Focus on Maritime Security

The emphasis on maritime security is a driving force in the Naval Weapon System Market. With the increasing frequency of piracy, smuggling, and territorial disputes, nations are compelled to bolster their naval defenses. The market for naval weapon systems is projected to reach USD 50 billion by 2026, reflecting the urgent need for enhanced maritime security measures. This focus on securing sea lanes and protecting national interests is likely to result in increased investments in advanced naval weaponry, including missile systems and surveillance technologies, thereby shaping the future landscape of naval defense.

Modernization of Naval Forces

The modernization of naval forces is a pivotal driver in the Naval Weapon System Market. Many countries are undertaking extensive programs to upgrade their existing fleets, replacing outdated systems with state-of-the-art technologies. This modernization trend is particularly evident in nations with aging naval assets, where the need for enhanced capabilities is paramount. Reports indicate that the modernization efforts could account for nearly 60% of total naval procurement budgets in the coming years. Such initiatives not only improve operational capabilities but also stimulate demand for advanced naval weapon systems, thereby influencing market dynamics.

Advancements in Naval Technology

Technological advancements play a crucial role in shaping the Naval Weapon System Market. Innovations in areas such as artificial intelligence, automation, and precision-guided munitions are transforming naval warfare. The integration of these technologies is expected to enhance the effectiveness and efficiency of naval operations. For example, the market for unmanned naval systems is projected to grow at a compound annual growth rate of 7% through 2028, indicating a shift towards more sophisticated and autonomous naval capabilities. This evolution in technology not only improves operational readiness but also influences procurement strategies within the naval sector.

Increasing Geopolitical Tensions

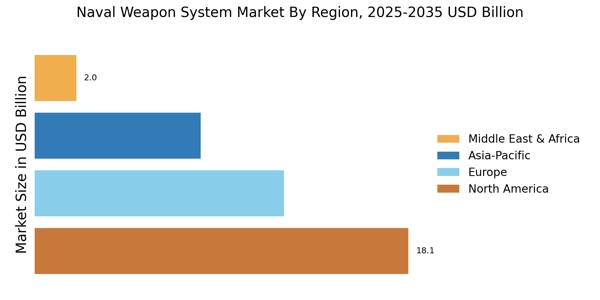

The Naval Weapon System Market appears to be significantly influenced by rising geopolitical tensions among nations. As countries seek to assert their dominance and protect their interests, military spending, particularly in naval capabilities, is likely to increase. For instance, defense budgets in regions such as Asia-Pacific and Eastern Europe have seen substantial growth, with naval expenditures projected to rise by approximately 5% annually over the next five years. This trend suggests that nations are prioritizing the enhancement of their naval fleets, which may include advanced weapon systems, to ensure maritime security and deterrence against potential threats.

Strategic Partnerships and Alliances

Strategic partnerships and alliances are increasingly shaping the Naval Weapon System Market. Collaborative efforts among nations, particularly in defense technology sharing and joint exercises, are becoming more prevalent. These partnerships often lead to co-development of advanced naval weapon systems, which can enhance interoperability and reduce costs. For instance, recent agreements between countries in Europe and Asia have resulted in shared research initiatives aimed at developing next-generation naval technologies. Such collaborations are expected to drive innovation and expand the market for naval weapon systems, as nations seek to leverage collective expertise and resources.