Market Analysis

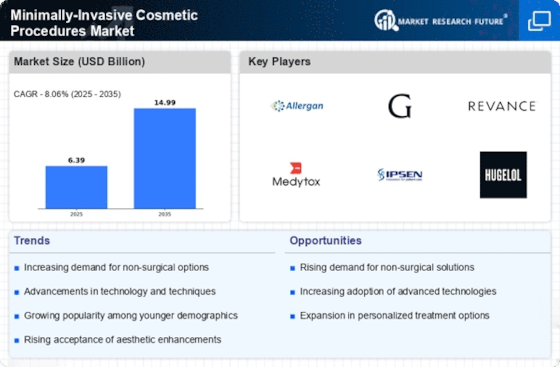

In-depth Analysis of Minimally-Invasive Cosmetic Procedures Market Industry Landscape

In the past years, market dynamics of mininal invasive cosmetic procedures have accelerated massively as a lot is happening at once due to changing consumer preferences, technological advancements and the growing interest towards non-surgical aesthetic treatments. The rising demand for less invasive options to traditional cosmetic surgeries is one of the key driving forces behind the growth of this market. Botox injections, dermal fillers and laser treatments have become very popular since individuals nowadays want minimal downtime and reduced risks when they decide to get beauty enhancements.

Also, brilliance in technology has had an effect on minimally-invasive esthetic surgical processes. Consequently, there are better laser treatments that have brought about more accurate and efficient treatment thus increasing the safety and efficacy of such procedures. Additionally, consumers’ trust in these nonsurgical alternatives has been boosted by injectables with longer-lasting results and improved formulations. This has seen many manufacturers in the market turning into centers of R&D so that they can provide best solutions at any time.

Still, societal norms change over time thus allowing people to accept themselves including their looks through plastic surgery without inhibitions. A wider population age group are taking up minor modifications without people having noticed them thereby diminishing stigma on aesthetic procedures. This attitude transformation has enlarged the client base leading to increased inclusion where different aged people from various backgrounds seek facial makeover services actively.

Contrarily economic environments also play their role in shaping market dynamics regarding these kinds of surgical treatments made less extensive but realistic medically speaking . When economic hardships set in clients may suffer tightened budgets leading industries like beauty care industry might appear as though it could go out but this sector’s endurance is exhibited by self-love practices which continue being prioritized by individuals in such times of trouble . People can still afford various types of external treatments even during tough financial moments unlike surgeries.

Additionally, competition within the market has intensified as numerous players join in offering differentiated products to a variety customers needing various types of services .The competition drives the process of constant innovation and efficiency that leads to differentiation through distinct offerings, well-thought-out partnerships, and integrated marketing. Also, these procedures have now been made available in a wider range of locations thanks to more new entrants into the market including specialized clinics as well as medical spas or even retails.

Market dynamics are also affected by regulatory frameworks that govern minimally invasive aesthetic procedures. More stringent regulations may hamper development and introduction of novel treatments due to safety reasons. Conversely, a conducive regulatory environment creates trust among practitioners and consumers thus fostering market growth. By collaboratively working with such bodies to establish and follow the existing security measures, it proves how much industry is committed to responsible innovation for patients’ good.

Leave a Comment