Growth in Consumer Electronics

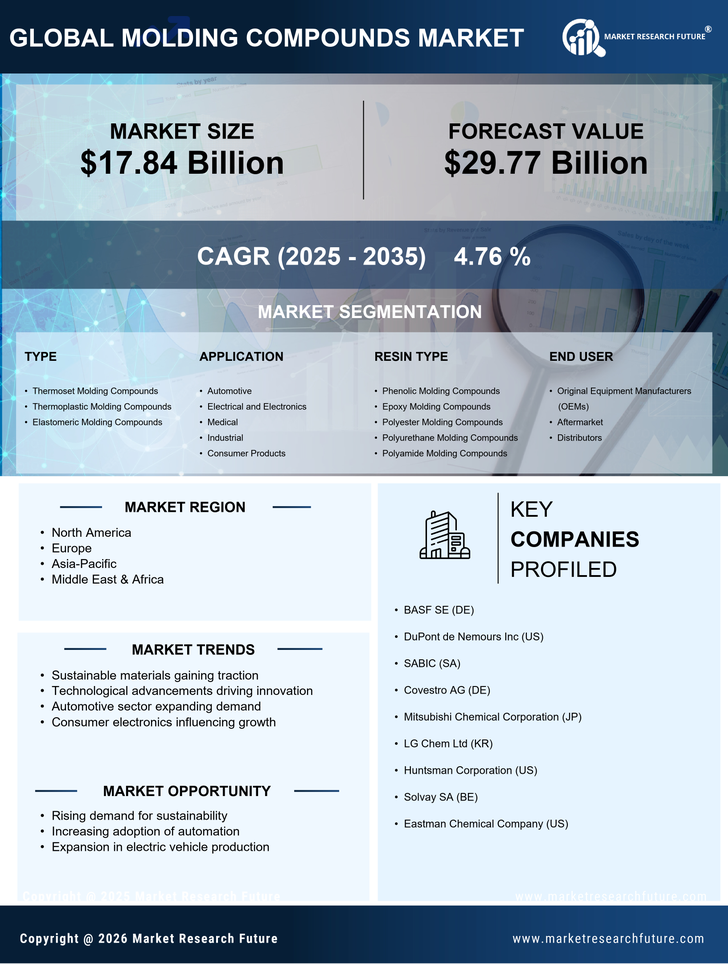

The Molding Compounds Market is poised for growth due to the expanding consumer electronics sector. With the proliferation of smart devices, there is an increasing need for high-performance materials that can withstand rigorous usage. Molding compounds are favored for their versatility and ability to be tailored for specific applications, such as housings for smartphones and tablets. Market data indicates that the consumer electronics segment is expected to grow at a compound annual growth rate of around 6% over the next few years. This growth is likely to drive innovation within the Molding Compounds Market, as manufacturers seek to develop compounds that offer enhanced durability and aesthetic appeal.

Increasing Focus on Sustainability

The Molding Compounds Market is witnessing a paradigm shift towards sustainability, driven by both consumer preferences and regulatory pressures. Manufacturers are increasingly adopting eco-friendly materials and processes to minimize environmental impact. This trend is reflected in the growing demand for bio-based and recyclable molding compounds, which are expected to capture a larger market share. Market analysis indicates that the sustainable segment of the molding compounds market could grow at a rate of 7% per year, as companies strive to meet sustainability targets. This focus on sustainability not only enhances brand reputation but also aligns with the broader industry movement towards responsible manufacturing practices.

Rising Demand in Automotive Sector

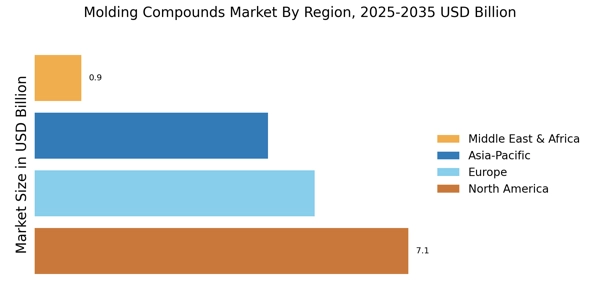

The Molding Compounds Market is experiencing a notable surge in demand driven by the automotive sector. As manufacturers increasingly prioritize lightweight materials to enhance fuel efficiency and reduce emissions, molding compounds are becoming essential. The automotive industry is projected to account for a significant share of the molding compounds market, with estimates suggesting a growth rate of approximately 5% annually. This trend is further fueled by the shift towards electric vehicles, which require advanced materials for battery housings and structural components. Consequently, the Molding Compounds Market is likely to witness substantial investments aimed at developing innovative formulations that meet the evolving needs of automotive manufacturers.

Expansion in Construction Applications

The Molding Compounds Market is benefiting from the expansion of construction applications, particularly in the development of infrastructure and residential projects. Molding compounds are increasingly utilized for their durability and resistance to environmental factors, making them ideal for construction materials. The construction sector is projected to grow at a rate of approximately 5% annually, which is likely to drive demand for advanced molding compounds. This growth is further supported by government initiatives aimed at improving infrastructure, thereby creating opportunities for the Molding Compounds Market to innovate and expand its product offerings to meet the specific needs of the construction sector.

Advancements in Manufacturing Technologies

Technological advancements in manufacturing processes are significantly impacting the Molding Compounds Market. Innovations such as 3D printing and injection molding are enabling the production of complex geometries and customized solutions. These advancements not only enhance efficiency but also reduce waste, aligning with sustainability goals. The introduction of smart manufacturing techniques is expected to streamline operations, thereby lowering production costs. As a result, the Molding Compounds Market is likely to benefit from increased adoption of these technologies, which could lead to a projected market growth of approximately 4% annually. This trend suggests a shift towards more efficient and sustainable production methods.