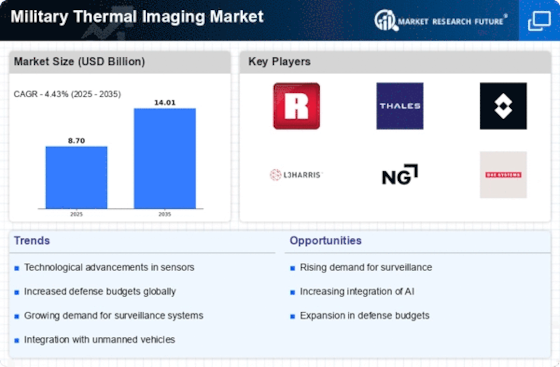

Increased Defense Spending

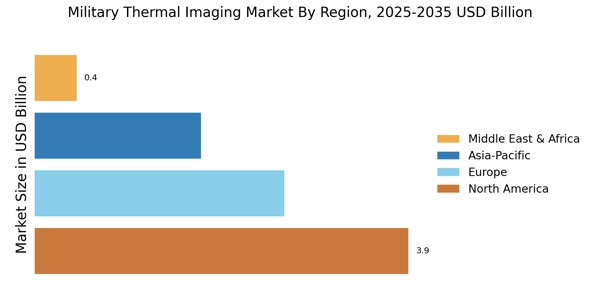

The Military Thermal Imaging Market is significantly influenced by the rising defense budgets across various nations. Governments are allocating more resources to modernize their military capabilities, which includes investing in advanced thermal imaging systems. For example, defense spending in regions such as North America and Europe has seen a notable increase, with many countries prioritizing the acquisition of sophisticated surveillance and reconnaissance technologies. This trend is expected to continue, as geopolitical tensions and security threats drive nations to enhance their military readiness. Consequently, the demand for thermal imaging systems is likely to rise, reflecting the growing emphasis on advanced military technologies.

Focus on Situational Awareness

The Military Thermal Imaging Market is increasingly shaped by the emphasis on situational awareness in military operations. As armed forces strive to improve their operational effectiveness, the need for real-time intelligence and enhanced visibility in various environments becomes paramount. Thermal imaging systems play a crucial role in providing critical information during both day and night operations, enabling military personnel to make informed decisions. The market is witnessing a shift towards integrated systems that combine thermal imaging with other sensor technologies, further enhancing situational awareness. This trend is expected to drive growth in the thermal imaging sector, as militaries recognize the importance of comprehensive battlefield awareness.

Rising Demand for Unmanned Systems

The Military Thermal Imaging Market is benefiting from the increasing deployment of unmanned systems, such as drones and unmanned ground vehicles. These platforms often incorporate advanced thermal imaging technologies to enhance their operational capabilities. The integration of thermal imaging allows for improved reconnaissance, surveillance, and target acquisition, making unmanned systems more effective in various military applications. As the use of drones continues to expand, particularly in intelligence, surveillance, and reconnaissance (ISR) missions, the demand for high-performance thermal imaging systems is likely to grow. This trend suggests a promising future for the thermal imaging market as militaries adapt to modern warfare dynamics.

Emerging Markets and Defense Modernization

The Military Thermal Imaging Market is witnessing growth in emerging markets as countries modernize their defense capabilities. Nations in Asia-Pacific, the Middle East, and Africa are increasingly investing in advanced military technologies, including thermal imaging systems, to enhance their operational effectiveness. This modernization is often driven by regional security challenges and the need to protect national interests. As these countries seek to upgrade their military assets, the demand for thermal imaging solutions is expected to rise. The potential for growth in these emerging markets presents opportunities for manufacturers and suppliers in the thermal imaging sector, indicating a dynamic landscape for the industry.

Technological Advancements in Imaging Systems

The Military Thermal Imaging Market is experiencing rapid technological advancements that enhance the capabilities of thermal imaging systems. Innovations such as improved sensor technologies, advanced image processing algorithms, and integration with artificial intelligence are driving the market forward. For instance, the introduction of uncooled thermal sensors has made systems more compact and cost-effective, appealing to a broader range of military applications. The market is projected to grow at a compound annual growth rate of approximately 7% over the next five years, indicating a robust demand for these advanced imaging solutions. As militaries seek to maintain a tactical edge, the adoption of cutting-edge thermal imaging technologies is likely to become increasingly prevalent.