Market Analysis

In-depth Analysis of Non Fuel Grade Alcohol Market Industry Landscape

The pharmaceutical sector is experiencing rapid expansion due to increasing healthcare expenses, a rise in the prevalence of diseases, and heightened public awareness of health concerns. Ethanol is utilized in some medications as a solvent for dispersing the active component, and herbal medicines use it as an extraction solvent. Its bactericidal and fungicidal properties make ethanol an effective antimicrobial preservative.

Pharmaceutical-grade non-fuel alcohol, known for its excellent antiseptic properties, is extensively employed in the pharmaceutical industry. Doctors use it as a sanitizer for handwashing, sterilizing the patient's skin before surgery or injections, and as a solvent in drug processing and medical wipes. The demand for pharmaceutical-grade non-fuel alcohol has surged, especially for producing hand sanitizers to control the spread of the novel coronavirus.

During pandemics, the World Health Organization recommends regular use of disinfectants and sanitizers to prevent viral contamination. Governments and health authorities conducted global public awareness campaigns on proper sanitization practices, leading to a sharp increase in demand for ethanol-containing sanitizers and disinfectants. The medicinal-grade ethanol faced global shortages due to overwhelming demand and supply imbalances, prompting ethanol factories to increase production.

The personal care industry is flourishing with a focus on better lifestyles, increased emphasis on self-care, and higher disposable incomes. Non-fuel grade alcohol is a key component in various pharmaceutical and personal care items, including sanitizers, wipes, aesthetics, medicines, lotions, perfumes, deodorants, and shampoos. Ethanol serves as a versatile solvent in household cleaning products, deodorants, lacquers, varnishes, and many other organic compounds.

The rising disposable income of the middle class and individuals' aspirations for a well-groomed lifestyle contribute to the demand for cosmetic items. Dehydrated alcohol is commonly used in cosmetic and beauty products, acting as an astringent to cleanse the skin and a preservative in lotions. The Indian Brand Equity Foundation estimates substantial growth in the beauty, cosmetics, and grooming industry, from $6.5 billion in 2016 to an anticipated $20 billion by 2025.

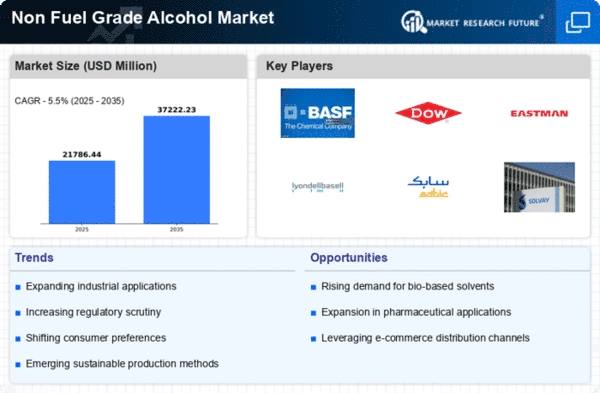

In summary, the expanding pharmaceutical and personal care industries, coupled with the increased use of non-fuel grade alcohol in their products, are expected to create opportunities for the non-fuel grade alcohol market in the forecast period.

Leave a Comment