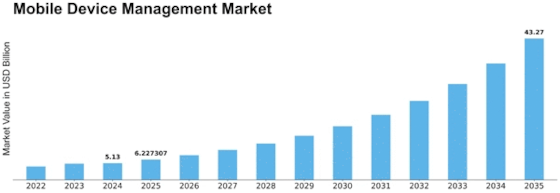

Mobile Device Management Size

Mobile Device Management Market Growth Projections and Opportunities

The MDM market is affected by a few market factors that on the whole shape its scene and development direction. One significant element is the rising dependence on cell phones in both individual and expert circles. With cell phones, tablets, and other associated gadgets becoming indispensable to day-to-day existence, associations are constrained to embrace MDM answers for really oversee and get these gadgets inside their organizations. The sheer multiplication of cell phones adds to the market's development, as organizations look for extensive answers for explore the difficulties related with gadget variety and intricacy.

Security concerns assume a central part in driving the MDM market. As digital dangers keep on developing, associations focus on the security of delicate information and the avoidance of unapproved admittance to cell phones. In response, the market provides MDM solutions with advanced security features like remote wiping, secure authentication, and encryption. Innovation in the MDM industry is driven by the constant need to stay one step ahead of cyber threats, which is why vendors constantly improve their security offerings to address new issues and vulnerabilities.

The MDM market is also influenced by the increasing mobility of the global workforce. The appearance of remote work and the far and wide reception of BYOD arrangements require MDM arrangements that give adaptability and backing to different gadget types and working frameworks. Associations look for MDM arrangements that empower consistent incorporation with different gadgets while keeping a harmony between engaging a versatile labour force and maintaining security principles. This element highlights the market's responsiveness to developing work designs and the requirement for versatile, easy to understand arrangements.

In addition, the administrative scene essentially influences the MDM market. MDM solutions that ensure compliance with these standards are required by organizations due to stringent data privacy and protection regulations like GDPR and HIPAA. In response, the market develops features and functions that help businesses comply with regulatory requirements and contribute to the creation of secure and compliant mobile environments. In order to avoid legal repercussions, businesses place a high priority on adhering to data protection laws, which drives innovation in MDM solutions.

Interoperability is a basic variable impacting the MDM market, given the different innovation conditions in which associations work. MDM arrangements that can consistently incorporate with existing framework, applications, and venture frameworks gain unmistakable quality. This interoperability factor underlines the market's acknowledgment of the requirement for durable, coordinated IT biological systems. Merchants centre around creating arrangements that are viable with different gadgets and stages, empowering associations to deal with their cell phones inside the more extensive setting of their mechanical scene.

Cost contemplations likewise assume a huge part in the MDM market. Associations gauge the expenses of executing and keeping up with MDM arrangements against the possible dangers and misfortunes related with insufficient gadget the executives. The market factors in the requirement for practical arrangements that convey esteem with regards to security, proficiency, and generally gadget the board. Sellers endeavour to give versatile arrangements that take care of the differing monetary limitations of associations while offering a hearty arrangement of highlights to meet their particular necessities.

Leave a Comment