Market Share

Modular Construction High Rise Buildings Market Share Analysis

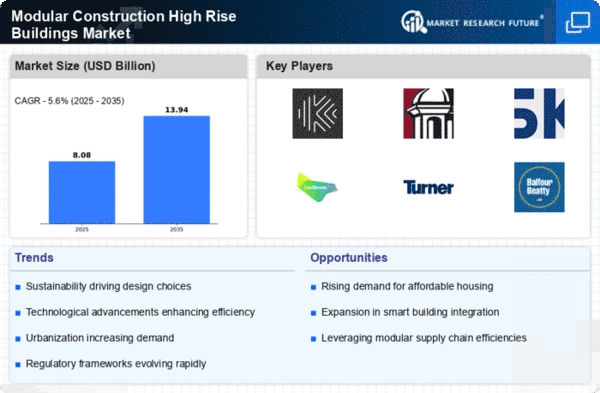

Modular construction has arisen as a vital participant in the High-Rise Buildings market, utilizing different piece of the pie situating systems to acquire an upper hand. These systems are vital in exploring the unique scene of construction and fulfilling the developing need for proficient and sustainable structure arrangements. Modular construction organizations separate themselves by offering imaginative plan arrangements that take care of the requirements of high-rise buildings. By consolidating state of the art innovations and building progressions, they position themselves as industry pioneers equipped for conveying stylishly satisfying and practically prevalent designs. A critical portion of the overall industry situating technique for modular construction is underscoring cost-effectiveness. By utilizing the upsides of factory-controlled environments, streamlined processes, and diminished construction courses of events, modular construction organizations position themselves as financially smart options in contrast to conventional construction strategies. This reverberates well with clients looking for both quality and cost investment funds. Speed is a basic consider the construction business, and modular construction succeeds in this perspective. Organizations center around situating themselves as suppliers of quick construction answers for high-rise buildings. Fast assembly and decreased adjacent construction time application to designers and financial backers as well as address the rising interest for speedier undertaking finish. Modular construction is not just about standard plans; organizations effectively position themselves as suppliers of highly adaptable arrangements. Offering adaptability in plan and construction permits them to take special care of different client inclinations and venture necessities, making modular construction an appealing choice for an extensive variety of high-rise building projects. Numerous potential clients might in any case be new to the advantages of modular construction. Positioning methodologies incorporate broad market schooling and awareness assignments to inform partners about the benefits, diffuse misunderstandings, and show productive contextual analyses. This proactive methodology helps in beating protection from change and growing the market for modular construction in high-rise buildings.

Leave a Comment