Enhanced Customer Insights

The Natural Language Processing in BFSI Market is increasingly leveraged to gain deeper customer insights. By analyzing customer interactions and feedback, financial institutions can better understand client needs and preferences. This capability is particularly valuable in tailoring services and products to meet specific demands. Recent studies indicate that organizations utilizing NLP for sentiment analysis can improve customer retention rates by as much as 25%. The ability to process vast amounts of unstructured data allows institutions to identify trends and patterns that were previously obscured. Consequently, the focus on enhancing customer insights through NLP is likely to drive further investment in these technologies, as firms aim to create more personalized experiences for their clients.

Cost Reduction in Operations

The Natural Language Processing in BFSI Market is recognized for its potential to significantly reduce operational costs. By automating routine tasks such as data entry, customer inquiries, and report generation, financial institutions can allocate resources more efficiently. Studies indicate that the implementation of NLP can lead to a reduction in labor costs by approximately 20%, allowing institutions to reallocate funds towards innovation and growth initiatives. This cost-saving potential is particularly appealing in a competitive market where margins are often tight. As institutions continue to seek ways to enhance profitability, the adoption of NLP technologies for operational efficiency is expected to be a driving force in the BFSI sector.

Fraud Detection and Prevention

The Natural Language Processing in BFSI Market is increasingly utilized for fraud detection and prevention. Financial institutions are adopting NLP technologies to analyze transaction data and customer communications for signs of fraudulent activity. By employing machine learning algorithms in conjunction with NLP, institutions can identify anomalies and patterns indicative of fraud. Recent reports suggest that the implementation of NLP in fraud detection can reduce false positives by up to 40%, thereby enhancing the accuracy of fraud prevention measures. As the sophistication of fraudulent schemes evolves, the reliance on advanced NLP solutions is likely to grow, positioning these technologies as essential tools in safeguarding financial assets and maintaining customer trust.

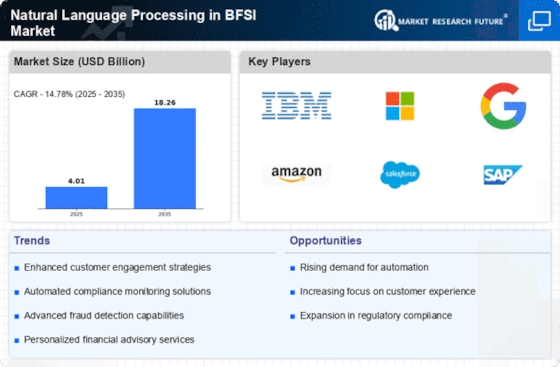

Increased Demand for Automation

The Natural Language Processing in BFSI Market is experiencing a surge in demand for automation solutions. Financial institutions are increasingly adopting NLP technologies to streamline operations, reduce costs, and enhance efficiency. According to recent data, the automation of customer service processes through NLP can lead to a reduction in operational costs by up to 30%. This trend is driven by the need for faster response times and improved customer satisfaction. As institutions seek to optimize their workflows, the integration of NLP tools for tasks such as document processing and transaction analysis becomes essential. The potential for automation to transform traditional banking practices is substantial, suggesting that the adoption of NLP will continue to grow as institutions strive for operational excellence.

Regulatory Compliance Efficiency

The Natural Language Processing in BFSI Market plays a crucial role in enhancing regulatory compliance efficiency. Financial institutions face increasing scrutiny from regulatory bodies, necessitating robust compliance measures. NLP technologies can assist in automating the monitoring of transactions and communications, ensuring adherence to regulations. For instance, NLP can analyze large volumes of text data to identify potential compliance risks, thereby reducing the likelihood of costly penalties. The market for compliance solutions is projected to grow significantly, with NLP being a key component in achieving compliance objectives. As regulatory requirements continue to evolve, the demand for NLP solutions that facilitate efficient compliance processes is expected to rise, making it a vital driver in the BFSI sector.

Leave a Comment