Top Industry Leaders in the Military Training Aircraft Market

Strategies Adopted: In the fiercely competitive Military Training Aircraft market, key players deploy strategic approaches to maintain a competitive edge. Continuous investment in research and development (R&D) is paramount, enabling companies to introduce next-generation training aircraft with enhanced performance, advanced avionics, and simulated training capabilities. Strategic collaborations with military agencies, international partnerships, and alliances facilitate technology transfer and ensure the development of specialized training aircraft tailored to the evolving needs of modern air forces. Global market expansion through participation in defense contracts, joint ventures, and establishing training centers in key regions ensures a broad market reach, allowing companies to cater to the diverse requirements of defense forces worldwide.

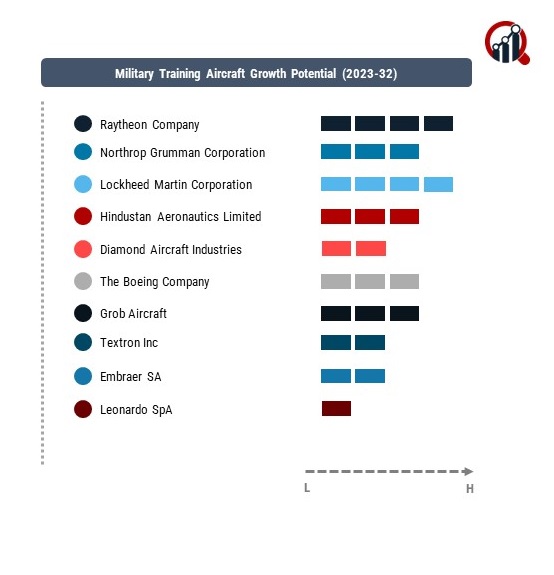

Competitive Landscape of Military Training Aircraft Market

- Raytheon Company (US)

- Northrop Grumman Corporation (US)

- IRKUT CORPORATION (Russia)

- BAE Systems plc (UK)

- Lockheed Martin Corporation (US)

- Hindustan Aeronautics Limited (India)

- Diamond Aircraft Industries (Austria)

- The Boeing Company (US)

- Grob Aircraft (Germany)

- Textron Inc(US)

- Embraer SA (Brazil)

- Leonardo SpA (Italy)

Factors for Market Share Analysis: Market share analysis in the Military Training Aircraft market involves considering various factors crucial to a company's competitive standing. Technical capabilities, such as offering a comprehensive range of training aircraft covering various categories, from basic trainers to advanced jet trainers, play a pivotal role. Companies providing adaptable and customizable training solutions capable of addressing diverse pilot training programs are better positioned to capture a larger market share. Compliance with stringent military standards, the incorporation of state-of-the-art simulation technologies, and integration of advanced avionics contribute significantly to market share dynamics. Additionally, factors like lifecycle support, maintenance services, and overall cost-effectiveness influence a company's market share by enhancing the overall value proposition for air forces seeking comprehensive and efficient training solutions.

New and Emerging Companies: While established players dominate the market, new and emerging companies are entering the Military Training Aircraft sector, contributing to innovation and market diversification. Companies like Leonardo S.p.A and Korea Aerospace Industries (KAI) are gaining recognition for their specialized training aircraft, often focusing on cost-effective solutions, innovative training technologies, and meeting the specific needs of emerging air forces. Emerging companies often bring agility and a fresh perspective to the Military Training Aircraft market, introducing novel approaches and technologies that address the evolving demands of modern pilot training programs.

Industry News: Recent industry news in the Military Training Aircraft market underscores ongoing developments and trends shaping the sector. Innovations in virtual reality (VR) and augmented reality (AR) training simulations, advancements in embedded training systems, and the integration of artificial intelligence for adaptive training programs are gaining prominence. News often covers developments in digital twin technologies for aircraft maintenance training and the use of data analytics to optimize training curricula. Additionally, the market is witnessing news related to the introduction of new training aircraft models, collaborative ventures for joint training programs, and advancements in synthetic training environments. Industry news reflects the dynamic nature of the Military Training Aircraft market, with continuous efforts to improve training effectiveness, efficiency, and overall air force readiness.

Current Company Investment Trends: Investment trends in the Military Training Aircraft market underscore a commitment to technological innovation, digitalization, and global market reach. Companies are allocating substantial resources to R&D initiatives focused on advanced simulation technologies, digital twin applications, and adaptive training solutions. Investments in cybersecurity measures for secure training systems and the development of networked training environments align with the defense industry's broader push towards network-centric warfare. Strategic acquisitions of technology startups specializing in training solutions, partnerships with aerospace research institutions, and collaborations with international defense contractors contribute to a comprehensive approach, ensuring a continuous stream of cutting-edge solutions and maintaining a competitive stance in the market.

Overall Competitive Scenario: The overall competitive scenario in the Military Training Aircraft market reflects a balance between established industry leaders and emerging companies that bring innovation and flexibility to the sector. Established aerospace manufacturers leverage their extensive experience, global reach, and comprehensive training aircraft portfolios to set industry standards. Simultaneously, emerging companies contribute to the diversification of Military Training Aircraft solutions, often focusing on specific training needs or introducing disruptive technologies. The industry's response to evolving air force requirements, technological advancements, and the integration of advanced features into training programs highlights the adaptability and resilience of Military Training Aircraft providers. As air forces globally seek more advanced, cost-effective, and tailored training solutions, the Military Training Aircraft market is poised for continued evolution. The emphasis on technological advancements, strategic collaborations, and meeting the dynamic needs of modern pilot training positions this market as a critical enabler for enhancing air force capabilities and readiness.

Recent Development:

December 2021, Turkish Aerospace and the Universiti Kuala Lumpur Malaysian Institute of Aviation Technology (UniKL MIAT) inked a Memorandum of Cooperation (MoC) to streamline the provision of aerospace education, technical training, and applied research programs in Malaysia.

July 2021, the French Air Force had acquired an additional nine PC-21s.

September 2020, Textron Aviation Defense LLC announced a successful bid for a USD 162 million contract from the Royal Thai Air Force. The contract encompassed 12 Wichita-built Beechcraft T-6C Texan II aircraft, along with associated training systems, spare parts, and ground support equipment, further strengthening military training capabilities.