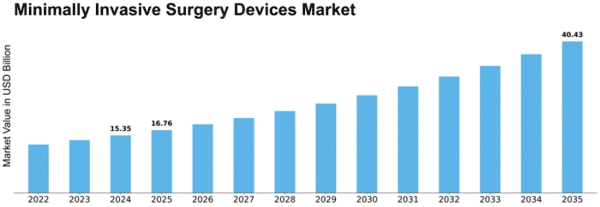

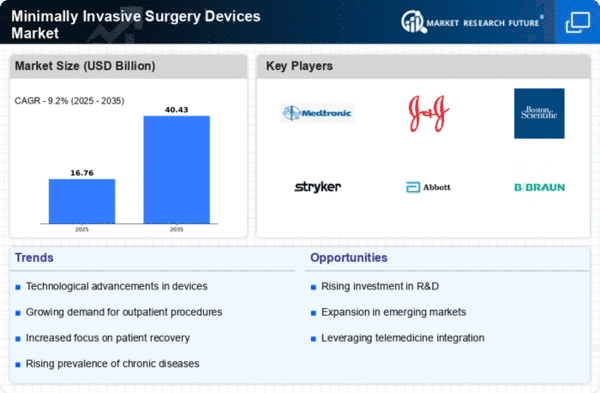

Minimally Invasive Surgery Devices Size

Minimally Invasive Surgery Devices Market Growth Projections and Opportunities

Many variables affect the Tire Changing Machines Market's development and dynamics. Automotive sector health is a major factor. Tire changing machine demand is strongly connected to the automobile industry. As vehicle production and sales rise, service centers and garages require more tire changing equipment.

Consumer tastes shape the tire changing machine industry. Advanced and automated tire changing equipment are in demand as customers seek more convenient and efficient car maintenance. Increasing popularity of electric cars and specialist tires also affect customer demands and the tire changing equipment industry.

Economic variables like inflation and buying power affect the tire changing machine industry. Automotive repair shops and garages buy new equipment based on economic stability and customer spending. Businesses may postpone or cut equipment purchases during recessions, hurting the market.

Tire changing equipment are evolving with technology. Smart technology like sensors and digital interfaces are improving tire change efficiency and accuracy. New tire changing equipment can handle a broad variety of tire sizes, including those used in trucks and buses, extending the market.

Tire changing machines are also affected by government rules and safety requirements. Automotive service providers must follow safety rules. Manufacturers of tire changing machines must meet or exceed these criteria, and regulatory changes might affect their design and features.

Competition in the tire changing machines industry also affects its dynamics. Manufacturers, from global giants to small suppliers, generate competition. Pricing, product quality, and after-sales service are crucial for organizations seeking market share and competitiveness.

Global commerce and geopolitics affect the tire changing machines business. International trade dynamics impact raw material and component availability and price, affecting market enterprises' production costs. Geopolitical conflicts may disrupt supply networks, impacting the market.

Increased vehicle automation affects the tire changing machines market. Tire changing devices with enhanced automation are in demand as vehicle repair facilities and garages automate to save time and money. This tendency will certainly continue as technology advances and corporations streamline operations.

Environmental factors influence the tire changing machine industry. Energy-efficient and eco-friendly technology is in demand due to the automobile industry's sustainability and environmental responsibilities. Environmentally concerned customers and companies will choose tire changing equipment with eco-friendly features.

In conclusion, economic circumstances, technical advances, regulatory requirements, and customer preferences affect the tire changing machines industry. Businesses in this sector must adjust their strategy and services to these elements to be competitive in a continually changing automobile service business.

Leave a Comment