Rising Demand for Commercial Vehicles

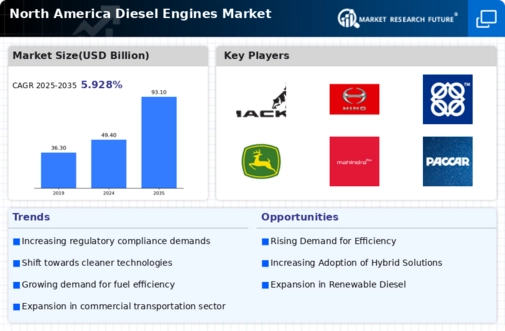

The rising demand for commercial vehicles is a significant driver of the diesel engines market in North America. As e-commerce continues to expand, the need for logistics and transportation services is increasing, leading to a higher demand for heavy-duty trucks and commercial vehicles powered by diesel engines. The diesel engines market is likely to see a surge in sales as businesses invest in new fleets to meet the growing consumer demand. By 2025, the market is expected to grow by approximately 5% annually, driven by the logistics sector's reliance on diesel-powered vehicles for their efficiency and durability. This trend suggests a robust future for diesel engines in the commercial vehicle segment.

Cost-Effectiveness and Fuel Availability

Cost-effectiveness remains a pivotal factor influencing the diesel engines market in North America. Diesel fuel is often more economical than gasoline, providing a lower cost per mile for heavy-duty vehicles. This economic advantage is particularly appealing to fleet operators and businesses that rely on transportation. Additionally, the widespread availability of diesel fuel across the continent supports its continued use in various applications. The diesel engines market is likely to benefit from this cost advantage, as it encourages the adoption of diesel engines in both commercial and industrial sectors. As of 2025, the market is projected to grow by around 4% annually, as businesses seek to optimize their operational costs while maintaining performance.

Infrastructure Development and Investment

Infrastructure development plays a crucial role in the diesel engines market in North America. The ongoing investment in transportation infrastructure, including highways, bridges, and railways, is expected to bolster the demand for diesel engines. The U.S. government has allocated substantial funding for infrastructure projects, which may lead to an increased need for heavy-duty vehicles powered by diesel engines. As of 2025, the market is projected to grow by 4% annually, driven by the rising demand for construction and transportation equipment. This trend indicates that the diesel engines market is likely to benefit from the expansion of infrastructure, as diesel engines are often preferred for their reliability and efficiency in heavy-duty applications.

Regulatory Compliance and Emission Standards

The diesel engines market in North America is significantly influenced by stringent regulatory compliance and emission standards. Governments are increasingly enforcing regulations aimed at reducing greenhouse gas emissions and improving air quality. For instance, the Environmental Protection Agency (EPA) has implemented regulations that require diesel engines to meet specific emission limits. This has led manufacturers to innovate and develop cleaner diesel technologies, which may enhance market growth. The diesel engines market is adapting to these changes, with a projected increase in demand for low-emission engines. As of 2025, it is estimated that compliance with these regulations could drive a market growth rate of approximately 5% annually, as companies invest in advanced technologies to meet these standards.

Technological Advancements in Engine Efficiency

Technological advancements are reshaping the diesel engines market in North America, particularly in terms of engine efficiency. Innovations such as turbocharging, fuel injection systems, and advanced combustion techniques are enhancing the performance of diesel engines. These improvements not only increase fuel efficiency but also reduce emissions, aligning with regulatory requirements. The diesel engines market is witnessing a shift towards engines that offer better fuel economy, which is becoming a key selling point for manufacturers. As of 2025, it is anticipated that the market will experience a growth rate of around 6% due to the increasing adoption of these advanced technologies, which appeal to both consumers and businesses seeking cost-effective solutions.