Innovations in Production Techniques

Innovations in production techniques are playing a pivotal role in shaping the Non-Dairy Cheese Market. Advances in fermentation technology and the use of novel ingredients have enabled producers to create non-dairy cheeses that closely mimic the texture and flavor of traditional dairy cheeses. For instance, the incorporation of nuts, seeds, and legumes has led to the development of a wide array of products that appeal to both vegans and non-vegans alike. Furthermore, the introduction of new processing methods has improved the shelf life and nutritional profile of these products, making them more attractive to health-conscious consumers. As a result, the market is witnessing an influx of innovative non-dairy cheese options, which are likely to drive further growth in the industry.

Growing Awareness of Lactose Intolerance

The Non-Dairy Cheese Market is significantly influenced by the growing awareness of lactose intolerance among consumers. As more individuals recognize their sensitivity to lactose, the demand for lactose-free alternatives, including non-dairy cheese, has surged. Research indicates that approximately 65% of the adult population experiences some degree of lactose intolerance, prompting a shift towards dairy alternatives. This awareness has led to an increase in product offerings that cater specifically to lactose-intolerant consumers, thereby expanding the market. Manufacturers are responding by developing non-dairy cheese products that not only meet dietary needs but also provide similar taste and texture to traditional cheese, thus appealing to a broader audience.

Environmental Concerns and Sustainability

Environmental concerns and sustainability are increasingly shaping consumer choices within the Non-Dairy Cheese Market. As awareness of the environmental impact of dairy farming grows, many consumers are seeking alternatives that align with their values regarding sustainability. Non-dairy cheese Market products are often perceived as more environmentally friendly, as they typically require fewer resources and produce lower greenhouse gas emissions compared to their dairy counterparts. Recent studies suggest that plant-based cheese alternatives can reduce water usage by up to 90% compared to traditional cheese production. This shift towards environmentally conscious consumption is likely to drive further interest and investment in the non-dairy cheese sector, as consumers prioritize products that contribute to a more sustainable food system.

Increased Availability in Retail Channels

The Non-Dairy Cheese Market benefits from increased availability in various retail channels, which enhances consumer access to these products. Supermarkets, health food stores, and online platforms are increasingly stocking a diverse range of non-dairy cheese options, catering to the rising demand. Recent statistics suggest that the presence of non-dairy cheese in mainstream grocery stores has increased by over 30% in the past two years. This expansion in distribution channels not only facilitates consumer choice but also raises awareness about non-dairy alternatives. As more consumers encounter these products in their daily shopping experiences, the likelihood of trial and adoption increases, thereby propelling market growth.

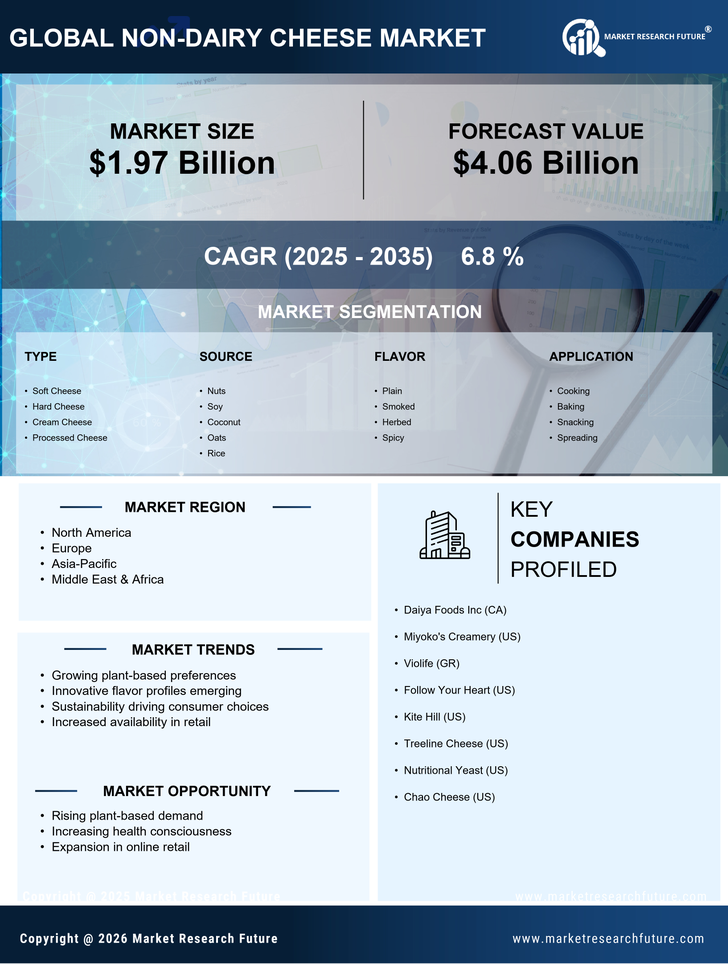

Rising Demand for Plant-Based Alternatives

The Non-Dairy Cheese Market experiences a notable surge in demand for plant-based alternatives, driven by a growing consumer preference for healthier dietary options. As individuals increasingly seek to reduce their intake of animal products, the market for non-dairy cheese has expanded significantly. Recent data indicates that the non-dairy cheese segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is not merely a passing fad; it reflects a broader shift towards plant-based diets, which are perceived as healthier and more sustainable. Consequently, manufacturers are innovating to create diverse non-dairy cheese products that cater to various taste preferences and dietary restrictions, thereby enhancing their market appeal.