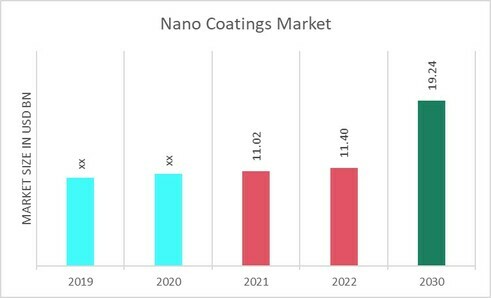

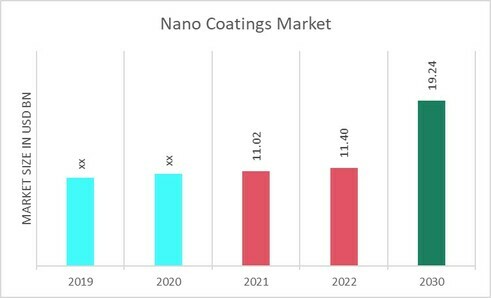

Global Nano Coatings Market Overview

Nano Coatings Market Size was valued at USD 11.02 billion in 2021. The Nano Coatings market industry is projected to grow from USD 11.40 Billion in 2022 to USD 19.24 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 6.7 % during the forecast period (2022 - 2030). The growth in demand for Self-Healing Coatings (Bionic & Photocatalytic) for various end-use industries such as building & construction, automotive and others are driving the market growth.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Nano Coatings Market Trends

- Increasing demand for high-speed engines to boost market growth

Despite being relatively new among other coatings, demand for nanocoatings is rising rapidly due to its specialized properties. Nanocoatings enhance properties of substrate with respect to corrosion resistance, abrasion and wear resistance, anti-fouling, fingerprint, and scratch resistance, anti-microbial, thermal and UV resistance, and conductivity. This substantiates nanocoatings to have become integral part of several industries such as aerospace, electronics, energy, and automobile that require protective properties for long lasting durability.

Moreover, nanocoatings, primarily anti-fingerprint coatings gain traction as they are widely utilized in oven display, dishwasher display, refrigerator, laptops, and mobiles, due to advancement and development in touch-based technology. Furthermore, growth in automotive industry along with continuous extensive research by various key players across the globe is expected to offer ample opportunities to the market players.

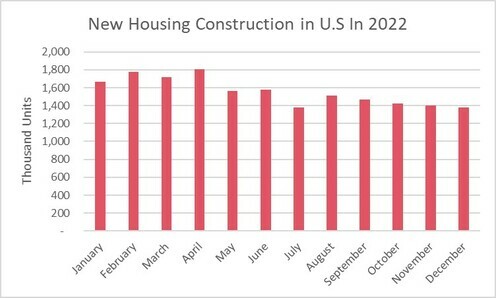

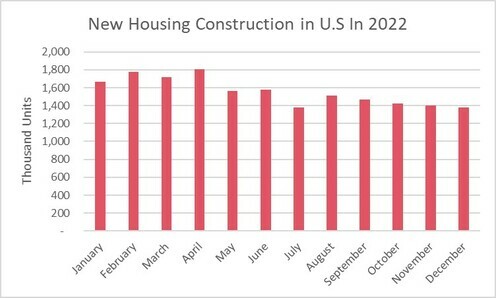

Figure 1: New housing construction in U.S

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Nonmetallic (based on polymers or oxides) and metallic protective coatings are used to protect metal products against the harmful action of the corrosion environment. In recent years, self-healing coatings have been the subject of increasing interest. The ability of such coatings to self-repair local damage caused by external factors is a major factor contributing to their attractiveness. Polymer layers, silica-organic layers, conversion layers, metallic layers, and ceramic layers, to mention but a few, are used as self-healing coatings. Thus, the increasing demand in nano coatings for construction market driving the growth of the Nano Coatings market revenue.

Nano Coatings Market Segment Insights

Nano Coatings Raw Material Insights

The Nano Coatings market segmentation, based on raw material, Alumina (Al2O3), Titania (TiO2), Chromia (Cr2O3), Silicon Dioxide (SiO2), Tungsten Carbide (WC), Yttria-Stabilized Zirconia (YSZ), Lanthanum Strontium Manganite (LSM), Combination Chemistries, Others. The Alumina (Al2O3) segment held the majority share in 2021 contribution to around ~30-35% in respect to the Nano Coatings market revenue. This is primarily owing to the rising demand construction activities across the globe. For instance, as per the US housing statistics published in 2022, rising demand for housing construction.

January 2021: Tesla Nanocoatings launched a new technology that incorporates carbon nanotubes to ensure worker safety. NANO anti-skid product is a single-layer Teslan 1105 ZnCNT. It combines carbon nanotubes with sacrificial Zinc and anti-slip aggregates for increased durability.

April 2021: Actnano announced the achievement of a significant milestone for the company. In 2020, the company’s “nanoGAURD” branded protective coating secured 1.2 million production vehicles and many automobiles on the road.

Nano Coatings Coating Method Insights

The Nano Coatings market segmentation, based on base stock, includes Chemical Vapor, Deposition (CVD), Physical Vapor deposition (PVD), Atomic Layer Deposition (ALD), Layer-By-Layer Self-Assembly (LBL), Electrospray and Electrospinning, Chemical and Electrochemical Deposition, Others. The Chemical Vapor, Deposition (CVD) segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is due to the expansion in Anti-Fingerprint Coatings and rising uses in automotive. According to American Coatings Association (ACA), the coating market is expected to soar.

China accounts for nearly a third of the increase, but this is primarily due to a rebound in domestic demand as the country reduces product exports. Nonetheless, increased coating in the rest of the world will propel throughputs above product demand, assisting in the reversal of inventory losses. Hence, expansion in construction and Anti-Fingerprint Coatings positively impacts market growth.

Nano Coatings Type Insights

The Nano Coatings market data has been divided into Anti-Corrosive Coatings, Anti-Microbial Coatings, Anti-Fingerprint Coatings, Easy to Clean & Anti-Fouling Coatings, Self-Healing Coatings (Bionic & Photocatalytic), Anti-Icing & Deicing Coatings, Anti-Graffiti Coatings, Anti-Reflection Coatings, Thermal Barrier & Flame-Retardant Coatings, Oleophobic Coatings, Hydrophobic Coatings, Others. The Self-Healing Coatings (Bionic & Photocatalytic) segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. Anti-microbial nanocoating’s have found application in packaging, food processing, medical & healthcare, and water treatment. They provide protection against microorganisms.

Due to the rising demand from medical and healthcare industries, the anti-microbial nanocoating segment is expected to expand over the forecast timeframe. Anti-fouling & easy-to-clean coatings are anticipated to develop in the nanocoatings market with their growing usage in electronics, marine, automotive, and food production applications. These nanocoatings prevent the growth of fungi and algae as well. The use of Self-Healing Coatings (Bionic & Photocatalytic)in Automotive & aerospace is increasing.

April 2018: A new electrically conductive metalized nonwoven, flexible, lightweight technology called VeeloVEIL, has been launched by General Nano which is largely used in the aerospace industry. This launch has further increased market share in the Nano Coatings industry.

April 2021: Actnano announced the achievement of a significant milestone for the company. In 2020, the company’s “nanoGAURD” branded protective coating secured 1.2 million production vehicles and many automobiles on the road.

Nano Coatings End-Use Industry Insights

The Nano Coatings market data has been divided into Building & Construction, Automotive, Aerospace, Electrical & Electronics, Healthcare, Packaging, Marine Industry, Military & Defense, Renewable Energy, Chemical, Others. The Building & Construction segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. The use of Self-Healing Coatings (Bionic & Photocatalytic)in building & construction is increasing.

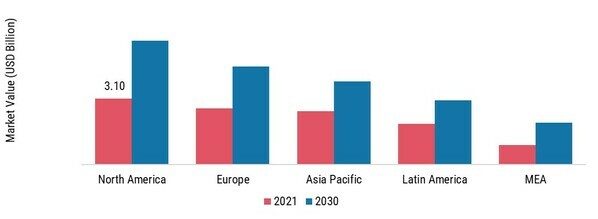

Figure 2: Nano Coatings Market, by raw material, 2021 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Additionally, alumina-based Nano Coatings are often used to coat mechanical parts with several purposes, such as bearings, chains, gears, slides, and threaded connections. Alumina based Nano Coatings can provide benefits such as improved anti-corrosive characteristics.

Nano Coatings Method Insights

Based on Type, the Nano Coatings industry has been segmented into Chemical Vapor Deposition (CVD), Physical Vapor deposition (PVD), Atomic Layer Deposition (ALD) , Layer-By-Layer Self-Assembly (LBL), Electrospray and Electrospinning, Chemical and Electrochemical Deposition, Others. Chemical Vapor Deposition (CVD) held the largest segment share in 2021, owing to the increasing demand for building & construction. The other segment is expected to bolster at an 8.12% CAGR during the assessed timeline.

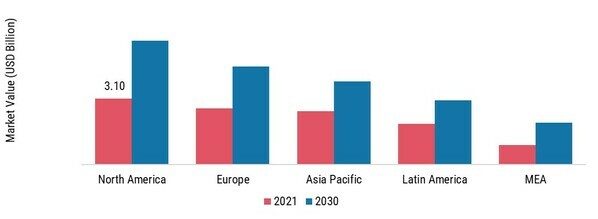

Nano Coatings Regional Insights

By Region, the study segments the market into North America, Europe, Asia-Pacific, Latin America, Middle east & South Africa. North America Nano Coatings market accounted for USD 3.10 billion in 2021 and is expected to exhibit a 6.49% CAGR during the study period. This is attributed to the shift in demand towards nanocoatings from polymer coatings, mainly due to the superior properties and low VOC emissions associated with nanocoatings across the region.

Further, the major countries studied are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: NANO COATINGS MARKET SHARE BY REGION 2021 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Nano Coatings market accounts for the second-largest market share due to the growing demand for the product from various applications, including the automotive and building & construction industry. Further, the Germany Nano Coatings market held the largest market share, and the UK Nano Coatings market was the fastest growing market in the European region

The Asia-Pacific Nano Coatings Market is expected to grow at a CAGR of 4.66% from 2022 to 2030. This is because of rising government investments in infrastructure development in developing nations like China and India. Moreover, China Nano Coatings market held the largest market share, and the India Nano Coatings market was the fastest growing market in the Asia-Pacific region

For instance, India Nano Coatings market is the favored destination for nano coatings manufacturers due to the infrastructure projects. On the other hand, Japan is famous for automotive industry. Hence, Asia-Pacific is anticipated to register the highest growth rate over the forecast period from 2022–2030.

Nano Coatings Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the Nano Coatings market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Nano Coatings industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the Nano Coatings industry to benefit clients and expand the Nano Coatings market sector is to manufacture locally to reduce operating costs. In recent years, Nano Coatings has some of the most significant benefits.

Bio-Gate AG (Germany) is a Germany-based medical technology company. The Company employs silver technology to endow materials and products with antimicrobial properties and specializes in plasma coating, spray, additives, and textile solutions, among others. In June 2020, Bio-Gate AG, one of the world’s leading providers of innovative technologies and individual solutions for health and hygiene, has signed an extensive cooperation agreement with Aesculap AG, one of the world’s leading suppliers of implants, and a subsidiary of B. Braun, for the antimicrobial coating of revision implants for knee and hip systems.

The agreement also includes an option for using the HyProtectTM coating technology in other application areas.

Also, Eikos, Inc. (US) is a developer and manufacturer of highly transparent carbon nanotube inks for conductive coatings and circuits for use in solar cells, flat panel displays, OLED lighting, smart windows, and other established markets. Eikos' patented invisicon transparent conductors ('nanowires') will enable high-volume, low-cost production of a thinner, more flexible, and more durable conductive coating technology that will displace Indium Tin Oxide (ITO), Zinc Oxide, PEDOT/PSS, and other transparent conductors.

Key Companies in the Nano Coatings market include

- Nanovere Technologies, LLC. (U.S.)

- Inframat Corporation (U.S.)

- CYTONIX (U.S.), and Möller Medical GmbH & Co. KG (Germany)among others

Nanocoatings Industry Developments

-

Q2 2024: BASF and Adaptive Surface Technologies Announce Strategic Partnership to Develop Next-Generation Nanocoatings BASF entered a strategic partnership with Adaptive Surface Technologies to co-develop and commercialize advanced nanocoating solutions for industrial and consumer applications, aiming to accelerate the adoption of high-performance, sustainable coatings.

-

Q2 2024: PPG Launches New Antimicrobial Nanocoating for Healthcare Surfaces PPG Industries introduced a new line of antimicrobial nanocoatings designed for use on hospital and medical device surfaces, targeting the growing demand for infection-resistant materials in healthcare settings.

-

Q3 2024: AkzoNobel Opens New Nanocoatings R&D Facility in the Netherlands AkzoNobel inaugurated a state-of-the-art research and development center focused on nanocoatings technology, aiming to accelerate innovation in protective and functional coatings for automotive and industrial markets.

-

Q3 2024: Nano-Care AG Secures Major Contract to Supply Hydrophobic Nanocoatings to European Automotive OEM Nano-Care AG announced it has won a multi-year contract to supply its proprietary hydrophobic nanocoatings to a leading European automotive manufacturer, expanding its footprint in the automotive sector.

-

Q4 2024: Henkel Launches Eco-Friendly Nanocoating for Electronics Industry Henkel introduced a new environmentally friendly nanocoating product line for electronics, designed to enhance device durability and reduce environmental impact, in response to increasing regulatory and consumer demands.

-

Q4 2024: Nanofilm Technologies Appoints New CEO to Drive Global Expansion Nanofilm Technologies announced the appointment of Dr. Emily Tan as Chief Executive Officer, with a mandate to accelerate the company's international growth and innovation in nanocoating solutions.

-

Q1 2025: Surfix Raises €15 Million in Series B Funding to Scale Medical Nanocoatings Production Dutch nanocoatings company Surfix closed a €15 million Series B funding round to expand its manufacturing capacity for medical device coatings, supporting increased demand from European and US healthcare clients.

-

Q1 2025: PPG Acquires NanoGuard Technologies to Expand Functional Coatings Portfolio PPG completed the acquisition of NanoGuard Technologies, a US-based nanocoatings innovator, to strengthen its portfolio in protective and functional coatings for industrial and consumer markets.

-

Q2 2025: MDS Coating Receives Canadian Government Grant for Aerospace Nanocoatings Facility MDS Coating was awarded a government grant to build a new manufacturing facility in Ontario dedicated to advanced nanocoatings for aerospace applications, supporting domestic innovation and job creation.

-

Q2 2025: Nano-Care AG Partners with Indian EV Manufacturer for Battery Protection Nanocoatings Nano-Care AG entered a partnership with a major Indian electric vehicle manufacturer to supply nanocoatings that enhance battery durability and safety, targeting the rapidly growing EV market in Asia.

-

Q3 2025: Nanogate Files for IPO on Frankfurt Stock Exchange to Fund Nanocoatings Expansion German nanocoatings specialist Nanogate filed for an initial public offering on the Frankfurt Stock Exchange, aiming to raise capital for expanding its production capacity and R&D in Europe and Asia.

-

Q3 2025: AkzoNobel Signs Supply Agreement with Samsung for Nanocoated Display Panels AkzoNobel secured a multi-year supply agreement with Samsung to provide nanocoated materials for use in next-generation display panels, strengthening its position in the electronics sector.

Nano Coatings Market Segmentation

Nano Coatings Raw Material Outlook

- Yttria-Stabilized Zirconia (YSZ)

- Lanthanum Strontium Manganite (LSM)

Nano Coatings Method Outlook

- Chemical Vapor Deposition (CVD)

- Physical Vapor deposition (PVD)

- Atomic Layer Deposition (ALD)

- Layer-By-Layer Self-Assembly (LBL)

- Electrospray And Electrospinning

- Chemical And Electrochemical Deposition

Nano Coatings End-Use Outlook

- Anti-Fingerprint Coatings

- Easy To Clean & Anti-Fouling Coatings

- Self-Healing Coatings (Bionic & Photocatalytic)

- Anti-Icing & Deicing Coatings

- Thermal Barrier & Flame-Retardant Coatings

Nano Coatings End-Use Industry Outlook

Nano Coatings Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2021 |

USD 11.10 billion |

| Market Size 2022 |

USD 11.40 billion |

| Market Size 2030 |

USD 19.24 billion |

| Compound Annual Growth Rate (CAGR) |

6.7 % (2022-2030) |

| Base Year |

2021 |

| Forecast Period |

2022-2030 |

| Historical Data |

2019 & 2020 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Raw material. Type, End-Use Industry, Coating Method, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, Latin America, and MEA |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Nanowerk. (U.S.), Nanovere Technologies, LLC. (U.S.), P2i Ltd. (U.K), Nanoslic Protective Ceramic Coatings (U.S.), NANOFILM. (U.S.), Inframat Corporation (U.S.), Plasmatreat Gmbh (U.S.), Nanogate SE (Germany), NanoTech Coatings · (U.S.), CYTONIX (U.S.), and Möller Medical GmbH & Co. KG (Germany) |

| Key Market Opportunities |

Rise in the demand for nanocoatings |

| Key Market Dynamics |

Increasing uses in industries like elections, building, and aerospace, renewable energy industry, healthcare, automotive, marine |

Nanocoatings Market Highlights:

Frequently Asked Questions (FAQ):

The Nano Coatings market is USD 11.02 billion in 2021

The Nano Coatings market is expected to grow at a CAGR of 6.7%

North America held the largest market share in the Nano Coatings market

Nanowerk. (U.S.), Nanovere Technologies, LLC. (U.S.), P2i Ltd. (U.K), Nanoslic Protective Ceramic Coatings (U.S.), NANOFILM. (U.S.), Inframat Corporation (U.S.) are the key players

Self-Healing Coatings (Bionic & Photocatalytic) led the Nano Coatings market

Building & Construction had the largest market share in the Nano Coatings market