Advancements in Mobile Technology

Technological advancements are significantly influencing the byod enterprise-mobility market, as innovations in mobile devices and applications enhance user experience and productivity. The proliferation of high-performance smartphones and tablets, coupled with improved connectivity options such as 5G, is enabling employees to work efficiently from virtually anywhere. According to recent data, the adoption of 5G technology is expected to reach 50% of mobile subscriptions in North America by 2026, facilitating faster data transfer and seamless access to enterprise applications. This technological evolution encourages organizations to embrace BYOD policies, as employees can leverage their personal devices to access critical business resources, ultimately driving growth in the market.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the byod enterprise-mobility market, as organizations seek to reduce operational expenses associated with traditional IT infrastructure. By implementing BYOD policies, companies can minimize hardware costs, as employees utilize their personal devices for work purposes. A study indicates that businesses can save up to 30% on IT costs by adopting BYOD strategies, as they reduce the need for extensive device provisioning and maintenance. Furthermore, this approach allows organizations to allocate resources more effectively, investing in other critical areas such as employee training and development. As cost-saving measures become increasingly important, the BYOD trend is likely to gain further traction in the market.

Growing Emphasis on Employee Productivity

The byod enterprise-mobility market is witnessing a growing emphasis on enhancing employee productivity, which is increasingly linked to the adoption of BYOD policies. Organizations recognize that allowing employees to use their preferred devices can lead to higher job satisfaction and improved performance. Research suggests that employees who utilize personal devices for work report a 20% increase in productivity compared to those using company-issued devices. This trend is prompting businesses to invest in secure mobile applications and collaboration tools that facilitate seamless communication and workflow. As productivity becomes a key focus for organizations, the BYOD model is likely to be embraced more widely, further driving growth in the market.

Regulatory Compliance and Data Protection

Regulatory compliance and data protection are critical considerations in the byod enterprise-mobility market, as organizations navigate the complexities of safeguarding sensitive information. With the increasing number of data breaches and stringent regulations such as the General Data Protection Regulation (GDPR), companies are compelled to implement robust security measures within their BYOD frameworks. This includes deploying mobile device management solutions that ensure compliance with data protection laws while enabling employees to access corporate resources securely. The market is expected to grow as organizations prioritize compliance and invest in technologies that mitigate risks associated with BYOD practices. As a result, the focus on regulatory adherence is likely to shape the future landscape of the BYOD enterprise-mobility market.

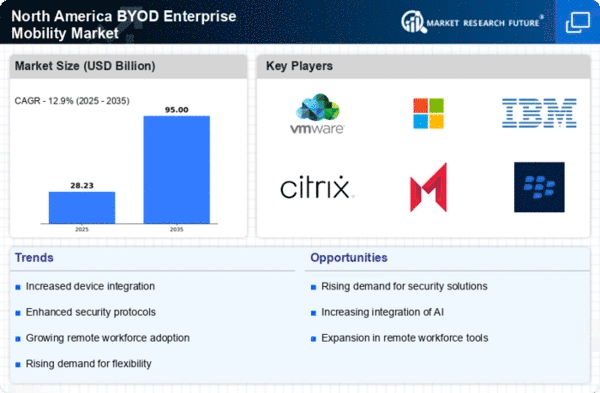

Rising Demand for Flexible Work Arrangements

The byod enterprise-mobility market is experiencing a notable shift towards flexible work arrangements, driven by employee preferences for remote and hybrid work models. Organizations are increasingly adopting BYOD policies to accommodate this demand, allowing employees to use personal devices for work purposes. This trend is reflected in a survey indicating that approximately 70% of employees favor the option to work remotely at least part of the time. As a result, companies are investing in mobile device management solutions to ensure security and compliance, thereby enhancing productivity and employee satisfaction. The growing acceptance of BYOD practices is likely to propel the market forward, as businesses recognize the benefits of flexibility in attracting and retaining talent.