Aging Infrastructure

The deterioration of aging water infrastructure is a significant factor influencing the Municipal Water Treatment Chemical Market. Many municipalities are grappling with outdated water treatment facilities that require substantial upgrades or replacements. This situation necessitates the use of more effective treatment chemicals to maintain water quality and safety. Reports indicate that municipalities are allocating approximately 30% of their budgets to infrastructure improvements, which includes the procurement of advanced treatment chemicals. As these upgrades are implemented, the demand for innovative and efficient water treatment solutions is likely to rise, thereby propelling the Municipal Water Treatment Chemical Market forward.

Public Health Awareness

Growing public awareness regarding water quality and its impact on health is a crucial driver for the Municipal Water Treatment Chemical Market. As communities become more informed about the potential health risks associated with contaminated water, there is an increasing demand for effective treatment solutions. This heightened awareness has led to municipalities investing more in water treatment technologies and chemicals to ensure safe drinking water. Surveys indicate that 70% of consumers are willing to support local initiatives aimed at improving water quality, which in turn influences municipal budgets and spending on treatment chemicals. Consequently, this trend is likely to bolster the Municipal Water Treatment Chemical Market.

Environmental Regulations

Stringent environmental regulations are increasingly shaping the Municipal Water Treatment Chemical Market. Governments are enacting laws that mandate the reduction of contaminants in drinking water, compelling municipalities to adopt more rigorous treatment processes. Compliance with these regulations often requires the use of specialized chemicals that can effectively remove pollutants. Data shows that municipalities that have adopted stricter water quality standards have seen a 15% increase in the procurement of treatment chemicals. This regulatory landscape not only drives demand but also encourages innovation within the Municipal Water Treatment Chemical Market as companies strive to develop compliant and effective solutions.

Increasing Water Scarcity

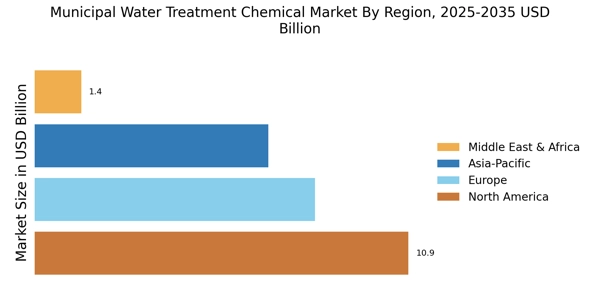

The rising concern over water scarcity is a pivotal driver for the Municipal Water Treatment Chemical Market. As populations grow and urban areas expand, the demand for clean and safe drinking water intensifies. This scarcity compels municipalities to invest in advanced water treatment solutions, thereby increasing the consumption of treatment chemicals. According to recent data, regions experiencing severe water shortages have reported a 20% increase in the use of water treatment chemicals over the past five years. This trend suggests that municipalities are prioritizing the enhancement of water quality to ensure public health and sustainability, which in turn fuels the Municipal Water Treatment Chemical Market.

Technological Innovations

Technological advancements in water treatment processes are significantly influencing the Municipal Water Treatment Chemical Market. Innovations such as advanced oxidation processes, membrane filtration, and real-time monitoring systems are enhancing the efficiency and effectiveness of water treatment. These technologies often require specialized chemicals that can optimize treatment outcomes. Recent studies suggest that municipalities adopting these technologies have experienced a 25% reduction in chemical usage while improving water quality. This trend indicates a shift towards more sustainable practices within the Municipal Water Treatment Chemical Market, as municipalities seek to balance cost-effectiveness with environmental responsibility.