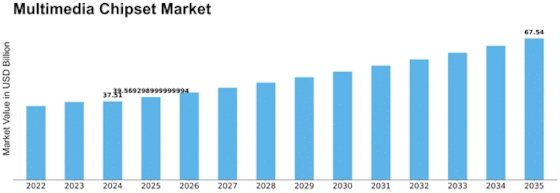

Multimedia Chipset Size

Multimedia Chipset Market Growth Projections and Opportunities

The Multimedia Chipset market, a key player in the electronics industry, is subject to various market factors that significantly influence its dynamics. Technological innovation is a primary driver, propelling the market forward. As multimedia technologies advance, there is a constant demand for more powerful and efficient chipsets. Manufacturers are compelled to stay at the forefront of innovation, incorporating features like enhanced graphics capabilities, improved video processing, and support for emerging multimedia formats into their chipsets to meet consumer expectations.

Market demand is another pivotal factor shaping the Multimedia Chipset market. The increasing ubiquity of multimedia applications in devices such as smartphones, laptops, and gaming consoles fuels the demand for chipsets capable of handling complex multimedia tasks. As consumers seek richer multimedia experiences, manufacturers are pressured to deliver chipsets that can support high-definition video playback, immersive gaming graphics, and seamless multitasking.

Cost considerations play a significant role in shaping the Multimedia Chipset market. With an ever-growing demand for affordable consumer electronics, manufacturers need to strike a balance between cost-effectiveness and delivering high-performance chipsets. This is particularly crucial in the highly competitive consumer electronics market, where pricing directly impacts product adoption. Chipset manufacturers must optimize production costs while ensuring their products meet the performance expectations of diverse market segments.

Global economic conditions contribute to the market dynamics of Multimedia Chipsets. Economic stability and growth influence consumer purchasing power, affecting the demand for electronic devices and, consequently, multimedia chipsets. During economic downturns, consumers may opt for budget-friendly devices, influencing the demand for lower-cost chipsets. Conversely, economic prosperity often results in increased consumer spending on high-end devices, driving demand for premium multimedia chipsets.

Regulatory considerations also shape the Multimedia Chipset market. Compliance with international standards and regulations is essential for manufacturers to ensure the acceptance of their products in global markets. Adherence to standards related to energy efficiency, electromagnetic compatibility, and environmental sustainability is crucial for market entry and sustained growth. Manufacturers need to navigate a complex regulatory landscape to ensure their chipsets meet the diverse requirements of different regions.

Competition among key players is a driving force in the Multimedia Chipset market. Companies vie for market share by innovating and differentiating their chipsets. Strategic partnerships, mergers, and acquisitions are common strategies as companies seek to strengthen their positions and expand their product portfolios. The competitive landscape directly impacts product development cycles, pricing strategies, and overall market trends.

Consumer preferences and trends also contribute to the market's dynamism. Preferences for specific multimedia features, such as advanced graphics, AI-powered processing, and support for virtual and augmented reality, can rapidly change based on consumer trends and evolving technologies. Chipset manufacturers must stay attuned to these shifts, ensuring their products align with the expectations of end-users and the rapidly changing landscape of multimedia consumption.

Due to the growing popularity of handheld phones and smartphones, more people want electronic devices to watch movies and videos online. This has led to increased broadband and mobile data usage. The rising use of mobile data is increasing the demand for high-speed internet.

With improved internet services worldwide, it has become easier for consumers to upload videos online, significantly increasing their numbers in recent years. As a result, graphics chipsets have consistently held a larger share of revenue in the multimedia chipsets market.

Additionally, the increasing use of wearable devices, driven by health concerns among millennials, is also expected to boost market growth.

Leave a Comment