Global Non-Dairy Ice Cream Market Overview

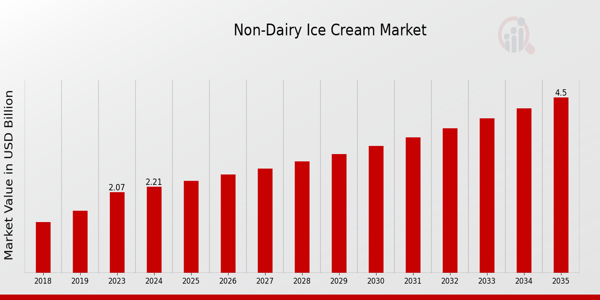

As per MRFR analysis, the Non-Dairy Ice Cream Market Size was estimated at 2.07 (USD Billion) in 2023. The Non-Dairy Ice Cream Market Industry is expected to grow from 2.21(USD Billion) in 2024 to 4.5 (USD Billion) by 2035. The Non-Dairy Ice Cream Market CAGR (growth rate) is expected to be around 6.68% during the forecast period (2025 - 2035).

Key Non-Dairy Ice Cream Market Trends Highlighted

The Non-Dairy Ice Cream Market is experiencing significant growth driven by an increasing number of consumers seeking plant-based alternatives. Awareness of health and wellness is a key driver, with many people opting for non-dairy options due to dietary restrictions, lactose intolerance, or a desire for a healthier lifestyle. The rising popularity of veganism and the growing acceptance of plant-based diets contribute to the demand for non-dairy ice cream products. Additionally, the development of innovative flavors and textures is attracting a wider customer base, further fueling market expansion.

The opportunities in this market continue to grow as manufacturers explore new ingredients, such as coconut, almond, and oat, to create unique and appealing products.There is an opportunity to target particular market segments, particularly for health-oriented consumers searching for low-calorie and organic products. The growing trend of online shopping and e-commerce platforms also gives an opportunity for brands to reach customers directly and broaden their distribution channels. By addressing trends in sustainability, companies can cater to the growing inclination toward eco-friendly goods, which increases brand loyalty and consumer satisfaction.

Today, there has been a great shift towards clean label products in which consumers want products that have few ingredients and are closer to nature. The impact of social networks has contributed to shaping consumer preferences, as appealing images of non-dairy ice cream products on social networks enhance their popularity.

Brands have started to utilize influencer advertising to reach their audiences more accurately, resulting in non-dairy products receiving greater coverage and interest. At this point, the market is more oriented toward being product-specific to improve product formulation, the quality and taste of which is going to be a silver bullet for pushing sales in the long run.

Non-Dairy Ice Cream Market Drivers

Growing Demand for Plant-Based Products

The increase in consumer awareness regarding health and wellness has prompted a significant shift towards plant-based diets. With rising concerns about animal welfare, environmental sustainability, and personal health, consumers are seeking alternatives to traditional dairy products. This trend is particularly prominent among millennials and Gen Z, who are driving the demand for non-dairy alternatives.

The Non-Dairy Ice Cream Market Industry is benefiting from this shift, as non-dairy ice cream provides a delicious, enjoyable product that aligns with consumer preferences for vegan and vegetarian lifestyles.Moreover, the wide variety of ingredients used in non-dairy ice creams, such as coconut, almond, soy, and cashew bases, contribute to the appeal of these products. As more people adopt dairy-free or lactose-free diets due to allergies or lactose intolerance, the demand for non-dairy ice cream is projected to grow steadily.

Retailers and manufacturers are increasingly focusing on expanding their non-dairy ice cream offerings, further driving the market growth.Plant-based diets have garnered attention not just for health benefits but also for the positive environmental impact associated with lower greenhouse gas emissions. Consequently, this shift is likely to continue influencing consumer choices, supporting the growth and expansion of the Non-Dairy Ice Cream Market Industry.

Innovation in Flavors and Ingredients

Innovation plays a crucial role in the Non-Dairy Ice Cream Market Industry as manufacturers continuously seek to create new and exciting flavors that tempt the palate. The introduction of unique combinations and exotic ingredients enhances the overall appeal of non-dairy ice creams. By leveraging different bases and natural flavorings, companies are reaching out to adventurous consumers looking for distinct taste experiences.

The focus on natural and organic ingredients further resonates with health-conscious buyers, pushing brands to develop products that are not only delicious but also nutritious.This continuous innovation ensures that the market remains dynamic and meets the evolving preferences of consumers.

Increasing Health Consciousness Among Consumers

Health consciousness is on the rise globally, with individuals becoming more mindful of their dietary choices and the implications of these choices on their well-being. Many people are moving away from high-calorie, high-sugar foods and seeking healthier dessert options that do not compromise on taste. Non-dairy ice cream, often lower in calories and fat than traditional ice cream, fits well within this trend.

The Non-Dairy Ice Cream Market Industry thrives on this growing base of consumers prioritizing healthier eating habits.As brands promote the health benefits of their non-dairy products, ranging from lower cholesterol content to enriched vitamins, the market is likely to experience continued expansion.

Non-Dairy Ice Cream Market Segment Insights

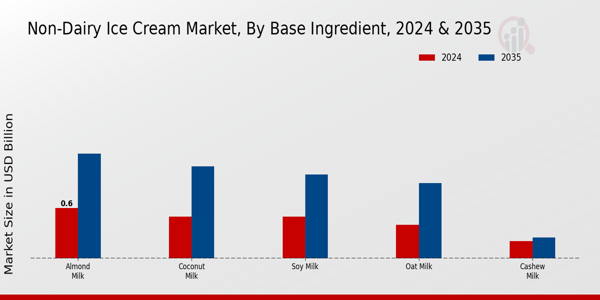

Non-Dairy Ice Cream Market Base Ingredient Insights

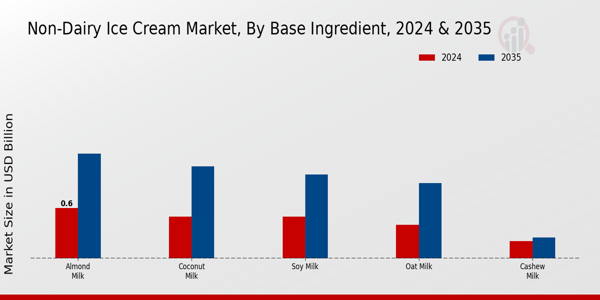

The Base Ingredient segment of the Non-Dairy Ice Cream Market is a crucial category, reflecting a significant portion of market growth. By 2024, this segment will hold a value of about 2.21 USD Billion, showcasing consumer preferences shifting towards non-dairy alternatives driven by health concerns and dietary choices. Among the various ingredients, Almond Milk leads the market with a valuation of 0.6 USD Billion in 2024, and it is projected to grow to 1.25 USD Billion by 2035; its popularity stems from its creamy texture and lower calorie content, making it a preferred choice among health-conscious individuals.

Coconut Milk, valued at 0.5 USD Billion in 2024 and expected to reach 1.1 USD Billion in 2035, is appreciated for its unique flavor and natural sweetness, often catering to those seeking a tropical taste in their ice creams. Soy Milk holds a parallel valuation to Coconut Milk at 0.5 USD Billion in 2024, with a projected growth to 1.0 USD Billion in 2035; its protein-rich content and versatility make it a significant option for those desiring a balance of texture and taste.

Oat Milk, while at a lower valuation of 0.4 USD Billion in 2024, is anticipated to grow to 0.9 USD Billion by 2035, reflecting a growing acceptance and an increase in oat-based diets for its fiber content and creaminess, which provides an interesting texture to ice cream. Lastly, Cashew Milk shows a more modest valuation of 0.21 USD Billion in 2024, with a slight increase expected to 0.25 USD Billion by 2035; its rich and buttery flavor offers a unique option but is often overshadowed by the more popular almond and coconut varieties.

The market statistics reveal that the Base Ingredient segment is influenced by key trends such as the rise in veganism, lactose intolerance awareness, and innovation in flavors and textures. Furthermore, opportunities for growth exist in product development and marketing strategies that target health-focused consumers, while challenges may arise from sourcing quality raw materials and maintaining competitive pricing against traditional dairy ice cream products.

Non-Dairy Ice Cream Market Flavor Profile Insights

The Non-Dairy Ice Cream Market is poised for significant growth, with a projected revenue of approximately 2.21 billion USD in 2024, rising to 4.5 billion USD by 2035. This market is actively segmented into various flavor profiles, including Vanilla, Chocolate, Fruit Flavors, Mint, and Coffee, contributing diverse options that cater to consumer preferences. Among these flavors, Vanilla retains a major position due to its classic appeal and versatility, making it a staple in the market.

Chocolate is similarly attractive as it appeals to a wide demographic, often driving impulse purchases.Fruit flavors offer a refreshing alternative, particularly appealing to health-conscious consumers seeking natural ingredients. Mint flavors provide a unique taste experience that is often associated with indulgence, while Coffee flavors cater to adult consumers looking for a sophisticated treat. The Non-Dairy Ice Cream Market data reflects shifting consumer trends towards plant-based diets, driven by health considerations and lactose intolerance, further enhancing the importance of these flavor profiles.

The overall market growth is supported by rising demand for non-dairy alternatives and experiential flavor innovations.However, challenges include the need for competitive pricing and the sourcing of high-quality ingredients to maintain flavor integrity and consumer satisfaction.

Non-Dairy Ice Cream Market Packaging Type Insights

The Non-Dairy Ice Cream Market, projected to be valued at approximately 2.21 billion USD in 2024, showcases significant diversity in its Packaging Type segment. This diversification serves to cater to evolving consumer preferences, driving market growth. Among the various packaging formats, single-serve cups have become increasingly popular due to their convenience and portion control, which align well with on-the-go lifestyles.

Pints and quarts are also essential, appealing to consumers looking for indulgent experiences shared with family or friends.Bulk packaging typically targets the food service sector, providing a cost-effective option for restaurants and cafes, while multi-pack offerings cater to families or group settings, ensuring variety in flavors and serving size. The overall Non-Dairy Ice Cream Market revenue is supported by a growing demand for vegan and plant-based diets, contributing to the rise of these packaging types.

However, challenges such as environmental concerns regarding packaging waste are influencing the industry to innovate towards more sustainable solutions, creating both obstacles and new opportunities for growth in this vibrant market.The Non-Dairy Ice Cream Market segmentation reflects these trends, illustrating the importance of packaging types in meeting consumer needs.

Non-Dairy Ice Cream Market Distribution Channel Insights

The Non-Dairy Ice Cream Market revenue is influenced significantly by the various distribution channels, including supermarkets, online retail, convenience stores, and health food stores. In 2024, the market was expected to be valued at 2.21 billion USD, showcasing a robust growth trajectory. Supermarkets play a crucial role in the distribution of non-dairy ice cream, offering consumers a wide variety of options and convenience.

Online retail has been gaining traction, especially as consumers increasingly prefer the ease of home delivery, making it a significant driver in this market.Convenience stores cater to on-the-go shoppers, providing a selection of quick snacks, thus capturing a vital segment of consumers seeking instant gratification. Health food stores also hold an essential position by appealing to health-conscious individuals who are seeking plant-based options, contributing to market expansion.

The interplay between these channels presents varied opportunities, with each contributing uniquely to the overall dynamics of the Non-Dairy Ice Cream Market segmentation, responding to shifting consumer preferences towards healthier alternatives and convenience.The expected growth of these channels will likely shape the market landscape over the coming years.

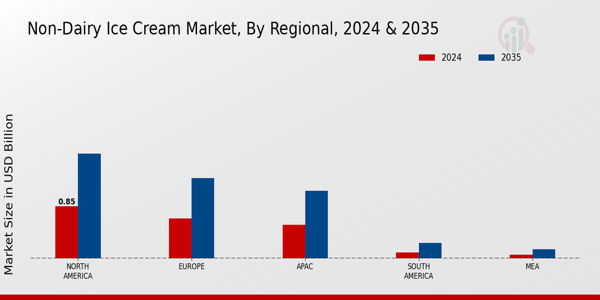

Non-Dairy Ice Cream Market Regional Insights

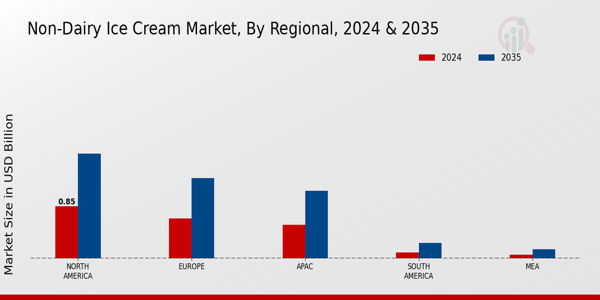

The Regional segment of the Non-Dairy Ice Cream Market highlights significant growth trends, with North America leading in market valuation, achieving a value of 0.85 USD Billion in 2024, which is expected to grow to 1.7 USD Billion by 2035, thus dominating the market. Europe follows closely, valued at 0.65 USD Billion in 2024 and projected to reach 1.3 USD Billion in 2035, showcasing its importance due to the rising demand for plant-based products among health-conscious consumers.

Meanwhile, the APAC region, although smaller with a valuation of 0.55 USD Billion in 2024, is vital for its rapid expansion potential, aiming for 1.1 USD Billion by 2035 as lifestyle changes spur greater adoption of non-dairy options.South America holds a value of 0.1 USD Billion in 2024, highlighting a developing market expected to grow to 0.25 USD Billion by 2035. Lastly, the MEA region, albeit the least with a market value of 0.06 USD Billion in 2024, indicates potential growth opportunities due to increasing awareness of vegan diets, expected to reach 0.15 USD Billion by 2035.

The market growth across these regions contributes to the broader Non-Dairy Ice Cream Market revenue, portraying a dynamic landscape driven by shifting consumer preferences towards healthier, dairy-free alternatives.

Non-Dairy Ice Cream Market Key Players and Competitive Insights:

The competitive landscape of the Non-Dairy Ice Cream Market has witnessed significant transformations driven by changing consumer preferences towards healthier and plant-based alternatives. As more consumers seek dairy-free options, companies operating in this sector have started to innovate and diversify their offerings, focusing on ingredients that cater to vegan, lactose-free, and health-conscious consumers. The market is characterized by a growing number of players, product variations, and promotional strategies that emphasize natural ingredients, sustainability, and ethical sourcing.

This competitive environment requires companies to be agile and responsive to market trends, ensuring that they remain relevant amidst evolving consumer demands and lifestyle choices.Nestle has positioned itself as a formidable player in the Non-Dairy Ice Cream Market, leveraging its extensive experience and strong brand equity. With a diverse range of products, Nestle has effectively tapped into the increasing demand for non-dairy ice cream by offering innovative flavors and formulations that appeal to a broad audience. The company's commitment to sustainability and ethical sourcing enhances its competitive edge, as the transparency and integrity of brands increasingly influence consumers.

Nestle's strong distribution network further amplifies its market reach, allowing it to make its non-dairy offerings accessible to a wide array of consumers both in retail environments and through online platforms.Edy's has carved out a distinct niche in the Non-Dairy Ice Cream Market, gaining recognition for its high-quality, tasty alternatives that cater to a growing demographic seeking dairy-free options. The company emphasizes flavor innovation, and its product line is designed to provide a satisfying experience comparable to traditional ice cream. With an appeal to families and health-conscious individuals, Edy's successfully blends delightful taste with appealing nutritional profiles.

The brand's marketing strategies and community engagement initiatives resonate well with consumers, reinforcing loyalty and presence in the market. Edy's focus on quality ingredients and a consumer-first approach creates a unique value proposition, making it a notable competitor in the rapidly evolving non-dairy ice cream sector.

Key Companies in the Non-Dairy Ice Cream Market Include:

Non Dairy Ice Cream Market Industry Developments

-

Q2 2024: Oatly Launches New Non-Dairy Frozen Dessert Line in the U.S. Oatly announced the launch of its new line of non-dairy frozen desserts in the United States, expanding its plant-based product portfolio to include several new flavors made from oat milk.

-

Q2 2024: Ben & Jerry’s Introduces Two New Non-Dairy Ice Cream Flavors Ben & Jerry’s unveiled two new non-dairy ice cream flavors, further expanding its vegan-friendly offerings and responding to growing consumer demand for plant-based desserts.

-

Q3 2024: So Delicious Dairy Free Opens New Production Facility in Texas So Delicious Dairy Free, a subsidiary of Danone, opened a new manufacturing facility in Texas dedicated to producing non-dairy ice cream and frozen desserts to meet rising demand in North America.

-

Q2 2024: Perfect Day Raises $90 Million in Series D Funding to Expand Animal-Free Dairy Offerings Perfect Day, a company specializing in animal-free dairy proteins, secured $90 million in Series D funding to accelerate the development and commercialization of its non-dairy ice cream products.

-

Q1 2025: Unilever’s Magnum Launches Vegan Ice Cream Bars in Japan Unilever’s Magnum brand launched its first vegan ice cream bars in Japan, marking the company’s entry into the Japanese plant-based frozen dessert market.

-

Q2 2025: NadaMoo! Announces Strategic Partnership with Whole Foods Market NadaMoo! entered into a strategic partnership with Whole Foods Market to expand the distribution of its non-dairy ice cream products across all U.S. locations.

-

Q1 2024: Swedish Vegan Ice Cream Brand Lily & Hanna’s Acquired by Froneri Froneri, a global ice cream manufacturer, acquired Swedish vegan ice cream brand Lily & Hanna’s to strengthen its presence in the European non-dairy frozen dessert market.

-

Q3 2024: Breyers Expands Non-Dairy Line with Oat Milk-Based Flavors Breyers announced the addition of new oat milk-based flavors to its non-dairy ice cream line, aiming to cater to consumers seeking plant-based alternatives.

-

Q2 2025: Cado Secures $15 Million in Series B Funding to Scale Avocado-Based Non-Dairy Ice Cream Cado, known for its avocado-based non-dairy ice cream, raised $15 million in Series B funding to expand production capacity and accelerate national retail distribution.

-

Q1 2025: Tofutti Brands Appoints New CEO to Drive Growth in Non-Dairy Frozen Desserts Tofutti Brands announced the appointment of a new CEO, aiming to strengthen its leadership team and accelerate growth in the non-dairy frozen dessert segment.

-

Q2 2024: Cosmic Bliss Launches Organic Coconut Milk Ice Cream Nationwide Cosmic Bliss launched a new line of organic coconut milk-based ice cream, now available in major grocery chains across the United States.

-

Q3 2024: Dream Pops Partners with Target to Launch Non-Dairy Ice Cream Bites Nationwide Dream Pops announced a partnership with Target to launch its non-dairy ice cream bites in stores nationwide, expanding its retail footprint.

Non-Dairy Ice Cream Market Segmentation Insights

-

Non-Dairy Ice Cream Market Base Ingredient Outlook

-

Non-Dairy Ice Cream Market Flavor Profile Outlook

-

Non-Dairy Ice Cream Market Packaging Type Outlook

-

Non-Dairy Ice Cream Market Distribution Channel Outlook

-

Non-Dairy Ice Cream Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

2.07(USD Billion) |

| Market Size 2024 |

2.21(USD Billion) |

| Market Size 2035 |

4.5(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

6.68% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Nestle, Edy's, Luna and Larry's, HäagenDazs, Talenti, Unilever, Alpro, So Delicious, Sweet Ritual, Coconut Bliss, Oatly, Ben and Jerry's, NadaMoo, Dreyer's |

| Segments Covered |

Base Ingredient, Flavor Profile, Packaging Type, Distribution Channel, Regional |

| Key Market Opportunities |

Plant-based ingredient innovations, Increased health consciousness among consumers, Expansion in vegan product lines, Rising demand in emerging markets, Strategic partnerships with retailers |

| Key Market Dynamics |

Health consciousness among consumers, Rising lactose intolerance prevalence, Growing veganism trend, Innovation in flavors and textures, Increasing availability of plant-based ingredients |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The Non-Dairy Ice Cream Market was valued at 2.21 USD Billion in 2024.

By 2035, the Non-Dairy Ice Cream Market is estimated to reach a value of 4.5 USD Billion.

The market is anticipated to register a CAGR of 6.68% from 2025 to 2035.

The Coconut Milk segment of the Non-Dairy Ice Cream Market is expected to be valued at 1.1 USD Billion in 2035.

The Almond Milk segment was expected to be valued at 0.6 USD Billion in 2024.

Key players include Nestle, Häagen-Dazs, Unilever, and Ben Jerry's, among others.

The Soy Milk segment is projected to reach a market size of 1.0 USD Billion by 2035.

The Cashew Milk segment is estimated to be valued at 0.21 USD Billion in 2024 and 0.25 USD Billion in 2035.