Research Methodology on Non Dairy Frozen Desserts Market

Introduction

Frozen desserts are becoming increasingly popular in the global food industry due to their convenience and taste. With the rise of health consciousness and ethical concerns, there has been a noticeable shift towards non-dairy frozen desserts as an alternative to ice cream and other dairy-based products.

Currently, plant-based non-dairy frozen desserts are gaining excellent traction due to their ability to be used as a substitute for traditional desserts. Several surveys have revealed that the younger generations are increasingly looking for healthier and more ethically friendly options. This has seen a growing demand for non-dairy frozen desserts in the market. Major companies are now looking to invest in this segment to take advantage of the growing opportunities.

Research Objectives

The research objectives for this report are as follows:

- Get an overview of the global non-dairy frozen desserts market including market dynamics and market trends.

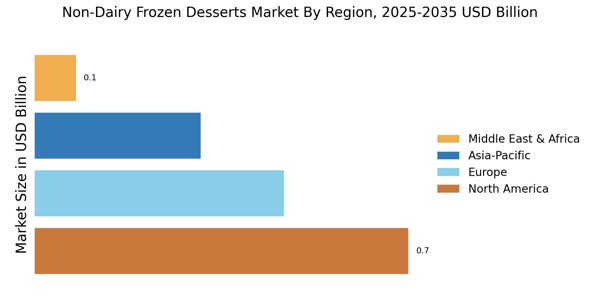

- Estimate the current market size and future market potential for non-dairy frozen desserts.

- Analyze key market segments and determine their growth potential.

- Analyze the major players in the non-dairy frozen desserts market and their strategies for success.

Research Design

The research design for this report includes both qualitative and quantitative components. The qualitative component involves exploratory research, including a literature review and expert interviews. The quantitative component involves descriptive and inferential research, employing both primary and secondary data.

Data Sources

The data sources for the research report include both primary and secondary sources. Primary sources include a survey of industry experts and stakeholders, as well as direct input from consumers. Secondary sources will include a literature review and analysis of existing market data, including research reports and statistical data.

Research Methodology

The research methodology includes both qualitative and quantitative components, as mentioned earlier.

Qualitative Research Methodology

The exploratory study employs the use of qualitative research techniques such as focus group discussions and semi-structured interviews. The survey will be conducted with both industry experts and consumers to get a better understanding of the market and understand the opinions and preferences of the consumers. The focus group discussions will include both the experts and the consumers. The semi-structured interviews will include questions about the tastes, trends and preferences of the consumers, as well as opinionated questions about the industry and the potential for growth.

Quantitative Research Methodology

The quantitative research will include descriptive and inferential analysis of the data collected from both primary and secondary sources. Descriptive analysis will allow us to quantitatively measure the market size and potential, while inferential analysis will allow us to study the relationships between variables, test existing theories and suggest new ones.

Data Analysis

All the data collected in the study will be analyzed using both qualitative and quantitative methods. Qualitative analysis will allow us to get an in-depth understanding of the context and explain the phenomena observed in the data. Quantitative analysis will allow us to make more objective inferences and draw meaningful conclusions.

The study makes use of SPSS and Microsoft Excel tools to analyze the data collected. These tools will enable us to carry out statistical tests, such as cross-tabulations, correlations and regressions, in order to study the relationship between variables.