Rising Feed Costs

The cattle feed market is currently facing challenges due to rising feed costs, which have been driven by fluctuations in commodity prices. In 2025, the average cost of feed ingredients has surged by approximately 15%, primarily due to adverse weather conditions affecting crop yields. This increase in feed prices poses a significant challenge for cattle producers, who must balance profitability with the need to provide adequate nutrition for their livestock. Consequently, the cattle feed market is likely to witness a shift towards more cost-effective feed formulations and alternative ingredients that can help mitigate these rising costs.

Increasing Livestock Production

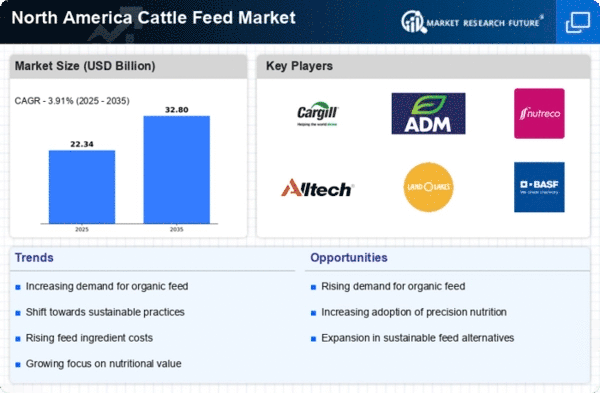

The cattle feed market in North America is experiencing growth due to the rising demand for livestock production. As consumer preferences shift towards high-quality meat and dairy products, farmers are compelled to enhance their production capabilities. This trend is reflected in the increasing number of cattle raised, which reached approximately 94 million head in 2025. Consequently, the demand for high-quality cattle feed is expected to rise, as producers seek to optimize growth rates and improve feed conversion ratios. The cattle feed market must adapt to these changes by providing innovative feed solutions that meet the nutritional needs of livestock, thereby supporting the overall growth of the sector.

Consumer Preferences for Organic Products

The cattle feed market is adapting to changing consumer preferences, particularly the growing demand for organic and non-GMO products. In North America, consumers are increasingly seeking meat and dairy products that are produced using organic feed. This trend is reflected in the organic cattle feed market, which has seen a growth rate of approximately 20% annually. As a result, cattle producers are compelled to source organic feed ingredients to meet consumer expectations. The cattle feed market must respond to this demand by developing organic feed formulations that comply with certification standards, thereby enhancing market competitiveness.

Regulatory Support for Sustainable Practices

The cattle feed market is influenced by regulatory frameworks that promote sustainable agricultural practices. In North America, government initiatives aimed at reducing the environmental impact of livestock farming are gaining traction. These regulations encourage the use of sustainable feed ingredients and practices that minimize greenhouse gas emissions. For instance, the implementation of the Environmental Quality Incentives Program (EQIP) has incentivized farmers to adopt sustainable feeding practices. As a result, the cattle feed market is likely to see an increase in demand for eco-friendly feed options, which could account for a substantial share of the market by 2026.

Technological Innovations in Feed Production

The cattle feed market is benefiting from technological innovations that enhance feed production efficiency. Advances in feed formulation technologies, such as precision nutrition and feed additives, are enabling producers to optimize the nutritional content of cattle feed. These innovations not only improve animal health and growth rates but also contribute to more sustainable feeding practices. In 2025, it is estimated that the adoption of these technologies could lead to a 10% increase in feed efficiency across the industry. As a result, the cattle feed market is likely to see a surge in demand for technologically advanced feed solutions that cater to the evolving needs of livestock producers.