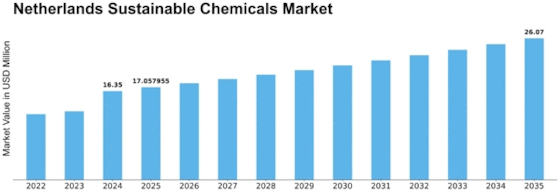

Netherlands Sustainable Chemicals Size

Netherlands Sustainable Chemicals Market Growth Projections and Opportunities

Numerous factors determine the dynamics and growth trajectory of the Netherlands Sustainable Chemicals Market. The global focus on sustainability and environmental friendliness drives this market. As climate change and environmental degradation worries rise, sustainable solutions are in demand, and the Netherlands is a leader. Sustainable chemical developments have thrived due to the Dutch government's green economy and carbon reduction efforts.

The Netherlands Sustainable Chemicals Market is also shaped by strict regulations. Strong environmental rules in the country promote eco-friendly alternatives and prohibit chemical use. This regulatory environment maintains compliance and promotes sustainable chemical technology research. Companies in this market must follow certain standards, promoting responsible and sustainable business practices.

Additionally, customer awareness and tastes greatly affect the industry. The Netherlands' well-informed and ecologically conscientious consumers actively seek products with low environmental impact. This understanding has changed customer tastes for sustainable products, prompting corporations to develop and market eco-friendly chemicals. This transition drives the market to offer sustainable alternatives in agriculture, manufacturing, and other areas.

Sustainable chemical markets in the Netherlands are also shaped by investments and collaborations. The government and commercial sector engage in R&D to expedite sustainable chemical solution invention and adoption. Academic, scientific, and business collaborations boost sustainable chemical efforts to address environmental issues.

Global market trends and economic considerations shape the Netherlands Sustainable Chemicals Market. International market dynamics, trade agreements, and economic conditions affect sustainable chemical demand and supply as the world becomes more sustainable. Being a worldwide chemical player, the Netherlands can capitalize on these trends by attracting foreign investments and creating global partnerships.

Market challenges include early expenditures of adopting sustainable practices. While the long-term benefits are clear, corporations may confront greater manufacturing costs and large capital investments. Strategic thinking, innovative technologies, and government and financial institution cooperation are needed to overcome these obstacles.

Leave a Comment