Rising Industrial Automation

The surge in industrial automation across North America is influencing the busbar systems market. As industries increasingly adopt automated processes, the need for reliable and efficient power distribution systems becomes critical. Busbar systems provide a compact and flexible solution for power distribution in automated environments, ensuring minimal downtime and enhanced operational efficiency. The industrial automation market is expected to grow at a CAGR of 10% over the next five years, which will likely drive demand for busbar systems. This trend indicates a strong correlation between industrial automation and the busbar systems market, suggesting a promising outlook for manufacturers and suppliers.

Increased Adoption of Smart Grids

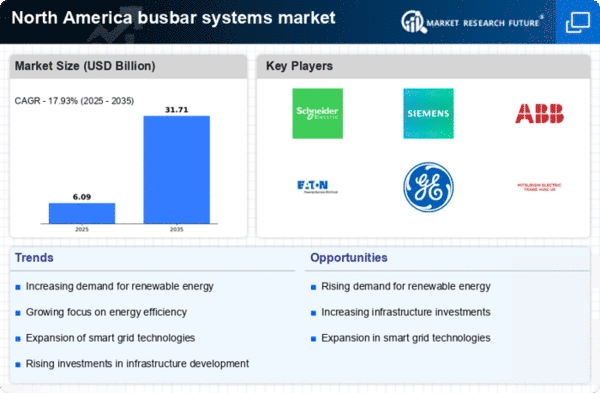

The transition towards smart grids in North America is a pivotal driver for the busbar systems market. Smart grids enhance the efficiency and reliability of electricity distribution, necessitating advanced busbar systems that can handle variable loads and integrate renewable energy sources. The market for smart grid technologies is projected to reach $100 billion by 2026, indicating a substantial opportunity for busbar systems. These systems facilitate real-time monitoring and control, which is essential for optimizing energy distribution. As utilities invest in smart grid infrastructure, the busbar systems market is likely to experience significant growth, driven by the demand for innovative power distribution solutions.

Growing Demand for Energy Efficiency

The increasing emphasis on energy efficiency in North America is driving the busbar systems market. Industries are seeking solutions that minimize energy loss and optimize power distribution. Busbar systems, known for their high conductivity and low resistance, are becoming essential in achieving these goals. According to recent data, energy-efficient systems can reduce operational costs by up to 30%. This trend is particularly evident in sectors such as manufacturing and commercial buildings, where energy consumption is substantial. As organizations strive to meet sustainability targets, the demand for advanced busbar systems is likely to rise, indicating a robust growth trajectory for the busbar systems market.

Infrastructure Development Initiatives

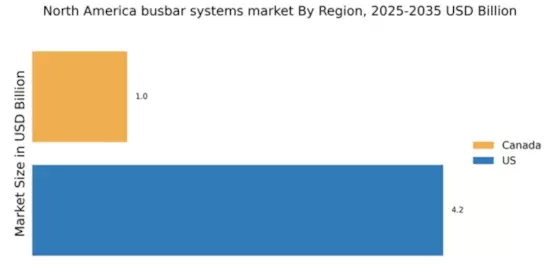

North America's ongoing infrastructure development initiatives are significantly impacting the busbar systems market. With substantial investments in upgrading electrical grids and expanding urban infrastructure, the need for reliable power distribution systems is paramount. The U.S. government has allocated billions of dollars for infrastructure projects, which include modernizing power distribution networks. This creates a favorable environment for busbar systems, which offer efficient and scalable solutions for high-capacity power distribution. As cities expand and new facilities are constructed, the busbar systems market is poised to benefit from these developments, potentially leading to a market growth rate of 5-7% annually.

Focus on Safety and Reliability Standards

The heightened focus on safety and reliability standards in North America is a crucial driver for the busbar systems market. Regulatory bodies are increasingly mandating stringent safety protocols for electrical installations, which necessitate the use of high-quality busbar systems. These systems are designed to withstand extreme conditions and provide reliable performance, making them a preferred choice for various applications. The market for safety-compliant electrical systems is projected to grow significantly, as industries prioritize risk management and compliance. This trend underscores the importance of safety in the busbar systems market, potentially leading to increased investments in advanced busbar technologies.