Innovation in Food Products

Innovation in food products is driving the chickpea protein-ingredients market as manufacturers explore new applications for chickpea protein. The versatility of chickpea protein allows it to be incorporated into a variety of food products, including snacks, beverages, and meat alternatives. This adaptability is crucial in a market where consumers are seeking diverse and convenient food options. Recent reports indicate that the North American plant-based food market reached approximately $7 billion in 2023, with chickpea protein playing a significant role in this growth. As companies continue to innovate and develop new formulations, the demand for chickpea protein-ingredients is expected to expand, catering to evolving consumer tastes and preferences.

Expansion of Food Retail Channels

The expansion of food retail channels is a notable driver for the chickpea protein-ingredients market. With the rise of e-commerce and specialty health food stores, consumers have greater access to a variety of chickpea protein products. This increased availability is likely to enhance consumer awareness and drive sales. Recent data indicates that online grocery sales in North America have surged, with plant-based products gaining traction among consumers. As retailers expand their offerings to include more chickpea protein-ingredients, the market is expected to grow, catering to the evolving shopping habits of health-conscious consumers. This trend suggests a promising future for the chickpea protein-ingredients market as it adapts to changing retail landscapes.

Health Consciousness Among Consumers

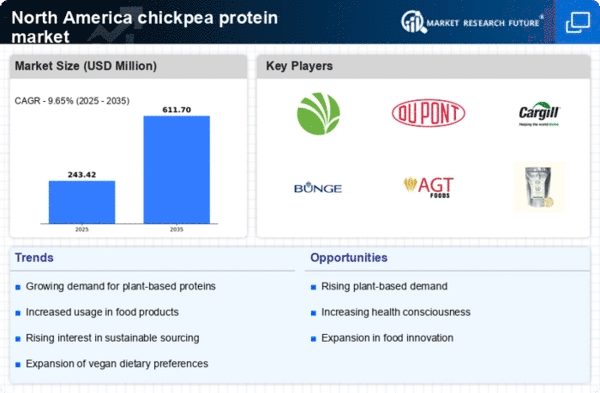

The increasing health consciousness among consumers in North America appears to be a pivotal driver for the chickpea protein-ingredients market. As individuals become more aware of the nutritional benefits associated with plant-based proteins, the demand for chickpea protein is likely to rise. Chickpeas are rich in protein, fiber, and essential nutrients, making them an attractive option for health-focused consumers. Recent data indicates that the plant-based protein market is projected to grow at a CAGR of approximately 8% through 2027, suggesting a robust interest in alternatives to animal proteins. This trend is expected to bolster the chickpea protein-ingredients market, as manufacturers respond to consumer preferences for healthier food options.

Rising Vegan and Vegetarian Population

The rising vegan and vegetarian population in North America is a significant driver for the chickpea protein-ingredients market. As more individuals adopt plant-based diets for ethical, health, or environmental reasons, the demand for plant-based protein sources, such as chickpeas, is likely to increase. Data suggests that the number of vegans in the U.S. has grown by over 300% in the past decade, indicating a substantial shift in dietary preferences. This demographic shift is prompting food manufacturers to enhance their product offerings with chickpea protein, thereby expanding the market. The chickpea protein-ingredients market is poised to benefit from this trend as it aligns with the growing consumer base seeking plant-based alternatives.

Increased Focus on Sustainable Sourcing

Increased focus on sustainable sourcing is influencing the chickpea protein-ingredients market as consumers and manufacturers alike prioritize environmentally friendly practices. Chickpeas are known for their low environmental impact compared to animal-based protein sources, which resonates with the growing demand for sustainable food options. Recent studies indicate that plant-based proteins, including chickpeas, require significantly less water and land compared to traditional livestock farming. This sustainability aspect is likely to attract environmentally conscious consumers, further driving the demand for chickpea protein-ingredients. As companies adopt sustainable sourcing practices, the market is expected to see growth, reflecting a broader commitment to environmental stewardship.