Regulatory Support for MVNOs

Regulatory frameworks are evolving to support the growth of the Telecom Mobile Virtual Network Operator Market. Many countries are implementing policies that facilitate MVNO entry into the market, thereby fostering competition. This regulatory support often includes access to network infrastructure and reduced barriers to entry, enabling new players to emerge. As a result, the number of MVNOs has increased, leading to a more competitive landscape. This trend is likely to continue, as regulators recognize the benefits of MVNOs in promoting consumer choice and driving innovation within the Telecom Mobile Virtual Network Operator Market.

Shift Towards Digital Services

The Telecom Mobile Virtual Network Operator Market is experiencing a notable shift towards digital services. As consumers increasingly prefer online interactions, MVNOs are adapting by enhancing their digital platforms. This includes offering mobile apps for account management, customer support, and service customization. The integration of digital services not only improves customer experience but also reduces operational costs for MVNOs. Market analysis indicates that companies focusing on digital transformation are likely to see a 25% increase in customer retention rates. This trend highlights the importance of digital capabilities in the competitive landscape of the Telecom Mobile Virtual Network Operator Market.

Increased Smartphone Penetration

The proliferation of smartphones is significantly impacting the Telecom Mobile Virtual Network Operator Market. With smartphone penetration rates exceeding 80% in many regions, consumers are increasingly reliant on mobile data services. MVNOs are well-positioned to capitalize on this trend by offering competitive data packages that appeal to smartphone users. The rise in mobile applications and streaming services further drives data consumption, creating opportunities for MVNOs to attract new customers. Market data suggests that data usage is projected to grow by over 30% in the coming years, underscoring the potential for MVNOs to expand their service offerings within the Telecom Mobile Virtual Network Operator Market.

Emergence of IoT Connectivity Solutions

The rise of Internet of Things (IoT) devices is creating new opportunities within the Telecom Mobile Virtual Network Operator Market. MVNOs are increasingly offering specialized connectivity solutions tailored for IoT applications, such as smart home devices and industrial automation. This segment is expected to grow rapidly, with forecasts suggesting that IoT connections could reach over 30 billion by 2025. MVNOs can leverage their agility to provide customized IoT plans, thus tapping into a lucrative market. As businesses seek reliable and scalable connectivity for their IoT deployments, MVNOs are likely to play a pivotal role in shaping the future of the Telecom Mobile Virtual Network Operator Market.

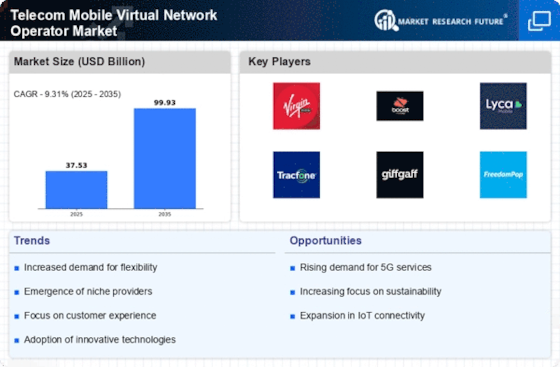

Growing Demand for Flexible Pricing Models

The Telecom Mobile Virtual Network Operator Market is witnessing a growing demand for flexible pricing models. Consumers increasingly seek cost-effective solutions that align with their usage patterns. MVNOs, by virtue of their operational structure, can offer tailored pricing plans that cater to diverse customer segments. This flexibility not only attracts price-sensitive customers but also enhances customer loyalty. According to recent data, MVNOs have captured approximately 20% of the mobile subscriber market, indicating a shift towards more personalized service offerings. As competition intensifies, the ability to provide innovative pricing strategies will likely become a key differentiator in the Telecom Mobile Virtual Network Operator Market.