Market Trends

Key Emerging Trends in the Minimally-Invasive Cosmetic Procedures Market

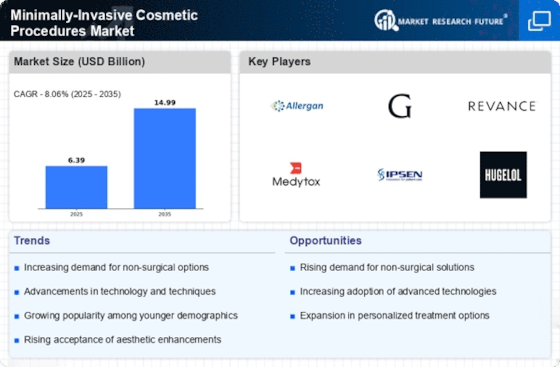

In recent years, minimally-invasive cosmetic procedures market has experienced significant growth as the preference for invasive and more convenient beauty boosters changed. One of the reasons this market is advancing is that people are beginning to accept non-surgical cosmetic treatments as alternatives to traditional surgical procedures. The majority now look for slight changes which do not need extraordinary recovery time and appear very natural. Primarily, this change has come about from an improved technology that has led to new techniques that would offer excellent aesthetic results without going through extensive surgery.

Recently, facial injectables such as dermal fillers and botulinum toxin have become a big thing in the minimally-invasive cosmetic procedures market. Through these injections, one can easily handle wrinkles, fine lines, and loss of facial volume which make them look younger without any surgical operation. These procedures have broad appeal because they are easy to administer and there is a short recover time.

Also worth mentioning is the advent of social media platforms like Instagram and TikTok, where users feel compelled to conform to seemingly perfect beauty standards. Thus, an increased desire among people who want a perfect look is noticed here. Minimally-invasive procedures correspond well with these wishes as they present affordable opportunities for individuals to modify their faces so as to improve their self-esteem.

Another important trend in this industry relates to demand for body contouring procedures such as nonsurgical fat reduction and skin tightening therapies. More people are becoming aware of such options since they don’t want invasive operations like liposuction any more. Such technologies like laser or radiofrequency enabled devices can produce great improvements with little pain or downtime meaning thus leading towards greater acceptance of non-surgical body contouring.

Geographically speaking, the world’s minimally-invasive cosmetic sector seems very promising in various regions worldwide especially developing countries with growing economies where per capita incomes are rising alongside higher levels of interest in self-care and appearance enhancement; besides, the rising number of aesthetic clinics plus availability of trained practitioners have facilitated these procedures hence enhancing market enlargement.

While the market is showing impressive growth, it has a fair share of challenges. This calls for careful consideration of regulatory matters and ethical issues as well as possible side effects. Therefore, it is vital to strike a balance between safety and innovation to keep the momentum going. Further research and development efforts are needed to introduce new technologies and procedures that meet changing consumer needs while maintaining high safety standards.”

Leave a Comment