Market Share

Mobile Application Testing Services Market Share Analysis

The global mobile application testing services market is undergoing a transformative shift, driven by the dynamic landscape of mobile technology and the increasing demand for seamless, high-quality mobile applications. This market has been segmented based on types of testing services and industry applications, offering valuable insights into the prevailing trends and growth opportunities. In terms of testing services, manual testing holds a dominant position, accounting for the largest market share of 51.1% in 2018, with a market value of USD 1,632.85 million. The manual testing segment is projected to register a substantial Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period.

This indicates a sustained preference for manual testing services in the mobile application domain, highlighting the nuanced and complex nature of testing requirements. Manual testing services involve human testers carefully evaluating mobile applications to identify issues, assess user experience, and ensure overall functionality. While automated testing has gained prominence, manual testing remains crucial for scenarios that require a human touch, such as subjective evaluations of user interfaces and real-world user interactions. The continued significance of manual testing reflects the evolving challenges in ensuring flawless mobile application performance. In terms of industry applications, the Information Technology (IT) and telecommunications segment emerges as a key player, accounting for the largest market share of 30.7% in 2018, with a market value of USD 980.93 million.

This segment is projected to maintain a robust CAGR of 20.2% during the forecast period. The dominance of the IT and telecom sector underscores the critical role of mobile applications in these industries. The IT and telecom segment leverages mobile applications for various purposes, including communication, data management, and customer engagement. With the increasing reliance on mobile solutions within these industries, the demand for effective testing services to ensure application quality and reliability is on the rise. This trend is likely to drive sustained growth in the mobile application testing services market within the IT and telecom sector.

The overarching growth of the global mobile application testing services market can be attributed to the escalating ownership of smartphones worldwide. As of April 2019, the Global System for Mobile Communications Association (GSMA) estimated a staggering 5 billion mobile phone users globally. This increasing smartphone penetration has resulted in a surge in mobile application downloads and extended usage, creating a pressing need for robust testing services. Furthermore, the rise of the Bring Your Own Device (BYOD) trend among enterprises is contributing to the increased demand for smartphones and mobile applications across the commercial sector.

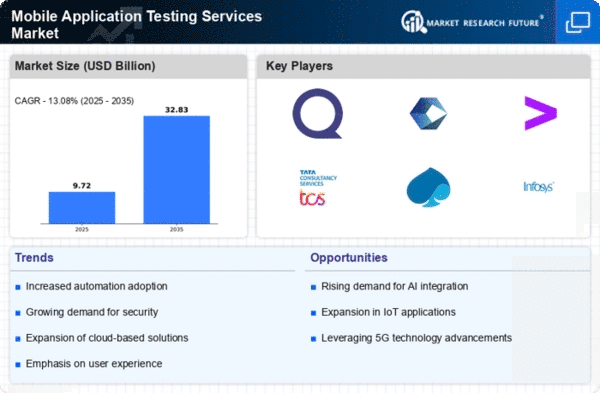

Businesses are increasingly relying on mobile applications for various functions, from internal communication to customer-facing applications. The critical role of mobile applications in business operations is propelling the need for comprehensive testing services to ensure optimal performance. The global mobile application testing services market is poised for substantial growth, with a projected CAGR of 20.3% during the forecast period from 2019 to 2026. In 2018, North America led the market with a significant 38.0% share, followed by Asia-Pacific with 26.0% and Europe with 25.4%. The North American market's dominance is attributed to its well-established infrastructure, early adoption of mobile application testing services, and high technical expertise. Europe, too, presents a promising market due to increasing smartphone ownership, with companies outsourcing testing services to countries with technical expertise. These insights highlight the diverse factors contributing to the growth and evolution of the global mobile application testing services market, positioning it as a key player in the technology landscape.

Leave a Comment