Mobile Emission Catalysts Size

Mobile Emission Catalysts Market Growth Projections and Opportunities

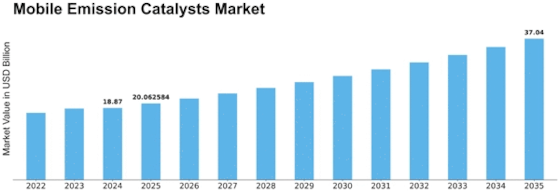

The Mobile Emission Catalysts Market is influenced by a range of factors that collectively shape its dynamics and growth trajectory. One of the primary driving forces behind this market is strict emissions regulations issued by governments worldwide aimed at limiting air pollution and reducing harmful pollutants coming from mobile sources like automobiles. The size of the Mobile Emission Catalysts Market was estimated at around USD 16.5 Billion in 2022. It is projected that, during the forecast period (2023 - 2032), the industry for the Mobile Emission Catalysts Market will grow from $17.6 billion in 2023 to $30.8 billion in 2032 at a CAGR (compound annual growth rate) of 7.20%. The Mobile Emission Catalysts Market is heavily influenced by shifting automotive technologies and fuel trends. Changing mobility patterns, such as increased adoption of electric vehicles (EVs) and hybrid cars, are shaping the design and composition of mobile emission catalysts. Market dynamics are largely shaped by technological advances in catalyst formulations and materials used in car parts manufacturing processes. Catalytic converter technology keeps evolving through continuous research, enhancing its performance, durability, and efficiency, among other factors. Global sustainability efforts also impact market drivers, hence fostering sustainable development initiatives across all sectors, including auto-making businesses focused on going green for environmental integrity purposes only, where eco-friendly solutions are being pursued as well as other green technologies to reduce its carbon footprints make it possible to have green transportation system being realized today thanks to vehicle emission control devices. The performance of the car industry affects both economic conditions and developments in the Mobile Emission Catalysts Market industry globally. By better understanding the competitive landscape and working more closely with other specialists within this broad field, we can better shape our approaches. These sorts of team-ups between automakers, OEMs (original equipment manufacturers) who make catalytic converters, and tech firms could allow them to maximize their emission control systems' efficiency while simultaneously improving catalysts or, more appropriately, meeting the ever-changing emission criteria. Alliances and partnerships include the development of new advanced catalytic devices and support progressive and future techniques on mobile catalyst production. Consumers' awareness of environment-friendly transportation, as well as strict regulations, determine market dynamics through customer changes. As we get closer to vehicle owners, fleet managers, and operators increasingly sensitive to the environmental impact of mobile emissions, for instance, automotive suppliers must develop better eco-friendly auto parts that can make their vehicles compliant with global standards of exhaust gases, which in turn contributes towards sustainable transport.

Leave a Comment