Top Industry Leaders in the Mobile Virtual Network Operator Market

Competitive Landscape of the Mobile Virtual Network Operator (MVNO) Market: A Strategic Appraisal

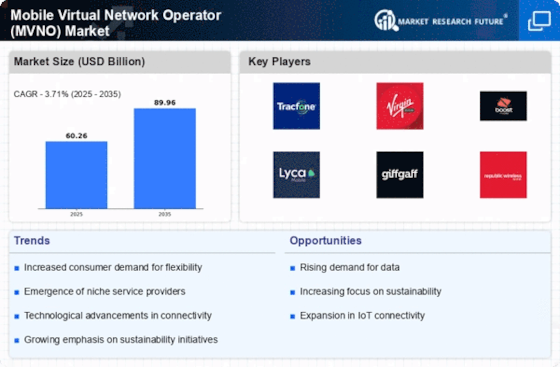

The Mobile Virtual Network Operator (MVNO) market is a dynamic and rapidly growing segment within the telecommunications industry. MVNOs, lacking their own network infrastructure, lease capacity from established operators (MNOs) and offer competitive mobile services under their own brands. This creates a unique competitive landscape with diverse players vying for customer attention.

Key Players:

-

Virgin Mobile

-

Tracfone Wireless Inc.

-

RedPocket Mobile

-

AirVoice Wireless

-

FreedomPop

-

Freenet AG

-

KDDI Mobile

-

Polkomtel Plus

-

Tesco Mobile Ltd

-

Kajeet Inc Schneider Electric SE

-

Ericsson

-

Axian

-

AireSpring

-

Amdocs

-

Piltron

Factors for Market Share Analysis:

-

Subscriber Base: Total number of active customers under an MVNO. Established players with large subscriber bases hold an advantage, but niche MVNOs can grow fast by catering to specific segments.

-

Revenue and Average Revenue Per User (ARPU): Measures financial performance and pricing effectiveness. Full MVNOs and established players may boast higher ARPU, while value-driven MVNOs target wider customer segments with lower ARPU.

-

Network Coverage and Quality: Quality of voice calls, data speeds, and network reliability. Reliance on MNOs' infrastructure necessitates careful selection and negotiation for MVNOs to ensure competitive service quality.

-

Brand Recognition and Marketing Strategies: Building trust and awareness through effective marketing campaigns is crucial for customer acquisition. Established brands and retail-backed MVNOs have an edge, while mobile-first players rely on digital marketing prowess.

-

Product and Service Differentiation: Innovative offerings like data-only plans, international calling packages, or bundled entertainment services can attract specific customer segments and stand out in the crowded market.

New and Emerging Companies:

-

Digital-Native MVNOs: Companies like Visible and Fi aim to disrupt the market with app-based, data-centric plans, automated customer service, and attractive pricing models. Their focus on digital channels and millennial/Gen Z audiences holds significant growth potential.

-

MVNOs Leveraging IoT and M2M Technology: Players like MachineMax and 1oT Wireless cater to the burgeoning Internet of Things (IoT) and Machine-to-Machine (M2M) communication market. Offering specialized SIM cards and data plans for connected devices unlocks new revenue streams and expands the MVNO landscape.

-

Regional and Niche MVNOs: Local players focused on specific geographic areas or catering to underserved niches (e.g., rural communities, specific ethnic groups) can carve out profitable segments within the broader market.

Current Investment Trends:

-

Expansion into New Markets and Segments: Established MVNOs are venturing into international markets and targeting new customer segments like enterprises and families. This diversification mitigates risks and drives growth.

-

Technology and Digital Optimization: Investments in automation, self-service platforms, and data analytics enhance customer experience, operational efficiency, and personalized service offerings.

-

Strategic Partnerships and Acquisitions: Collaborations with other MVNOs, retailers, and MNOs open up network access, distribution channels, and new service offerings. Acquisitions of smaller players can also help consolidate market share.

-

Focus on Innovation and Value Creation: Developing unique data plans, bundling value-added services, and exploring emerging technologies like 5G and cloud-based solutions are key areas of investment for future success.

Latest Company Updates:

-

Jan 5, 2024: Dish Network's Boost Mobile acquires Ting Mobile: In a deal announced on January 5, 2024, Dish Network's Boost Mobile acquired Ting Mobile, a popular MVNO known for its customizable data plans. This acquisition strengthens Boost's position in the US MVNO market and expands its customer base.

-

Dec 22, 2023: European MVNOs partner with Rakuten Mobile for roaming services: A consortium of European MVNOs, including Airalo, DENT Wireless, and Truphone, has partnered with Rakuten Mobile to provide global roaming services to their customers. This partnership leverages Rakuten's extensive network coverage and competitive pricing to offer MVNOs a cost-effective roaming solution.