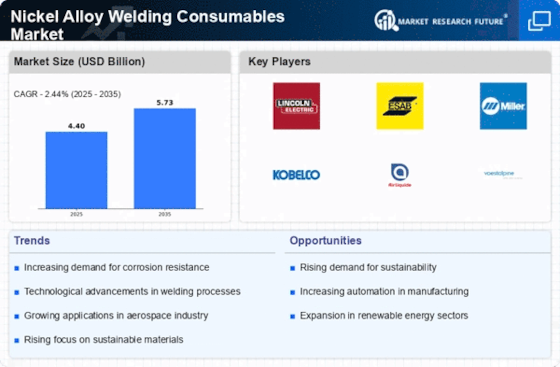

Growing Focus on Energy Sector

The energy sector, particularly renewable energy, is becoming a significant driver for the Nickel Alloy Welding Consumables Market. As countries transition towards sustainable energy sources, the demand for nickel alloys in the construction of wind turbines, solar panels, and other energy infrastructure is increasing. Nickel alloys offer superior performance in harsh environments, making them ideal for energy applications. Recent projections indicate that the renewable energy market could expand at a rate of 8% annually, further propelling the need for reliable welding consumables that can withstand the rigors of energy production and distribution.

Increasing Infrastructure Development

The ongoing expansion of infrastructure projects across various sectors appears to be a primary driver for the Nickel Alloy Welding Consumables Market. Governments and private entities are investing heavily in the construction of bridges, highways, and buildings, which necessitates the use of durable materials. Nickel alloys, known for their corrosion resistance and strength, are increasingly favored in these applications. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is likely to bolster the demand for nickel alloy welding consumables, as they are essential for ensuring the longevity and safety of infrastructure projects.

Rising Demand in Aerospace and Defense

The aerospace and defense sectors are experiencing a surge in demand for nickel alloy welding consumables, driven by the need for high-performance materials that can withstand extreme conditions. Nickel alloys are integral in manufacturing components for aircraft and military equipment due to their excellent mechanical properties and resistance to heat and corrosion. The aerospace industry alone is expected to grow significantly, with estimates suggesting a market size increase of over 4% annually. This trend indicates a robust future for the Nickel Alloy Welding Consumables Market, as manufacturers seek reliable materials to meet stringent safety and performance standards.

Regulatory Standards and Quality Assurance

Stringent regulatory standards and quality assurance measures are influencing the Nickel Alloy Welding Consumables Market. Industries such as oil and gas, aerospace, and automotive are subject to rigorous safety and quality regulations, necessitating the use of high-quality welding consumables. Nickel alloys, known for their reliability and performance, are often mandated in critical applications to meet these standards. As regulatory bodies continue to enforce compliance, the demand for nickel alloy welding consumables is expected to grow, as manufacturers prioritize quality and safety in their production processes.

Technological Innovations in Welding Processes

Technological advancements in welding processes are reshaping the Nickel Alloy Welding Consumables Market. Innovations such as laser welding and automated welding systems enhance efficiency and precision, leading to increased adoption of nickel alloys in various applications. These technologies not only improve the quality of welds but also reduce production costs, making nickel alloy consumables more attractive to manufacturers. As industries continue to embrace automation and advanced welding techniques, the demand for high-quality nickel alloy welding consumables is likely to rise, reflecting a shift towards more sophisticated manufacturing processes.

.png)