Increased Demand for Durable Fasteners

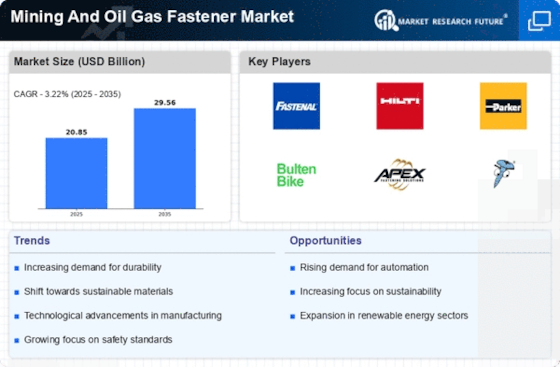

The Mining And Oil Gas Fastener Market experiences heightened demand for durable fasteners due to the rigorous conditions in which they operate. Fasteners must withstand extreme temperatures, corrosive environments, and heavy loads, which necessitates the use of high-quality materials and advanced manufacturing techniques. As mining and oil extraction activities expand, the need for reliable fastening solutions becomes paramount. Reports indicate that the market for fasteners in these sectors is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is driven by the increasing number of mining projects and oil drilling operations, which require robust fastening solutions to ensure operational efficiency and safety.

Focus on Safety and Compliance Standards

Safety and compliance standards are becoming increasingly stringent within the Mining And Oil Gas Fastener Market. Regulatory bodies are enforcing guidelines that mandate the use of high-quality fasteners to ensure the safety of operations. Companies are compelled to adhere to these regulations, which often require the use of certified fasteners that meet specific performance criteria. This focus on safety not only protects workers but also minimizes the risk of costly operational disruptions. As a result, manufacturers are investing in the production of fasteners that comply with these standards, thereby driving market growth. The emphasis on safety is likely to continue influencing purchasing decisions, as companies prioritize compliance to avoid penalties and enhance their operational reputation.

Sustainability and Eco-Friendly Practices

Sustainability is emerging as a key driver in the Mining And Oil Gas Fastener Market. Companies are increasingly adopting eco-friendly practices, which include the use of sustainable materials in fastener production. This shift is driven by both regulatory pressures and consumer demand for environmentally responsible products. Manufacturers are exploring options such as recycled materials and biodegradable coatings to reduce their environmental footprint. The market is witnessing a growing trend towards sustainable fasteners, which not only meet performance requirements but also align with corporate social responsibility goals. Analysts predict that the demand for eco-friendly fasteners could grow by 7% annually, reflecting a broader industry commitment to sustainability and responsible resource management.

Technological Innovations in Fastener Design

Technological innovations play a crucial role in shaping the Mining And Oil Gas Fastener Market. Advances in materials science and engineering have led to the development of fasteners that offer enhanced performance and longevity. For instance, the introduction of high-strength alloys and coatings has improved resistance to wear and corrosion, making fasteners more suitable for harsh environments. Additionally, the integration of smart technologies, such as sensors embedded in fasteners, allows for real-time monitoring of structural integrity. This trend is likely to drive market growth, as companies increasingly seek to adopt cutting-edge solutions that enhance safety and reduce maintenance costs. The market is expected to witness a surge in demand for these innovative fastening solutions.

Rising Investment in Infrastructure Development

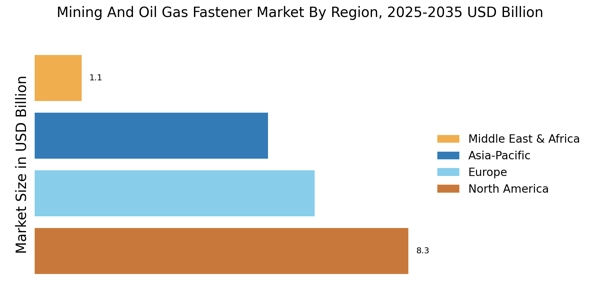

The Mining And Oil Gas Fastener Market is significantly influenced by rising investments in infrastructure development. Governments and private entities are increasingly allocating funds for the expansion of mining operations and oil extraction facilities. This trend is particularly evident in regions rich in natural resources, where infrastructure improvements are essential for efficient resource extraction. As new projects are initiated, the demand for fasteners that can withstand the rigors of these environments is expected to rise. Market analysts suggest that the infrastructure sector's growth could lead to an increase in fastener sales, with projections indicating a potential market expansion of 6% annually over the next five years. This investment-driven growth underscores the importance of reliable fastening solutions in supporting large-scale projects.