Growth in Security Applications

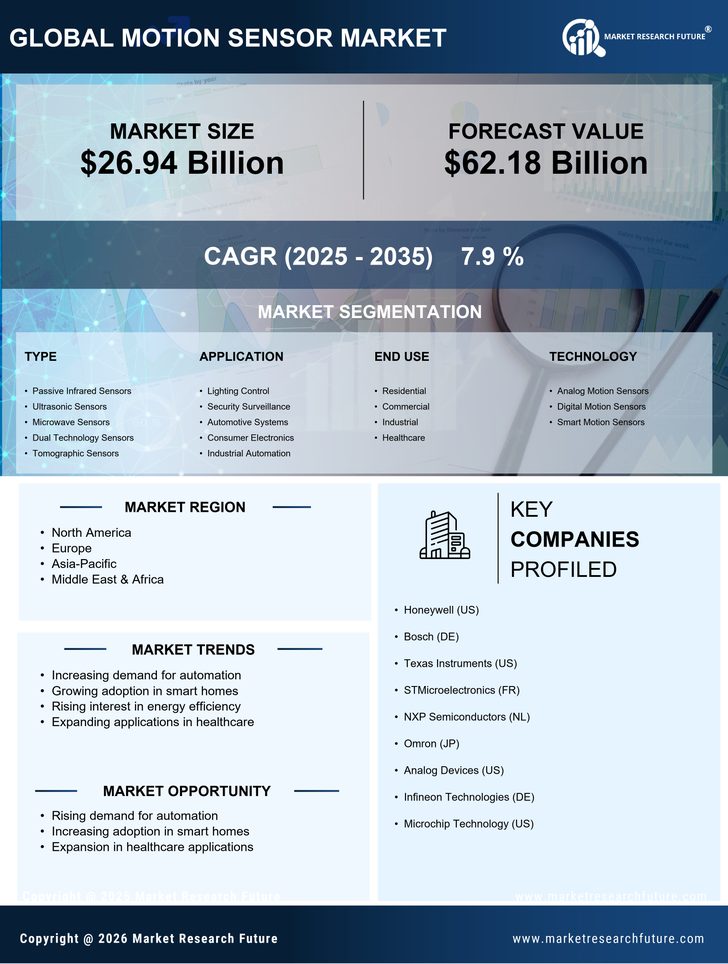

The Motion Sensor Market is significantly benefiting from the heightened focus on security and surveillance solutions. With increasing concerns over safety in residential and commercial spaces, the demand for advanced security systems is on the rise. Motion sensors are integral to these systems, providing real-time alerts and monitoring capabilities. The Motion Sensor Market is expected to surpass 300 billion dollars by 2025, indicating a substantial opportunity for motion sensor manufacturers. As businesses and homeowners invest in security technologies, the Motion Sensor Market is likely to see a corresponding increase in product development and innovation. This growth is further fueled by the integration of artificial intelligence and machine learning, which enhances the functionality of motion sensors in detecting and responding to potential threats.

Rising Demand for Home Automation

The Motion Sensor Market is experiencing a notable surge in demand due to the increasing adoption of home automation systems. Consumers are increasingly seeking smart home solutions that enhance convenience, security, and energy efficiency. According to recent estimates, the home automation market is projected to reach a value of approximately 80 billion dollars by 2026, which directly influences the motion sensor market. Motion sensors play a crucial role in these systems, enabling automated lighting, security alerts, and energy management. As more households integrate smart devices, the reliance on motion sensors is likely to grow, driving innovation and competition within the Motion Sensor Market. This trend suggests a shift towards more interconnected living environments, where motion sensors serve as essential components in creating seamless user experiences.

Expansion in Healthcare Applications

The Motion Sensor Market is witnessing growth driven by the expansion of healthcare applications. Motion sensors are increasingly utilized in patient monitoring systems, fall detection, and rehabilitation technologies. The healthcare sector is projected to grow significantly, with estimates suggesting a market value of over 500 billion dollars by 2025. This growth is likely to enhance the demand for motion sensors that facilitate remote patient monitoring and improve overall patient care. As healthcare providers seek to leverage technology for better outcomes, the Motion Sensor Market is expected to play a pivotal role in developing solutions that enhance patient safety and operational efficiency. The integration of motion sensors into healthcare devices may lead to innovative applications that further drive market growth.

Increasing Adoption in Automotive Sector

The Motion Sensor Market is experiencing a significant boost from the automotive sector, where the integration of motion sensors is becoming increasingly prevalent. These sensors are utilized in various applications, including parking assistance, collision detection, and driver monitoring systems. The automotive industry is projected to reach a market value of over 4 trillion dollars by 2025, with a substantial portion allocated to advanced driver-assistance systems (ADAS). As automakers strive to enhance vehicle safety and user experience, the demand for motion sensors is expected to rise. This trend indicates a promising future for the Motion Sensor Market, as automotive manufacturers seek innovative solutions to meet regulatory standards and consumer expectations.

Technological Advancements in Sensor Technology

The Motion Sensor Market is poised for growth due to rapid technological advancements in sensor technology. Innovations such as improved sensitivity, miniaturization, and energy efficiency are transforming the capabilities of motion sensors. For instance, the development of passive infrared (PIR) sensors and ultrasonic sensors has expanded their applications across various sectors, including automotive, healthcare, and industrial automation. The market for motion sensors is projected to grow at a compound annual growth rate of around 10% through the next few years, driven by these technological improvements. As manufacturers continue to invest in research and development, the Motion Sensor Market is likely to witness the introduction of more sophisticated and versatile products, catering to diverse consumer needs.