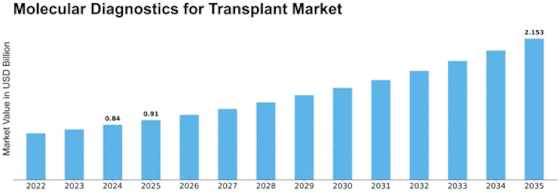

Molecular Diagnostics For Transplant Size

Molecular Diagnostics for Transplant Market Growth Projections and Opportunities

The amazing rise of the Molecular Diagnostics for Transplant Market is causing a revolutionary wave in the field of transplantation. The increased prevalence of infectious diseases, breakthroughs in molecular diagnostic tools, and a significant increase in transplant procedures are driving this surge. The increasing prevalence of infectious diseases has underscored the need for precise diagnostic tools, and molecular diagnostics have emerged as a game-changer. These advanced techniques allow for accurate and early detection of infectious agents, providing crucial insights for better management of transplant patients. Moreover, the growing number of transplant procedures globally has significantly contributed to the market's expansion. Transplants, whether organs or tissues, demand rigorous pre-transplant testing and ongoing monitoring to ensure compatibility and prevent complications. Molecular diagnostics play a pivotal role in these processes, enhancing the success rates of transplant procedures. A key driver accelerating market growth is the heightened awareness surrounding organ donation and transplantation. Public awareness campaigns and educational initiatives have played a pivotal role in dispelling myths and encouraging more individuals to become organ donors. The demand for molecular diagnostics in this context arises from the need to precisely match donors with recipients, ensuring successful transplantation outcomes. Crucially, all market projections and analyses are based on the assumption of a stable US dollar value over the next five years. To facilitate accurate currency conversions, historical exchange rates from the OANDA website have been utilized. Where specific data points were unavailable, trend line analysis and generalization based on related market trends were employed to arrive at comprehensive forecasts. The qualitative analysis presented in this report is a synthesis of the quantitative data, informed by the expert insights of the dedicated team behind this research. Understanding market trends, dynamics, and emerging patterns, the team has crafted a comprehensive overview that goes beyond numbers to capture the essence of the Molecular Diagnostics for Transplant Market.

Leave a Comment