Innovations in Rubber Compounding

Innovations in rubber compounding techniques are significantly influencing the Naphthenic Rubber Processing Oil Market. Manufacturers are increasingly adopting advanced compounding methods to enhance the performance characteristics of rubber products. This includes the integration of naphthenic rubber processing oils, which are known for their excellent compatibility with various rubber types. Market analysis suggests that the adoption of these innovative techniques could lead to a 3% increase in the overall efficiency of rubber production processes. As companies strive to meet evolving consumer expectations for high-quality rubber products, the demand for naphthenic rubber processing oils is expected to grow correspondingly.

Expansion of the Footwear Industry

The Naphthenic Rubber Processing Oil Market is also benefiting from the expansion of the footwear industry, which is increasingly utilizing rubber materials for various applications. As fashion trends evolve, there is a growing preference for rubberized footwear that offers comfort and durability. This shift is reflected in market data showing that The Naphthenic Rubber Processing Oil is expected to reach a valuation of over 400 billion by 2026, with a significant portion attributed to rubber-based products. Naphthenic rubber processing oils play a crucial role in enhancing the flexibility and resilience of rubber used in footwear, thereby driving their demand within this sector.

Rising Demand for High-Performance Tires

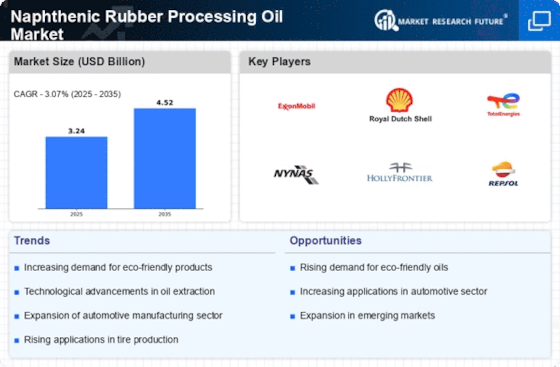

The Naphthenic Rubber Processing Oil Market is experiencing a notable increase in demand for high-performance tires, driven by the automotive sector's focus on enhancing vehicle performance and safety. As consumers seek tires that offer better grip, durability, and fuel efficiency, manufacturers are turning to naphthenic rubber processing oils to improve the quality of their products. This trend is supported by data indicating that the tire manufacturing segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. Consequently, the demand for naphthenic rubber processing oils is likely to rise, as these oils are essential in formulating advanced rubber compounds that meet stringent performance standards.

Regulatory Support for Eco-Friendly Products

The Naphthenic Rubber Processing Oil Market is witnessing a favorable regulatory environment that supports the development and use of eco-friendly products. Governments are increasingly implementing regulations that encourage the use of sustainable materials in manufacturing processes. This trend is particularly relevant for the rubber industry, where naphthenic rubber processing oils are being recognized for their lower environmental impact compared to traditional oils. As a result, manufacturers are likely to invest in naphthenic rubber processing oils to comply with these regulations and appeal to environmentally conscious consumers. This shift could potentially lead to a market growth rate of 5% in the coming years.

Growth in Construction and Infrastructure Projects

The Naphthenic Rubber Processing Oil Market is poised to benefit from the growth in construction and infrastructure projects, which require high-quality rubber materials for various applications. As urbanization accelerates, the demand for construction materials, including rubber-based products, is on the rise. Market data indicates that the construction sector is expected to grow at a rate of 6% annually, creating a substantial opportunity for naphthenic rubber processing oils. These oils are essential in producing rubber components used in construction equipment and materials, thereby driving their demand in this expanding market.