Rising Maritime Threats

The Naval Destroyers and Submarines Market is significantly influenced by the increasing maritime threats faced by nations. The rise in piracy, territorial disputes, and the proliferation of advanced naval capabilities among potential adversaries necessitates a robust naval presence. Reports suggest that incidents of piracy have surged in certain regions, prompting nations to enhance their naval capabilities to safeguard trade routes and national interests. Additionally, the emergence of new naval technologies among rival states has created a sense of urgency for modernization. As a result, countries are investing in advanced destroyers and submarines to ensure they remain competitive and capable of addressing these threats. This growing concern over maritime security is likely to propel the demand for sophisticated naval vessels, thereby shaping the future of the Naval Destroyers and Submarines Market.

Environmental Regulations

The Naval Destroyers and Submarines Market is increasingly impacted by stringent environmental regulations aimed at reducing the ecological footprint of naval operations. Governments are recognizing the importance of sustainable practices in defense procurement, leading to a shift towards greener technologies. This includes the development of submarines and destroyers that utilize alternative fuels and energy-efficient systems. Reports indicate that several navies are exploring hybrid propulsion systems to minimize emissions and enhance operational efficiency. As environmental concerns gain prominence, manufacturers are compelled to innovate and adapt their designs to comply with these regulations. This trend not only addresses environmental challenges but also aligns with the broader goals of sustainability in defense. Consequently, the market is likely to witness a growing demand for eco-friendly naval vessels, shaping the future of the Naval Destroyers and Submarines Market.

Technological Innovations

Technological innovations are a driving force in the Naval Destroyers and Submarines Market, as advancements in naval technology continue to reshape the landscape. The integration of cutting-edge systems such as artificial intelligence, autonomous operations, and advanced weaponry is revolutionizing naval warfare. For example, the development of stealth technologies and enhanced sonar systems is enabling submarines to operate more effectively in contested environments. Furthermore, the introduction of next-generation destroyers equipped with advanced missile systems is enhancing naval capabilities. As nations strive to maintain a technological edge, investments in research and development are expected to rise, fostering a competitive environment. This focus on innovation is likely to stimulate growth in the market, as manufacturers seek to deliver state-of-the-art solutions that meet the evolving needs of naval forces.

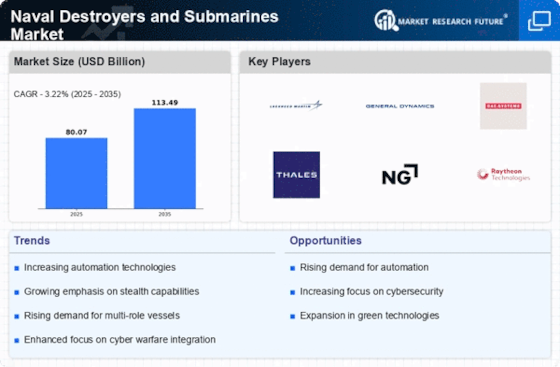

Increasing Defense Budgets

The Naval Destroyers and Submarines Market is experiencing a notable surge in defense budgets across various nations. Countries are prioritizing naval capabilities to enhance their maritime security and deterrence strategies. For instance, recent reports indicate that defense spending in several regions has increased by approximately 5-10% annually, reflecting a commitment to modernizing naval fleets. This trend is likely to drive demand for advanced destroyers and submarines, as nations seek to replace aging vessels with state-of-the-art technology. Furthermore, the emphasis on naval power projection and the need to secure vital trade routes are contributing factors. As nations invest in their naval forces, the market for destroyers and submarines is expected to expand, presenting opportunities for manufacturers and suppliers in the defense sector.

Strategic Alliances and Partnerships

Strategic alliances and partnerships are becoming increasingly prevalent in the Naval Destroyers and Submarines Market, as nations collaborate to enhance their naval capabilities. Joint ventures and cooperative agreements between countries facilitate the sharing of resources, technology, and expertise. For instance, recent collaborations have led to the co-development of advanced naval platforms, allowing nations to pool their strengths and reduce costs. This trend is particularly evident in regions where countries face common security challenges, prompting them to work together to bolster their naval forces. Additionally, partnerships with defense contractors enable access to cutting-edge technologies and innovations. As nations recognize the benefits of collaboration, the market is likely to see a rise in joint initiatives, ultimately driving growth and enhancing the capabilities of naval fleets.

Leave a Comment