featuring modularity, climate control technology, and enhanced fire retardancy for optimal protection and comfort in diverse environments.

Partnered with a leading research institute to develop self-healing body armor capable of repairing minor damage, potentially extending field lifespan and reducing replacement costs.

Honeywell International Inc. (HON)

Launched a new line of respiratory protection systems specifically designed for military applications, offering unparalleled filtration against chemical and biological agents.

Collaborating with the U.S. Air Force to develop advanced exoskeletons for pilots and ground crew, aiming to reduce fatigue and enhance physical capabilities for extended operations.

DuPont de Nemours, Inc. (DD)

Unveiled new flame-resistant fabrics for military uniforms and protective gear, offering superior thermal protection and improved breathability for increased soldier comfort.

Partnered with a tech startup to develop smart textiles integrated with sensors and communication systems, enabling real-time monitoring of soldier health and environmental conditions.