Non Fuel Grade Alcohol Size

Non Fuel Grade Alcohol Market Growth Projections and Opportunities

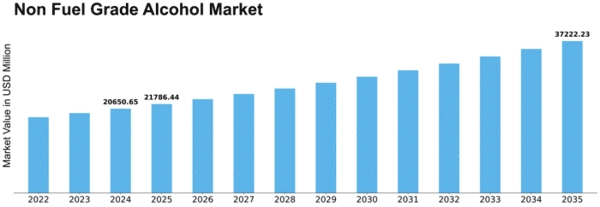

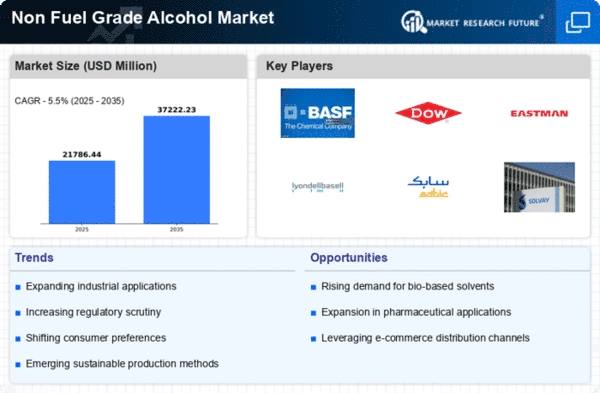

The global market for non-fuel grade alcohol, valued at USD 18,470.0 million in 2021, is anticipated to reach USD 29,114.2 million by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 5.50% throughout the forecast period. In terms of volume, the market stood at 16,341.5 kilotons in 2021, with projections indicating an increase to 24,338.2 kilotons by 2030.

The primary driver behind the expansion of the global non-fuel grade alcohol market is the escalating demand for this alcohol type in the food and beverages industry. This demand surge is attributed to the growing awareness of the adverse environmental effects and increasing knowledge regarding the depletion of fossil fuels among the populace. Additionally, the market benefits from favorable growth opportunities driven by changing lifestyles in various developing economies and an expanding economy across different regions.

The global non-fuel grade alcohol market is categorized based on type, application, and region. The increasing awareness of environmental issues and fossil fuel depletion has led to a rise in demand for non-fuel grade alcohol, contributing to the market's growth. The market is segmented into types such as food grade, pharmaceutical grade, lab grade, industrial grade, and others. Among these, the food grade segment dominated the market in 2021, holding a 48.02% share and is projected to maintain this lead with a CAGR of 5.91% during the forecast period.

In terms of application, the market is segmented into food and beverages, pharmaceuticals, cosmetics and personal care, chemical solvent, and others. The food and beverages segment claimed the largest share at 37.12% in 2021. This prominence is attributed to the exceptional properties of non-fuel grade alcohol as an additive in the food and beverages industry. The segment, valued at USD 6,855.4 million in 2021, is expected to grow at a CAGR of 6.07% to reach USD 11,349.7 million by 2030.

Leave a Comment