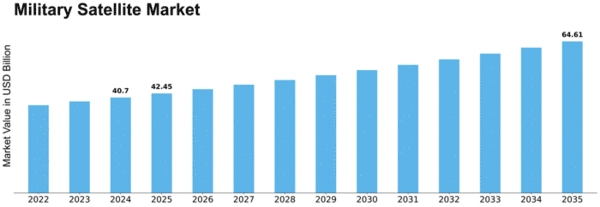

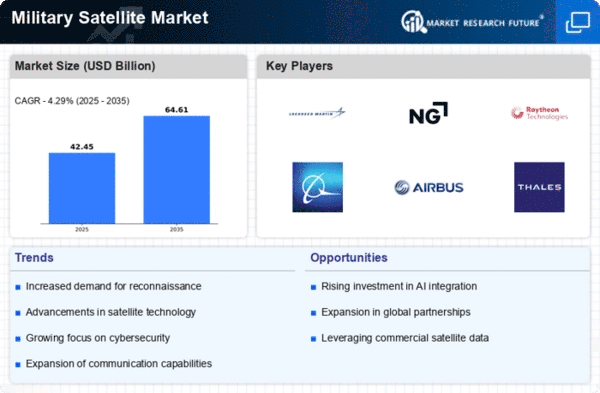

Military Satellite Size

Military Satellite Market Growth Projections and Opportunities

The SATCOM (Satellite Communication) market is a bustling hub of activity, driven by numerous companies vigorously addressing the escalating demand for satellite-based communication. The sheer number of companies in this market intensifies competition, and contrary to what one might think, this competition is a positive force. It acts as a catalyst, compelling companies to innovate and develop new and improved products. When companies introduce advanced and appealing satellite communication systems, it piques the interest of a broader audience, fostering the overall growth of the market. Honeywell International, Inc., a major player headquartered in the United States, stands out in this competitive landscape. Instead of resting on their laurels, they are actively launching new and enhanced SATCOM systems. This strategic move isn't just about staying in the game; it's about positioning themselves as leaders in the market, setting a standard for excellence and innovation. On a global scale, industry experts anticipate substantial growth in the SATCOM market, projecting an 8.44% increase from 2021 to 2027. In 2020, North America emerged as the frontrunner, constituting a significant share of the market at 31.70%. Following North America, Europe and Asia Pacific secured prominent positions with market shares of 24.70% and 22.78%, respectively. This signifies that a substantial portion of SATCOM activities worldwide is concentrated in these regions, showcasing their pivotal roles in shaping the global landscape. In essence, the SATCOM market is not only vibrant but also fiercely competitive, as companies strive to introduce superior and technologically advanced communication solutions through satellites. This competition, far from being a hindrance, fuels progress, ensuring that companies continuously enhance their offerings. As the market expands and undergoes evolution, the benefits extend beyond the companies involved. It translates into improved and efficient satellite communication services becoming more accessible to people worldwide. In essence, the competitive spirit within the SATCOM market serves as a driving force for positive change, bringing forth innovations that elevate the overall quality and accessibility of satellite-based communication.

Leave a Comment