North America : Leading Innovation and Growth

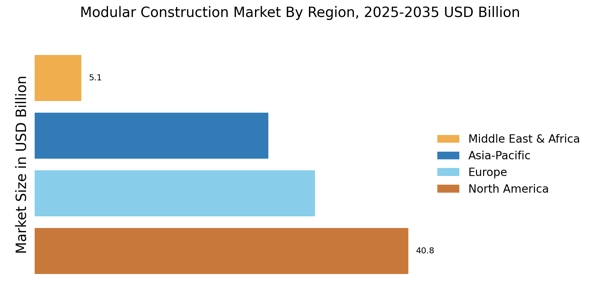

North America is the largest market for modular construction, holding approximately 40% of the global share. The region's growth is driven by increasing demand for affordable housing, sustainability initiatives, and advancements in construction technology. Regulatory support, such as streamlined building codes and incentives for green construction, further catalyzes market expansion. The U.S. is the primary contributor, followed by Canada, which is rapidly adopting modular solutions to address housing shortages. The competitive landscape in North America features key players like Katerra, Modular Building Institute, and Z Modular, which are leading the charge in innovation and efficiency. The presence of established companies and startups alike fosters a dynamic environment for modular construction. As urbanization continues to rise, the demand for modular solutions is expected to grow, making North America a focal point for investment and development in this sector.

Europe : Sustainable Growth and Innovation

Europe is witnessing a significant shift towards modular construction, driven by sustainability goals and the need for rapid housing solutions. The region holds approximately 30% of the global market share, with countries like Germany and the UK leading the charge. Regulatory frameworks promoting energy-efficient buildings and sustainable practices are key growth drivers. The European Union's Green Deal aims to enhance the construction sector's sustainability, further boosting modular adoption. Germany, the UK, and Sweden are at the forefront of this transformation, with companies like Skanska and Bouygues Construction leading the market. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying for a share of the growing demand. As urbanization and environmental concerns rise, Europe is set to become a hub for modular construction innovation and implementation.

Asia-Pacific : Emerging Markets and Opportunities

The Asia-Pacific region is emerging as a powerhouse in the modular construction market, holding approximately 25% of the global share. Countries like China and Australia are driving this growth, fueled by urbanization, population growth, and the need for affordable housing. Government initiatives promoting infrastructure development and smart city projects are significant catalysts for market expansion. The region's diverse regulatory landscape presents both challenges and opportunities for modular construction adoption. China is the largest market in the region, with significant investments in prefabricated housing. Australia follows closely, with companies like Lendlease leading the way in modular solutions. The competitive landscape is rapidly evolving, with both local and international players entering the market. As the demand for efficient and sustainable construction methods increases, Asia-Pacific is poised for substantial growth in the modular construction sector.

Middle East and Africa : Resource-Rich and Growing Demand

The Middle East and Africa region is witnessing a burgeoning interest in modular construction, holding approximately 5% of the global market share. The growth is primarily driven by rapid urbanization, infrastructure development, and a focus on sustainable building practices. Countries like the UAE and South Africa are leading the way, with government initiatives aimed at enhancing housing and infrastructure. Regulatory frameworks are evolving to support modular construction, making it an attractive option for developers. The UAE is at the forefront, with significant investments in modular projects, while South Africa is exploring innovative solutions to address housing shortages. The competitive landscape includes local firms and international players like Red Sea Housing Services, which are capitalizing on the growing demand. As the region continues to develop, modular construction is expected to play a crucial role in meeting the housing and infrastructure needs of the population.