E-commerce Growth

The coffee machines market in North America is witnessing a significant shift towards e-commerce as a primary sales channel. With the increasing penetration of the internet and the rise of online shopping, consumers are more inclined to purchase coffee machines through digital platforms. In 2025, it is projected that online sales will account for approximately 35% of total coffee machine sales, driven by the convenience and variety offered by e-commerce platforms. This trend is further supported by the availability of customer reviews and detailed product information online, which aids consumers in making informed purchasing decisions. As a result, the coffee machines market is likely to continue evolving, with e-commerce playing a crucial role in shaping consumer behavior and preferences.

Growing Coffee Culture

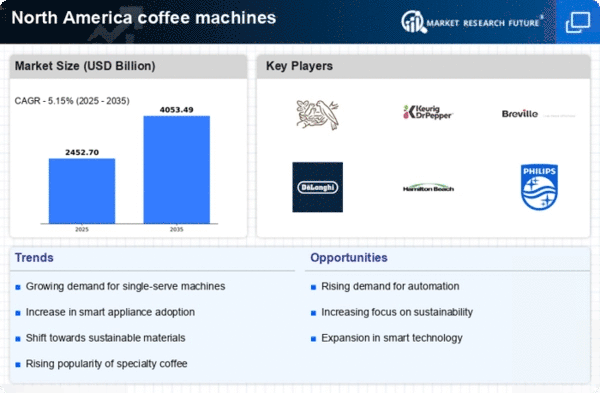

The coffee machines market in North America is experiencing a notable surge due to the growing coffee culture among consumers. This cultural shift is characterized by an increasing preference for specialty coffee and artisanal brewing methods. As consumers become more discerning about their coffee choices, the demand for high-quality coffee machines rises. In 2025, the market is projected to reach approximately $4 billion, reflecting a compound annual growth rate (CAGR) of around 6%. This growth is driven by consumers seeking to replicate café-quality beverages at home, thereby propelling the coffee machines market forward. Furthermore, the rise of coffee-centric social gatherings and events contributes to this trend, as individuals invest in machines that enhance their brewing experience.

Health and Wellness Trends

The coffee machines market in North America is also influenced by the rising health and wellness trends among consumers. As individuals become more health-conscious, there is a growing interest in organic and specialty coffee options. This trend encourages consumers to invest in high-quality coffee machines that can brew healthier beverages, such as cold brew or espresso with minimal additives. In 2025, the market for health-oriented coffee machines is projected to account for approximately 25% of total sales, indicating a shift towards machines that promote healthier lifestyles. Additionally, the emphasis on natural ingredients and sustainable sourcing aligns with the preferences of health-conscious consumers, further driving the coffee machines market.

Technological Advancements

Technological advancements play a pivotal role in shaping the coffee machines market in North America. Innovations such as programmable settings, touch-screen interfaces, and integrated grinders are becoming increasingly prevalent. These features not only enhance user convenience but also improve the overall brewing process. In 2025, it is estimated that around 30% of coffee machines sold will incorporate smart technology, allowing users to control their machines remotely via mobile applications. This integration of technology is likely to attract tech-savvy consumers who prioritize efficiency and customization in their coffee-making experience. As a result, the coffee machines market is expected to witness a significant transformation, catering to the evolving preferences of modern consumers.

Convenience and Time-Saving

Convenience and time-saving features are increasingly influencing the coffee machines market in North America. As lifestyles become busier, consumers are seeking machines that offer quick and efficient brewing solutions. Single-serve coffee machines, for instance, have gained immense popularity due to their ability to deliver a fresh cup of coffee in minutes. In 2025, it is anticipated that single-serve machines will represent over 40% of the total coffee machines market share. This trend reflects a broader consumer preference for products that simplify daily routines. Moreover, the integration of automatic cleaning and maintenance features in modern coffee machines further enhances their appeal, making them a practical choice for consumers looking to save time without compromising on quality.